China, the EU, and India are likely to take the lead when it comes to growing the lithium-ion battery recycling market, while the US still needs to deploy the necessary infrastructure to match the pace of those regions, a recent report by IDTechEx shows.

According to the document, while China has some of the more extensive policies regarding Li-ion battery recycling and end-of-life management, policies and regulations being implemented in the EU and India will contribute to Li-ion battery recycling market growth in these regions.

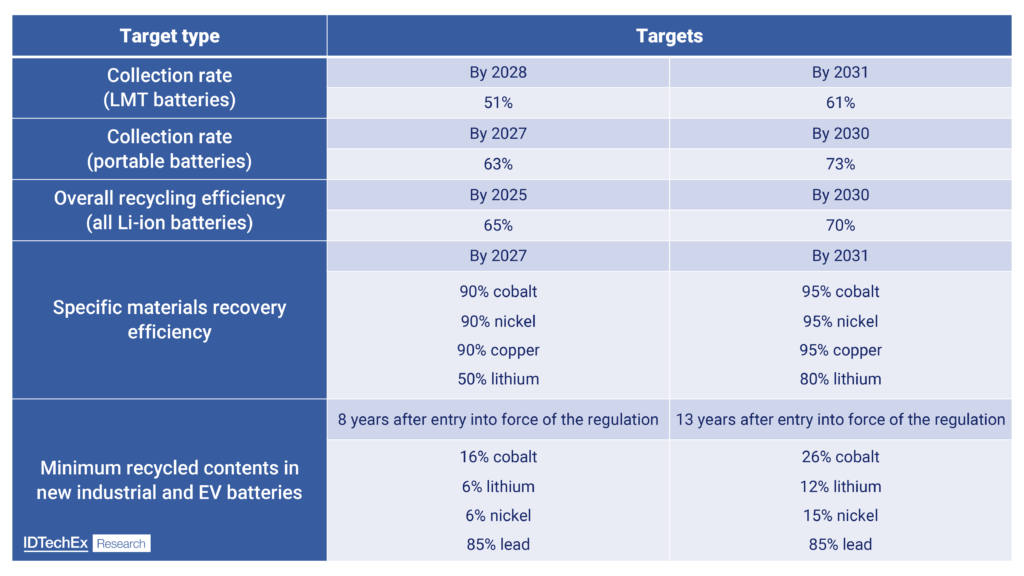

In the European Union specifically, the EU Battery Regulation is expected to enforce new specific collection rate targets for light means of transport (LMT) and portable batteries. These are important targets, as the collection of consumer batteries has not been greatly incentivized or well achieved in the past.

“The Commission plans to assess the feasibility of deposit schemes for portable batteries by the end of 2023. Also included in the Regulation are specific material recovery efficiency targets for all Li-ion batteries and minimum recycled contents targets in new EV and industrial batteries,” the dossier states.

In 2023, the EU compiled the fifth version of their critical raw materials list, which includes lithium, cobalt, manganese, natural graphite, and aluminum.

IDTechEx notes that while nickel and copper are not on the list, they are still considered strategic raw materials and potentially subject to future supply risks. Thus, domesticating the supply of lithium, nickel, and cobalt from recycling in the EU could help reduce future problems.

In India, on the other hand, the Battery Waste Management Rules 2022 cover electric vehicles, portable, and industrial batteries and they mandate that battery producers have to collect and recycle/refurbish retired batteries.

“Similar to the EU Battery Regulation, these rules specify targets for specific material recovery efficiency targets in EV batteries, but also for portable and industrial batteries. Targets are also specified for battery collection rates across these sectors and minimum percentages of recycled materials to be used in new EVs and industrial batteries,” the report explains.

Lagging behind

Different from China, the EU and India, the US does not see any strict policies regarding Li-ion battery recycling. However, through the Inflation Reduction Act, EV battery manufacturers may be eligible for an Advanced Manufacturing Production credit. This specifies that a minimum percentage, by value, of critical raw minerals are extracted or processed in the US, from a country with a free-trade agreement with the US, or recycled in North America. This minimum percentage is 40% until the end of 2023, increasing year-on-year until 1 January 2027, when this percentage is 80%.

“If this requirement is met, a battery producer would be eligible for a $3,750 PTC. Therefore, EV battery manufacturers will be keen to source more battery materials domestically, which could come from US recyclers,” IDTechEx points out. “However, sourcing minerals produced from recycling on a large scale in North America over the next few years is unlikely.”

The market analyst notes that there is a lack of commercial-scale hydrometallurgical recycling plants in North America, though players are looking to expand their hydrometallurgical capacities.

“For example, Li-Cycle is one of the few players planning to establish a commercial-scale hydrometallurgy plant in the US. Hydrometallurgical recycling offers the production of battery-grade metal salts, which can be further processed into precursors for new battery cathodes,” the paper reads. “Due to the lack of current hydrometallurgical recycling capacity in the US, it is unlikely that EV battery manufacturers will be able to make great use of the PTC being offered, at least in the short term.”