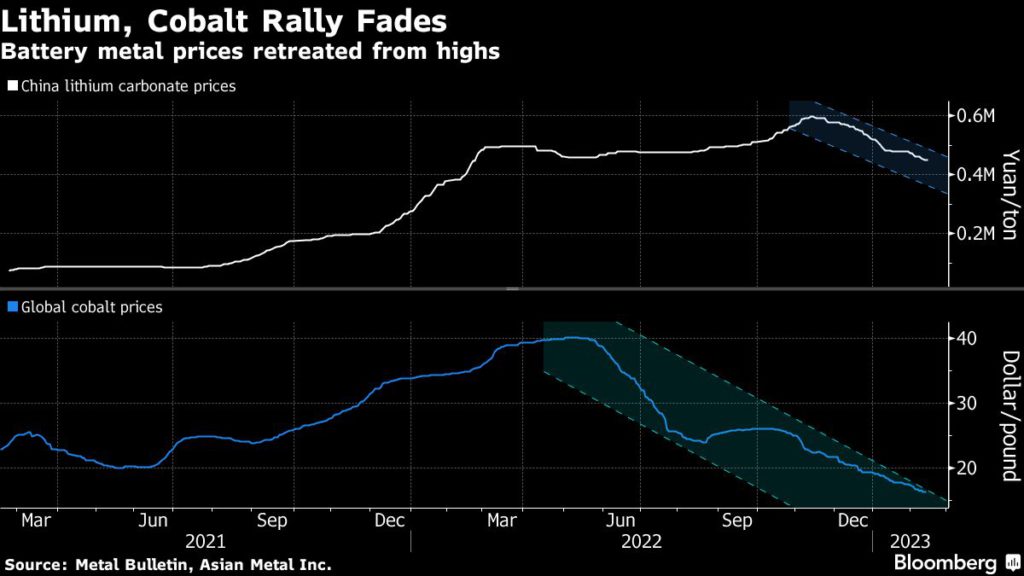

Battery-metals prices are set to retreat from highs this year as surging supplies trigger gluts, a leading Chinese industry group warned following a similar note of caution from Goldman Sachs Group Inc.

Nickel prices are likely to drop in the second half as the global market may see a surplus on rising supply led by mines in Indonesia, according to Chen Xuesen, a spokesman for the China Nonferrous Metals Industry Association. Cobalt and lithium carbonate prices may also come off, Chen said, according to a statement on the group’s Wechat account. No estimates were given.

The expected retracement poses a near-term challenge for miners but will be welcomed by automakers, which have struggled in recent years to secure adequate supplies to meet increased demand. The association’s warning echoes a forecast last week from Goldman Sachs, which said it was bearish on battery metals including nickel, cobalt and lithium on “surging” production. In China, slower electric-vehicle sales have also been a headwind for prices.

“The disappointing EV sales in China so far this year came at a time when the battery-supply chain is destocking,” said Susan Zou, an analyst at Rystad Energy. “This translated into thin spot demand for all battery metals, which is expected to last through the first quarter, pressuring prices across lithium, cobalt, and nickel.”

Following a 45% rally in 2022, nickel has slumped 11% on the London Metal Exchange this year, making it the worst performer among the main six metals traded on the exchange. In China, lithium-carbonate prices have also been in retreat, plunging almost 25% from a record in November.

The association — which represents base-metal producers in Asia’s biggest economy — also warned of a possible surplus in aluminum battery-foil capacity as plants are added. For other metals such as copper and lead, the country is looking to draft policies to cap overall capacity and cut emissions, it said.