In today’s “Futures in Focus,” Todd Horwitz, chief strategist at Bubba Trading, and Bloomberg’s Vonnie Quinn examine the impact of OPEC and the U.S. dollar on the oil market. They speak on “Bloomberg Markets.”

News and Information

May 31, 2017 By Staff Editor

In today’s “Futures in Focus,” Todd Horwitz, chief strategist at Bubba Trading, and Bloomberg’s Vonnie Quinn examine the impact of OPEC and the U.S. dollar on the oil market. They speak on “Bloomberg Markets.”

May 31, 2017 By Staff Editor

The bulls are trying to catch their breath after the stock market’s string of records. Stocks started the week mixed as investors weigh a fresh batch of economic data after the Memorial Day weekend.

Meanwhile, oil prices are lower on concerns that production cuts will not be enough to reduce the global supply glut. Yahoo Finance’s Alexis Christoforous, Andy Serwer and Seana Smith discuss the day’s top stories.

May 31, 2017 By Staff Editor

The U.S. Federal Aviation Administration on Tuesday proposed fining United Airlines (UAL) $435,000 for operating 23 flights in 2014 using a Boeing (BA) 787 that the government claims was not in a condition to fly, according to Reuters.

The FAA alleged that in June 2014, United mechanics replaced a fuel pump pressure switch on the aircraft but failed to perform a required inspection before returning the aircraft to service.

Top News: Bullfrog Gold Raises $816,000 Of Equity To Advance Its Nevada Gold Project

“The safety of our customers and employees is our top priority. We immediately took action after identifying the issue and are working closely with the FAA in their review,” a United spokesman said.

Shares of United closed lower nearly 2.5% on Tuesday.

