Rising geopolitical tensions and the prospect of industrial decoupling are fueling a surge of interest in the processing of energy-transition metals outside China, one of Asia’s leading hedge funds said in an interview.

Miners will add more processing capacity next to large deposits, according to John Stover, a portfolio manager of Tribeca Investment Partners. He said there would be carbon benefits too from the shift downstream, in the form of reduced transport needs — a boon for a sector that has struggled to clean up. Government incentives like the U.S. Inflation Reduction Act are adding encouragement.

“It’s just supply chain 101, you don’t want to be concentrated in an area where you have doubts about the future in one way or another,” Scott Clements, partner at Tribeca Capital, said in Singapore. “Geopolitically, it’s pushing people to do that and governments are throwing money at it.”

Emerging from a period of belt-tightening, the mining industry is beginning to spend again, hoping to ride the surge in demand for green metals like copper, nickel and lithium, which will power the energy transition. A drop in lithium prices since late last year on concerns over easing shortages and slower demand growth has triggered a flurry of deal activity.

That includes top lithium producer Albemarle Corp, which made an unsuccessful $3.7 billion cash offer for developer Liontown Resources Ltd. last week — its third bid in five months.

“It’s very telling,” Clements said. “Albemarle knows the market better than anyone. It’s hard to call bottoms and tops in commodities, but I think it’s definitely a signal to the market that they see a supply shortage over the medium to long term.”

The key concern for miners today is securing supply, said Stover. “I doubt the strategic value is going to change much in the next six to 12 months, because the dial-up for EVs is not really going to change. I wouldn’t be surprised if some of these other smaller companies come into play.”

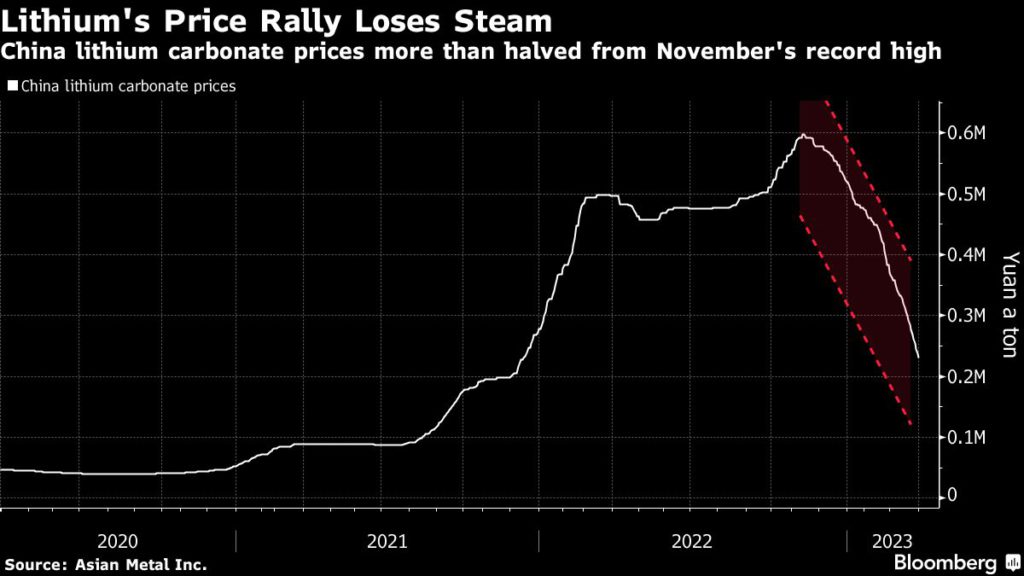

Prices of lithium carbonate, the benchmark product, have more than halved in China since rocketing to a record last November.

Other battery materials have faced similar oversupply concerns, including nickel, where Chinese investments in Indonesia have contributed to a surge in output.

Stover said he did not see a repeat of the market upheaval after the arrival of nickel pig iron, a low-grade alternative in the production of stainless steel. “Obviously there’s still gonna be a lot of nickel coming out, but it’s going into different end uses that are actually growing — versus just feeding into the steel value chain.”

Even global carmakers are realizing the need to secure long-term flows of the raw materials, with increasing discussions about direct investments in mines or refineries. Ford Motor Co. on March 30 announced it will take a stake in a battery-nickel plant in Indonesia, General Motors Co. has invested in a US lithium miner while Tesla Inc. is interested in buying a lithium producer.

The hedge fund is co-sponsoring a Future Facing Commodities conference in Singapore on April 5 and 6, with speakers ranging from miners of critical minerals to trading houses.