One of the keys to the success or failure of Tesla’s (TSLA) Model 3 will be the company’s ability to hit its margin targets, something that has not been done with the Model S and X so far. Over the past year or two, I’ve detailed how a surge in cobalt prices could knock down auto margins moving forward, but there’s another key metal whose rally could make things even more difficult for the company moving forward.

At the earnings report in early May, management cut its short to medium term target for Model 3 margins as seen in the investor letter. The following statement details the key reasoning, and at last week’s shareholder meeting, CEO Elon Musk revealed the potential for battery prices to hit key levels moving forward was based on commodity prices.

In the medium term, we expect to achieve slightly lower margin due to higher labor content in certain areas of manufacturing where we have temporarily dialed back automation, as well as higher material costs from recently imposed tariffs, commodity price increases and a weaker US dollar.

With cobalt prices going from $10 a pound at the Model 3 reveal to over $40 recently, it was assumed that margins would be impacted a little for all Tesla products. However, in a recent conflict minerals filing discussing concerns over how Tesla gets its metals, we got the following statement:

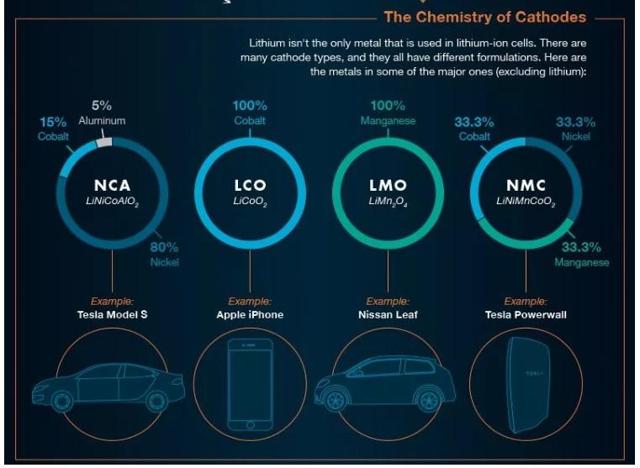

It is important to note that there is very little cobalt in Tesla’s battery cells. On a relative basis, cobalt simply is not that significant to the composition of Tesla’s battery cells, as we mainly use NCA batteries, which contain substantially less cobalt than NMC batteries. Cells used in Model 3 production are the highest energy density cells used in any electric vehicle. We have achieved this by significantly reducing cobalt content per battery pack while increasing nickel content and still maintaining superior thermal stability. The cobalt content of our Nickel-Cobalt-Aluminum cathode chemistry is already lower than next-generation cathodes that will be made by other cell producers with a Nickel-Manganese-Cobalt ratio of 8:1:1.

Depending on the size of the battery pack, there was previous speculation that there was a dozen or two pounds of cobalt in each Tesla vehicle. Even if the number is a little less than that, 8 times as much nickel would mean at least a few dozen pounds of the key metal. The graphic below showed how battery chemistry has varied across past vehicles and other products.

So why the major discussion about nickel? Well, take a look at the chart below, showing the rally in this metal’s price just since the start of May. We’ve seen a rise of nearly $1 per pound, more than 15%, in a very short time period. However, the more important thing to note is that a year ago, prices were at just $4 a pound, so the rally is more than 75% in 12 months.

If you think this is just a temporary rise in prices, let me tell you that over the past 15 years, $4.00 a pound is roughly the bottom for nickel. A little over a decade ago, prices spiked to about $23.00 a pound. With growing demand thanks to the rise in EVs, it wouldn’t surprise me to see prices get into the double digits in the next couple of years. Cobalt and lithium prices have certainly soared in recent years, and the recent rally in nickel could just be the start of a similar trend.

Tesla bulls will argue that a rise of a few dollars a pound in nickel, just like cobalt, really won’t impact margins. I will counter by saying that a few hundred extra dollars here, and a few hundred extra dollars there, is quite meaningful when you are planning on selling a vehicle that starts at $35,000 later this year or next. With Tesla’s inability to meet margin targets in the past, every dollar is key. For every 100,000 vehicles sold at $45,000, each percentage point of gross margins equals $45 million. That could equal a dollar per share of earnings if you assume that many sales per quarter. With increased VIN registrations, Tesla is starting to see meaningful production volumes on the Model 3.

In the end, while cobalt prices have perhaps seen the largest gain in recent years, perhaps those following Tesla should really start following nickel. With the metal being even more key to battery production, and a 75% rise in price over the past year, the company’s margins could feel some pain moving forward. Should the price of nickel rise into the double digits, it could really put that plan for 25% gross margins on the Model 3 in jeopardy.