May 30, 2017 By Staff Editor

Photographer: Anthony Kwan/Bloomberg

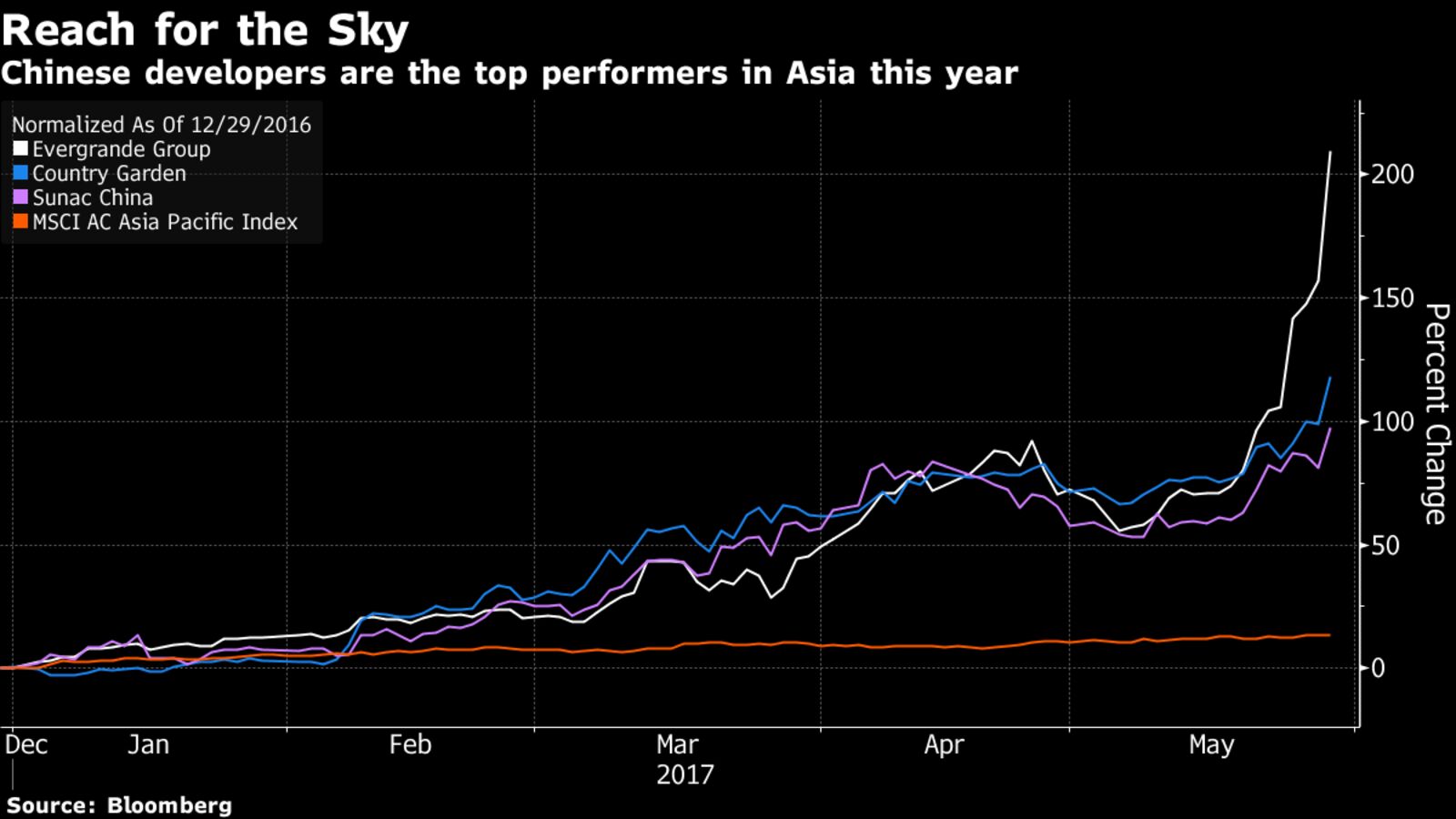

China Evergrande Group’s astonishing share rally has resulted in the world’s most painful short trade this year. To add insult to injury, bearish investors are paying higher fees to get crushed.

Top News: Bullfrog Gold Raises $816,000 Of Equity To Advance Its Nevada Gold Project

Fees to borrow shares of the Hong Kong-listed Chinese developer for shorting have surged by more than five times since January to about 10 percent and have doubled since Evergrande started buying back shares in late March, according to Simon Colvin, a London-based analyst at IHS Markit Ltd. Evergrande shares available for lending have “nearly all been spoken for,” Colvin wrote in an email, resulting in higher borrowing costs.

Evergrande shares have more than tripled this year, hurting short-sellers and baffling even some of the most bullish stock analysts. Part of the sharp rally can be explained by Evergrande’s plan to raise money from strategic investors ahead of a planned backdoor listing on the mainland and speculation that the developer will benefit from rising home sales in smaller Chinese cities. A buyback spree has also propelled a 123 percent jump since late March — when short interest started climbing from a low point.

“I wouldn’t recommend investors to short Evergrande because of the strong momentum. It’s too risky,” Raymond Cheng, Hong Kong-based analyst at CIMB Securities Ltd., said by phone. “The momentum will remain strong until the backdoor listing is completed and after that there might be some share price correction.”

Don’t Miss: Is This Tiny Gold Mining Company The Next Big Thing?

Evergrande soared as much as 27 percent to an all-time high on Monday, while peers such as Country Garden Holdings Co. and Sunac China Holdings Ltd. advanced more than 10 percent. The acceleration in gains is raising questions, with JPMorgan Chase & Co. saying in a note received Friday that Evergrande’s business model isn’t sustainable.

The pressures on short-sellers are mounting as investors are covering their bearish positions, said Citigroup Inc. analyst Oscar Choi, which could be contributing to higher demand for Evergrande shares. In a typical short sale, investors borrow shares and sell them with the expectation that the price will decline. In a successful trade, the investors later buy the shares back at a lower price to return to the lender, or cover the short, so they can pocket the difference.

Also see: Is this the end to banking as we know it?

