Swedish battery maker Northvolt AB is working to halt a financial tailspin by pausing some production at its flagship factory and cutting jobs as it comes to grips with operational difficulties and a drop in demand for electric vehicles.

The initial steps of its strategic review also include seeking partners for facilities in Poland, Northvolt said Monday in a statement, without specifying the size of any workforce reductions from among its about 6,000 staff. The company has sold a Swedish site it had previously planned for making cathode material, a precursor to manufacturing batteries.

“We are having to take some tough actions for the purpose of securing the foundations of Northvolt’s operations to improve our financial stability and strengthen our operational performance,” chief executive officer Peter Carlsson said.

The company is pausing operations at its Northvolt Ett Upstream 1 cathode material production facility until further notice, according to the statement.

Northvolt, the continent’s biggest homegrown battery manufacturer, has struggled to ramp up production at its main factory outside the town of Skelleftea near the Arctic Circle. It already pushed back plans for an initial public offering to next year because of a challenging market and the operational problems.

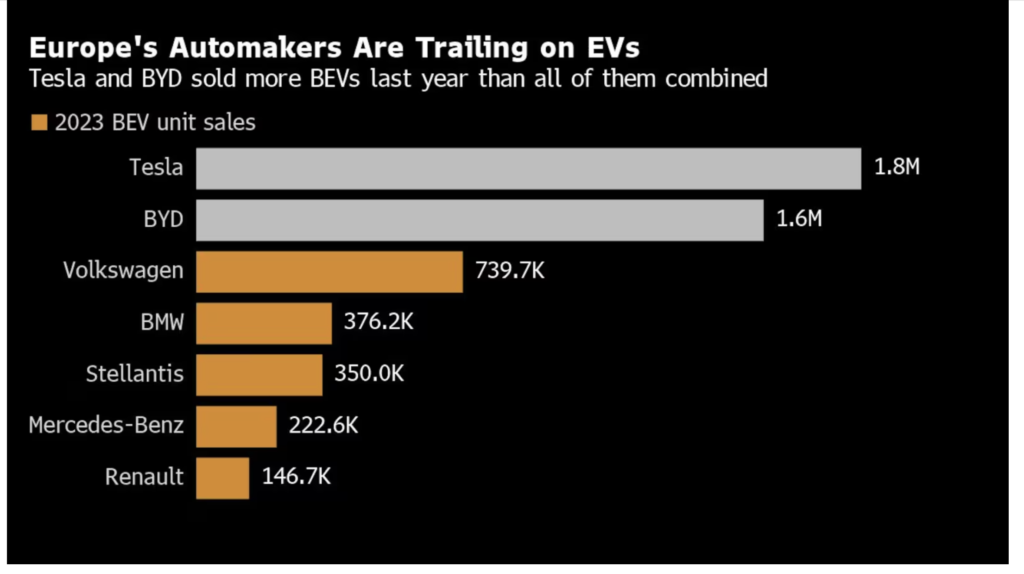

The market for battery makers continues to worsen amid a slump in EV sales. Companies including Volkswagen AG, Stellantis NV and Mercedes-Benz Group AG have had to scale back or refocus battery projects this year.

Northvolt said it remains committed to its facilities NOVO in Sweden, Northvolt Drei in Germany and Northvolt Six in Canada and is in close dialog with the key stakeholders.

Potential revisions to those projects’ timelines will be confirmed during the fall, along with any further cost-saving actions, the company said.

Northvolt’s main site delivered its first batteries in May 2022, but scaling up production has been far from smooth. BMW AG backed out of a €2 billion ($2.2 billion) order in June, while Volkswagen’s Scania complained of slow deliveries earlier this year.

There’s also been a sharp decline in electric vehicle sales in Europe as there aren’t enough affordable models to move past early adopters and the wealthy, and reduced government incentives have further sapped customer interest. The EVs that are sold are increasingly Chinese — or American — with BYD Co. and Tesla Inc. selling more than local manufacturers combined.

Northvolt, founded by two former Tesla managers about eight years ago, counted Volkswagen as its biggest individual owner at the end of last year, with a 21% stake, while funds managed by Goldman Sachs Asset Management had about 19%. Vargas Holding AB of Harald Mix had about 7% and Northvolt managers and staff a combined about 9%, according to its 2023 annual report.

Earlier on Monday, a long-awaited report by former European Central Bank President Mario Draghi on European Union competitiveness drew on the automotive sector for particular scorn. The bloc faces a real risk that EU carmakers continue to lose market share to China, which is ahead of the 27-member bloc in “virtually all domains,” while producing at a lower cost, the report said, calling the industry a “key example of a lack of EU planning.”