Rhodium prices are on the march again as original equipment manufacturers (OEMs) ramp up their demand for the shiny, silvery metal commonly used in vehicles’ catalytic converters.

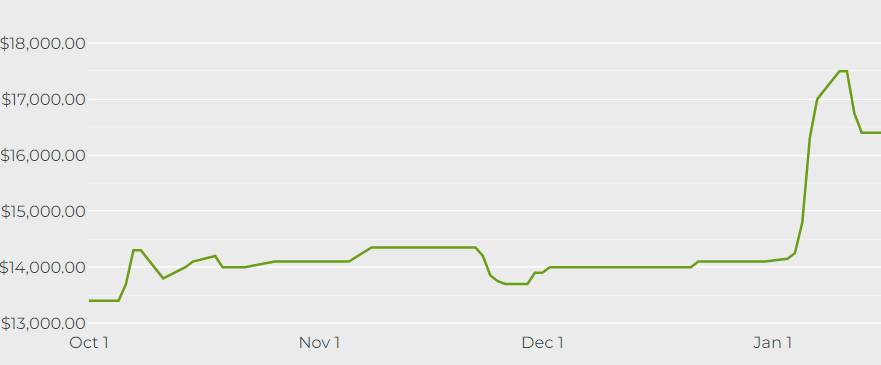

Since the start of 2022, rhodium prices have pushed up sharply, rising from $14,250/ozt on January 4 to reach $17,500/ozt on January 11 – the highest since September 2021. As of 2 p.m. EDT Wednesday, the metal was trading at $16,500/ozt.

The latest rally is largely underpinned by increasing demand from OEMs, which use rhodium in automotive catalytic converters to help combat nitrous oxide emissions, according to the latest market report from Argus Media.

In the spot market, offers are now seen in excess of $17,000/ozt, up from $14,500/ozt at the start of last week and $14,100/ozt at the end of 2021, market participants in Argus’ study said, with one pointing toward a rise in “OEM demand as well as Chinese industrial interest.”

Some automakers noted that the global chip shortage is starting to ease, suggesting that vehicle production will start to recover after 2021’s cutbacks, pushing up demand for automotive catalysts — and rhodium along the way.

Data showed that last year’s vehicle production cuts weighed heavily on rhodium prices, which peaked at $29,800/ozt in March, but then fell by 54% to $13,700/ozt by November.

Traders also noted that rhodium supply is tighter than expected, with global production expected to be flat this year.

“The supply angle is perhaps tighter than some had thought and it appears that producers are well sold,” one trader said, adding:

“There is a healthy amount of bullish speculation being mixed with genuine good early year demand which caused the market to move higher. As soon as it did that all offers clammed up, and with producers already well sold, we have got ourselves into this massive move higher.”

A platinum group metals (PGMs) producer commented that South African production is “certainly not thriving.”

“We always knew the supply/demand side of things would settle, it is just the question of when,” the producer told Argus, adding that Anglo American’s inventories – which had built up in 2020 during convertor outages – are likely to decline in early 2022, further squeezing the supply base.