After Monday’s rally, Evergrande’s share price increase is the biggest among major short targets worldwide, which include companies with a market value of at least $1 billion and short interest tracked by Markit of at least 10 percent, according to data compiled by Bloomberg. The only other wager that has inflicted pain of a similar magnitude is a bearish trade on Applied Optoelectronics Inc., whose shares advanced 205 percent this year, the data show.

Evergrande trades at a record 36 times reported earnings, more than double the valuations of Country Garden and Sunac, while Monday’s gain alone added $5.3 billion to its market value. Bearish bets accounted for 20.7 percent of its free float on May 25, according to IHS Market data, while its share price is 118 percent higher than consensus analyst estimates for the next 12 months.

Some analysts are still optimistic. Morgan Stanley analyst John Lam, one of the most bullish analysts on Evergrande with an overweight rating on the shares, has a street high price target of HK$12, according to data compiled by Bloomberg. Lam cited moves by Evergrande’s management to raise its second-round strategic investment target to 30 billion yuan from 15 billion yuan.

Lam expects Evergrande to lower its net gearing to 237 percent by the end of this year, from 432 percent at the end of 2016, according to a May 23 note. Evergrande’s six-month financial results, which will be released in August, is another potential catalyst for the share price, according to Morgan Stanley.

May 30, 2017 By Staff Editor

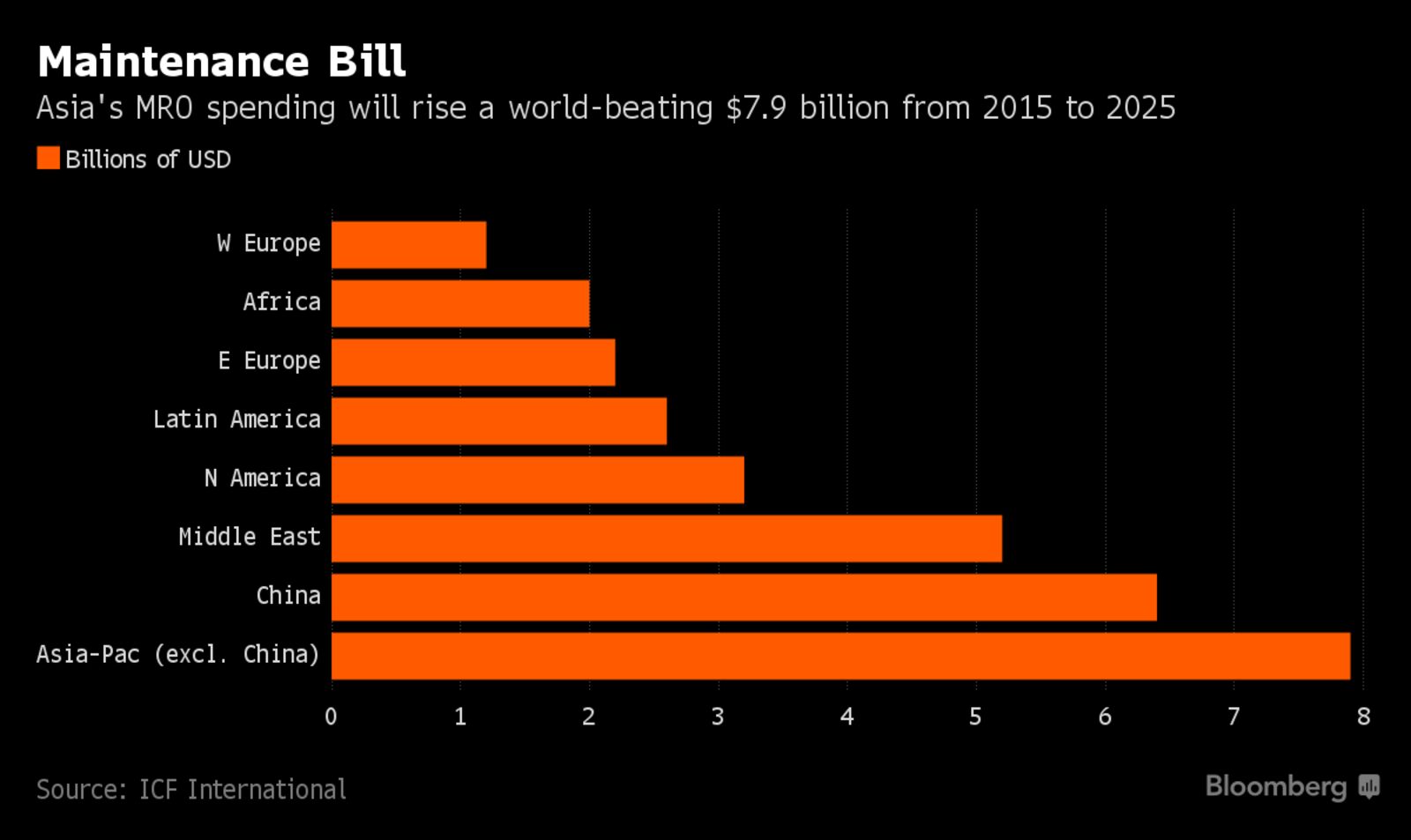

Thailand is seeking to take on Singapore’s dominance in aircraft maintenance, repair and overhaul with a $5.7 billion upgrade of a Vietnam War-era airport.

Lockheed Martin Corp.’s Sikorsky Aircraft is the latest company to study a possible increase in MRO spend in Thailand in the wake of the planned revamp of U-Tapao International Airport, said Ajarin Pattanapanchai, deputy secretary general of the nation’s Board of Investment. In March, Airbus SE signed an agreement with Thai Airways International Pcl to evaluate the development of MRO facilities at the civil-military airport near Bangkok.

Top News: Bullfrog Gold Raises $816,000 Of Equity To Advance Its Nevada Gold Project

