At a time when air pollution has become a leading environmental threat to public health, The Energy and Resources Institute (TERI) chief Ajay Mathur said India’s dependence on thermal power would end by 2050. Mathur in an inteview with Samreen Ahmad said solar batteries would become cheaper than coal by the mid 2020s and nuclear power is not economically viable for the country now.

At a time when air pollution has become a leading environmental threat to public health, The Energy and Resources Institute (TERI) chief Ajay Mathur said India’s dependence on thermal power would end by 2050. Mathur in an inteview with Samreen Ahmad said solar batteries would become cheaper than coal by the mid 2020s and nuclear power is not economically viable for the country now.

What is TERI doing to promote renewable energy?

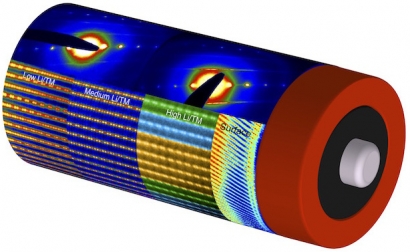

The key challenge today is producing electricity when the sun is not shining. We have made a huge economic transition, as the cost of solar power produced during the day has become much lower that of thermal electricity. But the peak power demand in India occurs at around 11 pm, when we go to bed and switch on air-conditioners. And only 6 per cent of the population have ACs. Consequently, we are looking at integration of solar energy into the grid on the one hand and adequate availability of storage options on the other hand.

In six or seven years, we hope the price of solar batteries will be such that it will start costing less than thermal power. Solar-plus batteries in the Philippines have already touched about 6 cents per kWh. We are looking at a goal of Rs 5 per kWh five years from now. We are working with utilities and manufacturers of solar cells and batteries to test these out.

But solar panels are mostly imported.

Until a few years ago, the vast amount of solar panels that were being used in India were being imported because they were cheaper. Now, as the demand in India is growing, domestic manufacturers are expanding their production. Adani Solar and Tata Power Solar are enhancing their capacities. BHEL has also expanded its current solar module and cell manufacturing facilities. As demand increases, the manufacturing capacity will also rise.

What is being done to reduce the dependence on thermal power plants?

Coal is the only 24×7 source of power in India. In a country where the willingness and ability to pay for power is limited, cheap electricity is important. Yes, coal power needs to be cleaner. Which is why, two years ago, the government brought out new environmental norms for coal-based power stations. This effectively adds 70 paise to Rs 1 to the cost of each unit of thermal electricity produced. Power producers have also invested huge money in coal-based plants. If they are not able to sell electricity, they won’t be able to repay their loans to banks. Hence, banks will suffer and consequently others who need loans. So it is in the economic interest of the country that these coal plants continue to function till their capacities have been utilised. We believe that given the natural growth of electricity demand, current thermal power stations will be fully utilised by 2025-26. It is possible by the mid-2020s, solar batteries will become cheaper than coal. So people will put their money in solar rather than thermal. TERI believes no new coal power plants will ever be approved in this country now. Coal-based power stations will live out their economic lives and will be slowly replaced by solar-plus batteries. There will be no coal power dependence by 2050.

What is the government doing to check transmission and distribution losses?

The government is running the restructured accelerated power development and reforms programme to improve the quality and reliability of power supply. Under this, distribution companies are given loans by the government to upgrade their structure. These companies then replace old wires and bring transformers closer to houses for efficient metering to check electricity theft. In case the distribution companies are able to bring down their losses to less than 15 per cent, half of their loan becomes a grant.

Is nuclear energy viable in India?

The question is more of economics. Nuclear stations produce relatively expensive power than coal and solar. So no distribution company will be willing to buy it. This economic issue needs to be addressed if nuclear power has to take off.

The London Metal Exchange has abandoned plans for a cobalt sulphate contract for the electric vehicle battery supply chain because pricing for the chemical has historically been based on the metal it is derived from, cobalt industry sources said.

The London Metal Exchange has abandoned plans for a cobalt sulphate contract for the electric vehicle battery supply chain because pricing for the chemical has historically been based on the metal it is derived from, cobalt industry sources said.