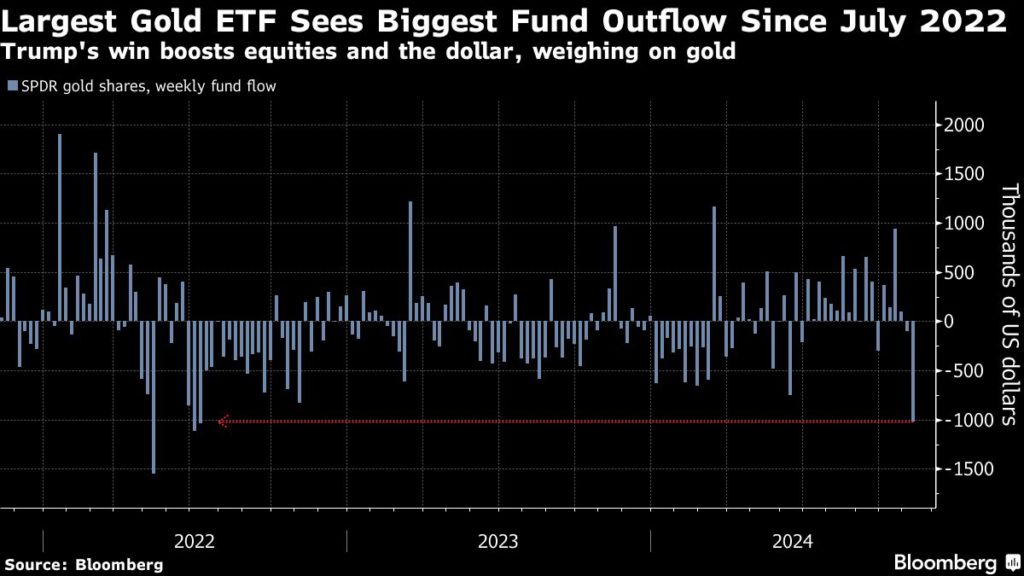

The world’s largest gold-backed exchange traded fund recorded it biggest weekly outflow in more than two years last week as Donald Trump’s decisive election win prompted traders to book profits.

SPDR Gold Shares (GLD) saw an outflow of over $1 billion, the largest weekly fund outflow since July 2022, according to data compiled by Bloomberg. Spot gold fell 1.9% over the same period. Total gold ETF holdings slipped 0.4%, the second straight weekly decline.

Investors typically seek safety in bullion in times of political and economic uncertainty. They sought haven in gold last month as expectations were high that the US presidential election would turn out to be a contested one. But as Trump clinched victory after taking key battleground states and Republicans gained control of the Senate, the definitive outcome prompted investors to exit their positions to book profits.

Trump’s win also boosted US equities and the dollar, which was negative for gold as it made bullion less appealing to investors holding other currencies. Bitcoin, for example, has been boosted by President-elect Donald Trump’s embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers.

Gold traders continued to take profits on Monday, with prices slipping to one-month low and shares of gold miners tumbling.