“Singapore is quite tight right now,” Ajarin said in an interview at Bloomberg’s Toronto office on May 25, during a visit to Canada to woo investment. “To catch up with the demand of airlines in the region — especially new demand from Myanmar, Vietnam, Cambodia — and given that we have existing strengths with automotives and engineering, Thailand will be the second choice to be the MRO hub.”

The airport project is part of junta leader Prime Minister Prayuth Chan-Ocha’s goal of boosting the economy, whose expansion has lagged behind neighbors since the military seized power three years ago. It’s also a key component of a plan to invest 1.5 trillion baht ($44 billion) between 2017-2021 to develop the country’s eastern seaboard.

Don’t Miss: Is This Tiny Gold Mining Company The Next Big Thing?

Apart from the airport in the Eastern Economic Corridor, the plan calls for $4.5 billion investment in high-speed rail, $11.5 billion for new cities and $14 billion for industry. The government will control and maintain the airport and a port. Other projects will be public-private-partnerships or privately held.

“I am confident we can make it,” Ajarin said, referring to raising the funds. The government has already allocated its budget for 2017, she said, declining to provide a figure for the administration’s outlay on the corridor or an estimate of the MRO business Thailand is targeting.

Foreign-direct investment has revived after sliding following the coup, especially in digital and high-technology sectors, Ajarin said.

She gave as an example Toronto-based Canadian Solar Inc., which applied for a license in 2015 and opened its Thai factory two years later. Among electric vehicles, a “big player — but not Tesla — is waiting to come in,” Ajarin said.

Also see: Is this the end to banking as we know it?

FDI increased to $8.6 billion in 2016 from $2.7 billion in 2015, according to data provided by the Board of Investment.

While the board offers incentives to foreign companies such as tax sops, it remains unclear how quickly the Thai government can implement its ambitious vision for the eastern seaboard given the scale of the project.

Challenges include a shortage of skilled workers, as well as concern that Thailand is prone to harmful episodes of political volatility.

