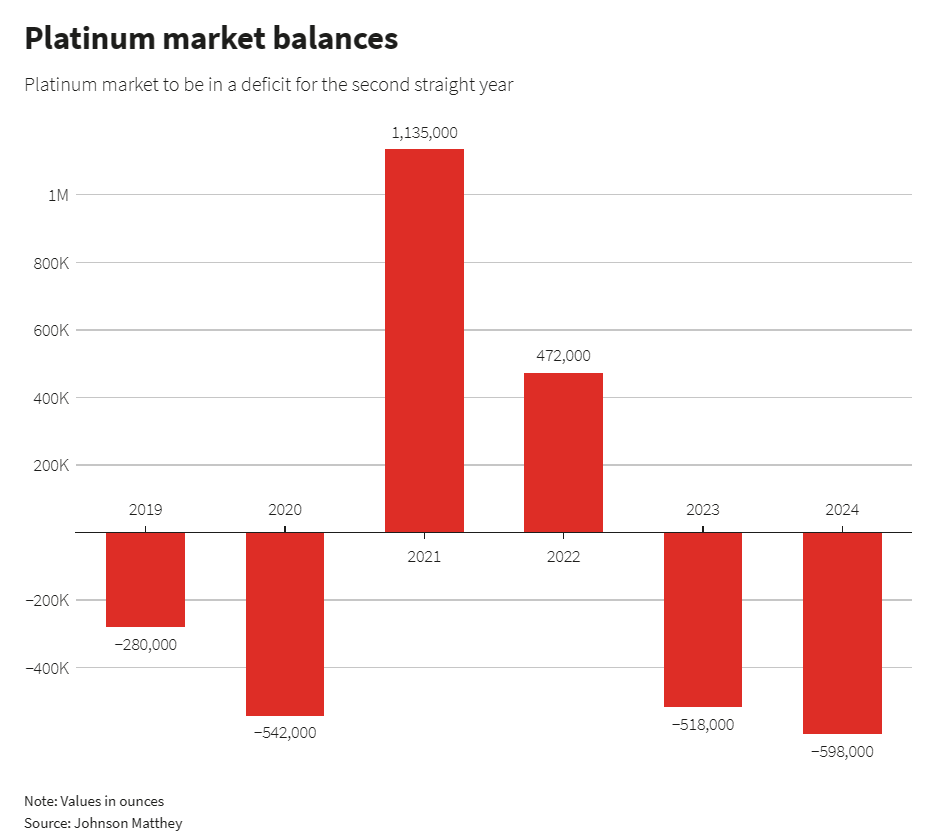

The platinum market faces its largest supply shortfall in 10 years in 2024 as shipments from Russia return to normal from last year’s highs and industrial demand stays firm, Johnson Matthey said in a report on Thursday.

The autocatalyst maker added that it expected all platinum group metals (PGM) – platinum, palladium, and rhodium – to remain in deficit in 2024.

The three metals are used in autocatalysts that reduce emissions from vehicle engines, with platinum also used in other industry and for jewellery and investment.

Johnson Matthey (JM) said it expected the platinum market’s deficit to increase to 598,000 ounces this year from a shortfall of 518,000 ounces in 2023.

It forecast platinum demand would stabilize at around 7.61 million ounces, with small decreases in automotive and jewellery balanced by an uptick in investment.

Auto sector consumption is expected to slip 1.3% in 2024, while primary supply is projected to fall 2% as Russian shipments return to more normal levels following heavy selling of mined stocks in 2023, JM said.

For palladium, JM said use by automakers would fall about 7%, reducing overall demand to 9.73 million ounces and cutting the market deficit to 358,000 ounces from 1.02 million ounces last year.

For rhodium, auto consumption is also expected to fall – by about 6% – dragging total demand down 4% to 1.06 million ounces. The rhodium market is likely to be undersupplied by 65,000 ounces, down from 125,000 ounces in 2023, JM said.

“Automotive and industrial users bought more metal than they needed during 2020-2022 to mitigate price and supply risks. Since then, consumers have been using up excess PGM inventory, and some have even sold metal back to the market,” Rupen Raithatha, market research director at Johnson Matthey, said.

At around $950 an ounce, palladium is trading lower than platinum at $960, pressured by growing demand concerns.

Rhodium is trading around $4,700 an ounce, down about 84% from all-time highs reached in March 2021.