Zinc could see more sharp price swings as growing tightness along the metal’s supply chain leaves buyers exposed to sudden changes in availability.

The material used to galvanize steel had a turbulent time on the London Metal Exchange last week, finishing almost 5% higher despite a 2.5% slump on Thursday. The spike was fueled by the withdrawal of huge volumes from LME warehouses, which stoked speculation of a potential squeeze on short-position holders.

The volatile week underscored tight supply conditions that analysts see persisting into next year. Any production cuts — either by miners or smelters — could provide the catalyst for more short-term price spikes, Shanghai-based analysts at Guotai & Junan Futures Co. wrote in a note. The level at which it’s safe to buy on dips was moving higher, they added.

Zinc declined 0.4% to $3,091 a ton as of 11:02 a.m. local time on the LME, as a stronger dollar weighed on commodities.

The dynamics of the zinc market bear similarity to those in copper, as smelters in top producer China struggle with poor profitability after a period of rapid expansion. That ramp-up of capacity has left them in fierce competition for raw materials, raising the stakes for annual ore supply contracts that are still under negotiation.

Chinese copper smelters are still in talks with Chilean miner Antofagasta Plc regarding the annual processing fee for next year. Progress on those discussions was slow last month when the industry gathered in Shanghai for CESCO Asia Copper Week, as expectations on prices from the two sides were split.

Spot copper treatment fees — paid to smelters to convert concentrate into metal — were at negative levels in mid-September, and a big drop in annual fees is likely to ramp up pressure on Chinese smelters to rein in output.

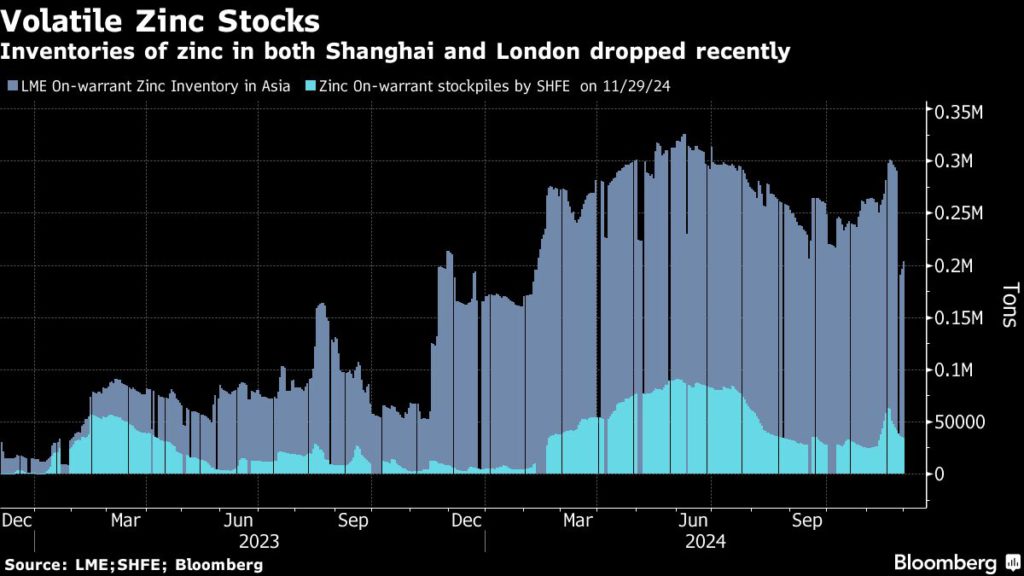

Zinc inventories

Supply pressures have made zinc the best performer of the LME’s six base metals this year, with a gain of about 16%. While Chinese demand has been subdued amid a downturn in the steel and property sectors, there have been production downgrades and other kinds of disruptions at major mines such as Ivanhoe Mines Ltd.’s Kipushi in the Democratic Republic of the Congo.

Trading giant Trafigura Group was behind last week’s big take-out orders from LME warehouses, according to people familiar with the matter. In the London market, traders are closely following whether the canceled zinc inventories will be re-registered as warehouse stockpiles at some point, or held off-exchange or fed to consumers.

On the Shanghai Futures Exchange, inventories also posted a sharp fall last week, declining by more than 9,000 tons for the biggest weekly drop in nearly a year.

Copper declined 0.3% on the LME on Monday, with other industrial metals also edging down.