Ajarin acknowledged that the risk of political turmoil is a worry for new investors, but argued that companies have weathered past such bouts.

May 30, 2017 By Staff Editor

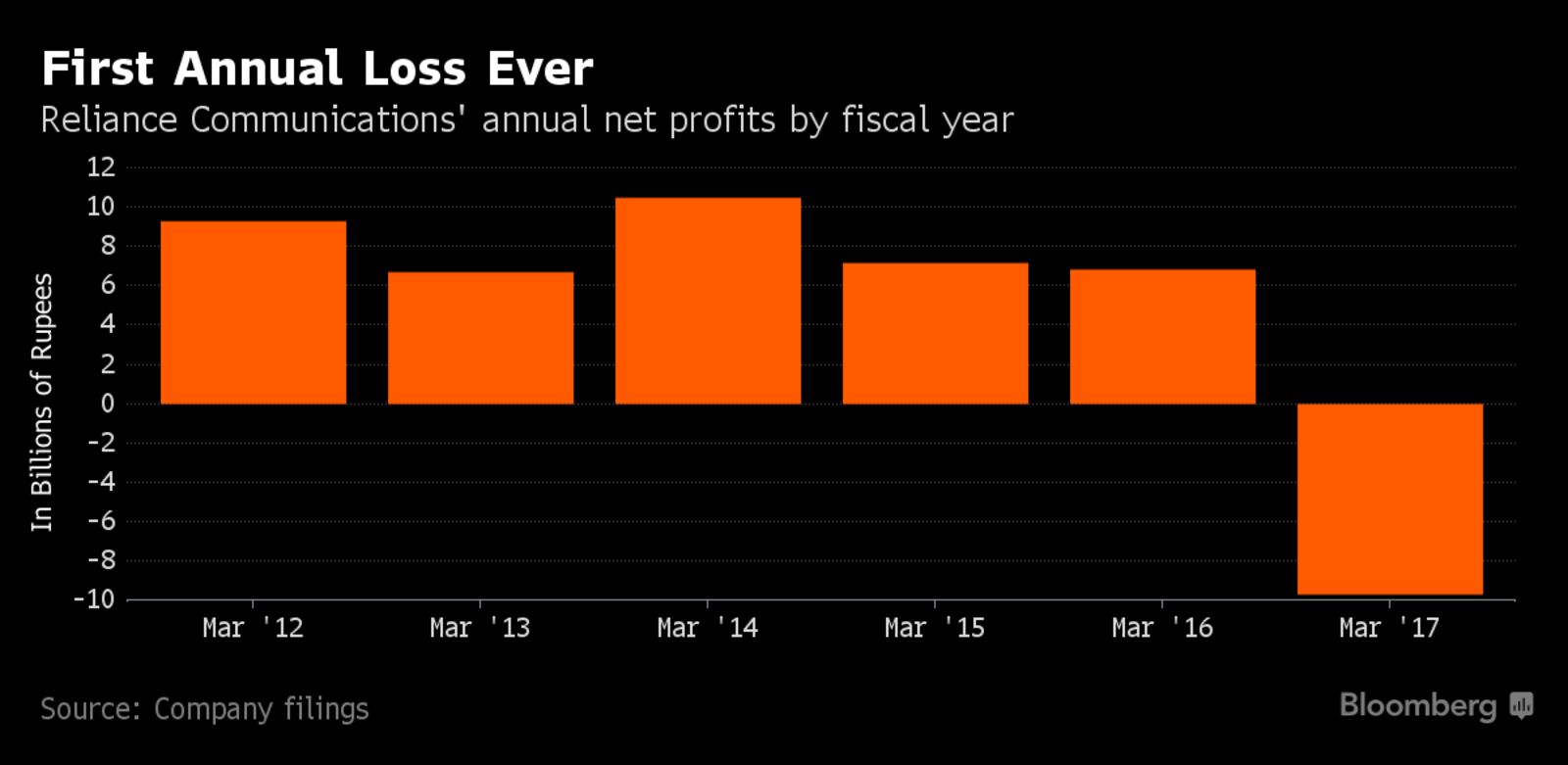

Brutal competition and 457 billion rupees ($7 billion) of borrowings have finally caught up with billionaire Anil Ambani’s Reliance Communications Ltd.

