Traders bought into bullish copper options Wednesday, betting the industrial metal’s rally will extend on possible supply tightness and monetary easing.

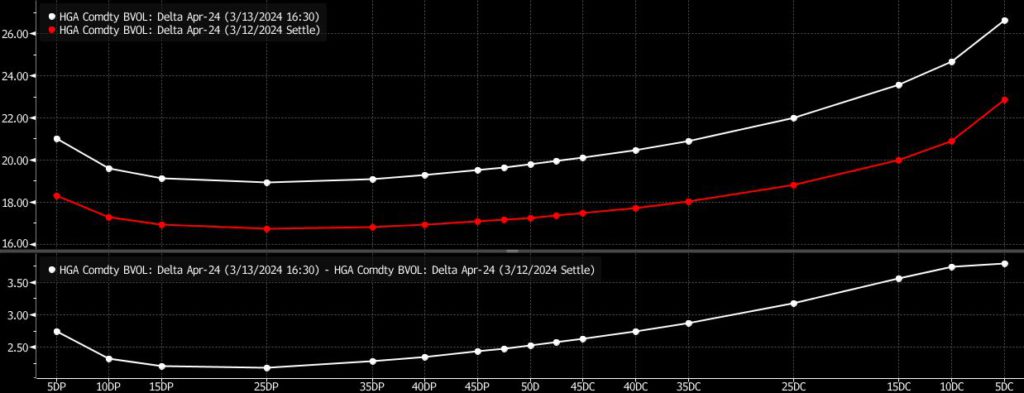

Total options volume spiked to more than 52,000 contracts, according to exchange data. Implied volatility and the call skew jumped, signaling additional bets on higher prices.

Copper jumped the most in more than 16 months on potential supply tightness after news that Chinese smelters discussed potential production cuts aimed at coping with a plunge in processing margins.

With traders sticking to their guns on the Federal Reserve’s rate-cut wagers after a slightly hot February inflation print earlier this week, the outsized move in copper is more of “a bet on the Fed rate action and the dollar weakness. We see aggressive buying on Comex, both outright and options,” said Xiaoyu Zhu, a trader at StoneX Financial Inc

The news of the smelter production cut served as “a catalyst” in the metal’s rally Wednesday and wasn’t surprising after the drop in margins, he said.

Smelters in China, the world’s top refined metal producer and consumer, are facing a crisis after so-called treatment and refining charges — the amount they’re paid to convert concentrate into metal — collapsed. That’s prompted talk of possible output cuts at smelters, which are highly dependent on imported raw materials. The plunge in spot processing fees has been driven by a slew of supply setbacks in the mining industry.

The biggest trade was a $15 million investment in December $4.25/$4.75 call spreads, with futures for that month trading around $4.086 per pound. There was also widespread buying in bullish spreads across April and May options.

| Strategy | Ratio | Trade Type | Ticker | Aggregated Size | Open Interest |

|---|---|---|---|---|---|

| Dec. 24 425 Call, Dec. 24 475 Call | 1:1 | Call Spread | HGZ4C 425 | 4,840 | 165 |

| HGZ4C 475 | 4,840 | 1,347 | |||

| April 24 400 Call, April 24 412 Call | 1:1 | Call Spread | HGJ4C 400 | 1,500 | 2,041 |

| HGJ4C 412 | 1,500 | 58 | |||

| April 24 440 Call, April 24 430 Call | 1:1 | Call Spread | HGJ4C 430 | 1,364 | 2,565 |

| HGJ4C 440 | 1,364 | 1,112 | |||

| May 24 450 Call, May 24 425 Call | 1:1 | Call Spread | HGK4C 425 | 1,318 | 2,578 |

| HGK4C 450 | 1,318 | 1,278 | |||

| April 24 420 Call, April 24 412 Call | 1:1 | Call Spread | HGJ4C 412 | 1,061 | 58 |

| HGJ4C 420 | 1,061 | 738 |

(By David Marino and Yvonne Yue Li)