The Indian wireless operator rattled investors with its first full-year net loss amid signs it’s struggling to repay debt. Its $300 million junk-rated note due in 2020 declined 5.5 cents on the dollar to 66 cents as of 12:23 p.m. in Hong Kong and the stock sank 4.4 percent to extend Monday’s 20 percent slump. Fitch Ratings and Lucror Analytics highlighted a potential liquidity crunch and people familiar with the matter said the company sought more time to repay some loans.

Top News: Bullfrog Gold Raises $816,000 Of Equity To Advance Its Nevada Gold Project

The company was in talks with its lenders to seek their approval for the sale of its tower business and an equal merger of its wireless business with rival Aircel Ltd., that would allow it to pare debt by 250 billion rupees, Gurdeep Singh, co-chief executive officer of Reliance Communications said on an investor call Monday. The company plans to refinance its debt in the interim period until Sept. 30 to facilitate the closing of the transactions, Singh said.

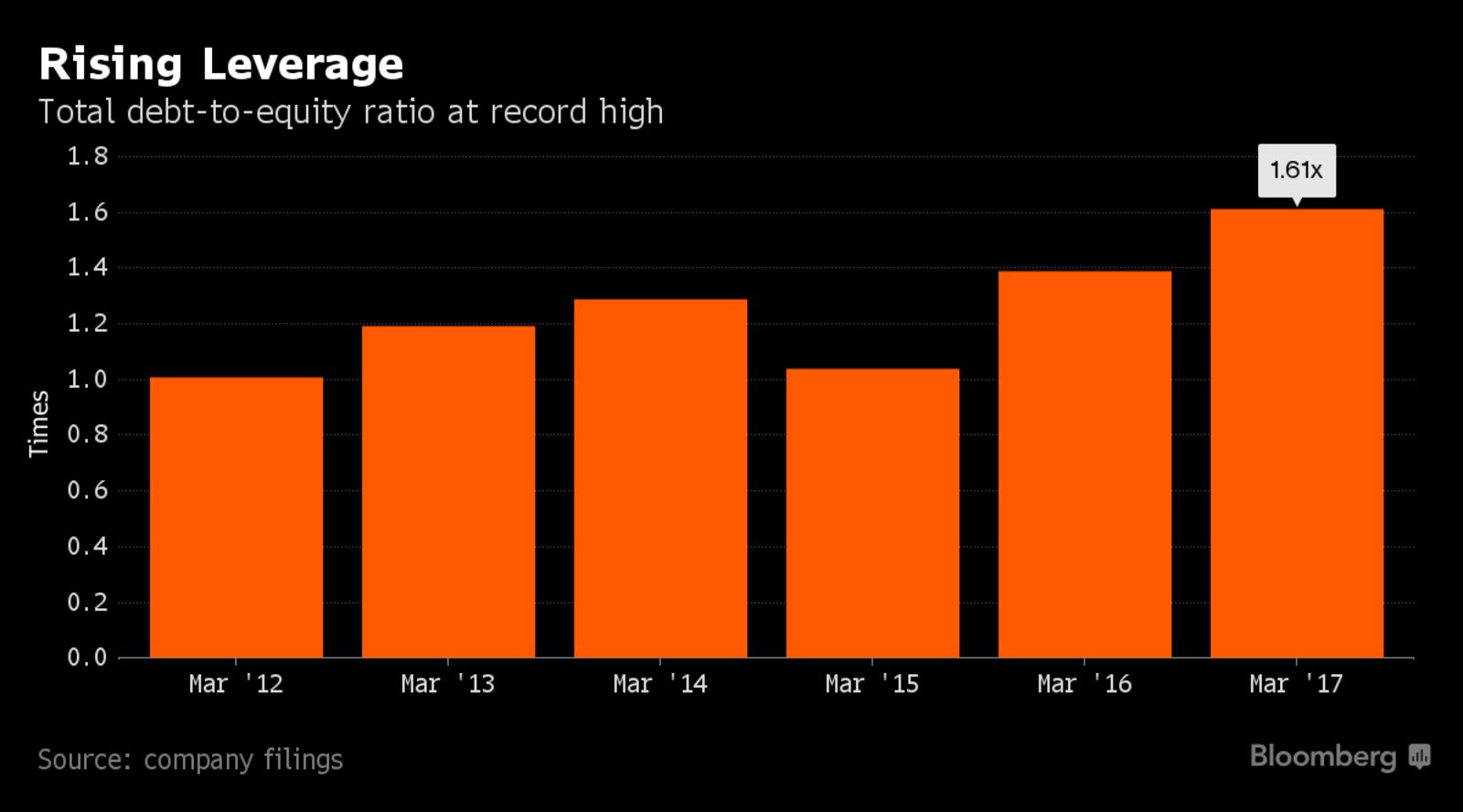

Here are four charts that show Reliance Communications’ financial challenges.

Reliance Communications had a full-year loss of 14 billion rupees. Subscribers have dwindled in the past five years as larger rivals such as Bharti Airtel Ltd. and Vodafone Plc slashed call rates and offered higher speed data. To repay debt, the company is selling its towers to Canadian asset manager Brookfield Infrastructure Group as well as merging the wireless business with Aircel Ltd.

Don’t Miss: Is This Tiny Gold Mining Company The Next Big Thing?

“The size of the RCOM debt has become unmanageable and both Brookfield and Aircel deals are getting delayed for a long time now,” Giriraj Daga, an investment manager at K M Visaria Family Trust in Mumbai. “Investors fear that a delay in loan repayments may lead to scrapping of the deals” and this may lead to financial stress at the company because it doesn’t have adequate refinancing resources, he said.

The carrier is likely to continue losing subscribers, Deepti Chaturvedi and Akshat Agarwal, analysts at CLSA Asia-Pacific Markets, said in a note Monday. CLSA estimates that only 66 million users are active, which is 20 percent lower than the company’s reported subscribers.

Reliance Communications’ cash generation and unrestricted cash of around $200 million would be insufficient to pay its short-term debt of around $600-$650 million, said Nitin Soni, director, Asia-Pacific corporate ratings at Fitch Ratings. However, liquidity would still be dependent on its ability to refinance maturing debt, Soni said.

Also see: Is this the end to banking as we know it?

The company also plans to sell its real estate assets in Delhi and Navi Mumbai, Singh said on the investor call. The company is getting the properties valued, he said.

The junk-rated company had 13.2 billion rupees of cash and cash equivalents as of March 31, less than a quarter of its short-term borrowings of 95 billion rupees, it said in its earnings report on May 27.

Reliance Communications has defaulted on loan servicing obligations and Indian banks have put the company’s loans into “special mention accounts,” which means interest payments are overdue, the Economic Times reported Monday, citing an unidentified bank official.

“Bank support would be the key thing investors are watching right now,” said Pavitra Sudhindran, credit analyst at Nomura Holdings Inc. “While we continue to view negatively the ongoing deterioration in operations, our base case is for banks to remain supportive but note that there could be potential headline risk, as we saw this morning.”

Reliance Communications’ shares are down 42 percent this year. In a sign of stress, the company’s leverage, measured by total debt to equity, rose to a record high of 1.6 times, up from one time in 2012, according to company filings.

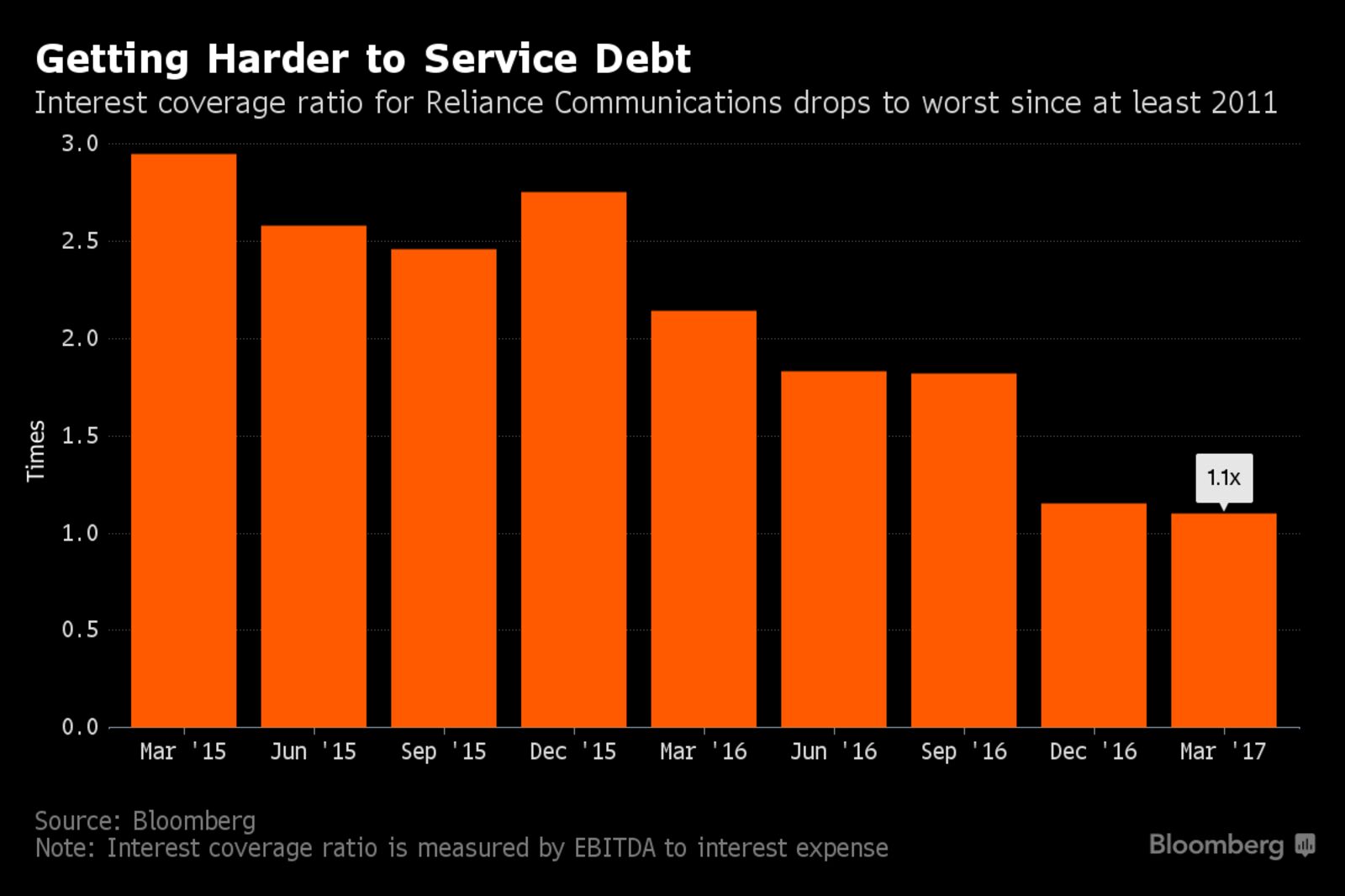

Pinched by a 24 percent rise in financing costs in the latest quarter to March 31, the company’s ability to service its debt has fallen to the weakest since at least 2011. The company generated just enough cash to cover interest expenses, down from three times in March 2015.