A recent study by Charles River Associates (CRA) outlines some worrying trends for global mining as the industry continues to expand and push into new markets.

The Toronto-based consultants, specialising in economic litigation found disputes between governments and investors involving mineral assets are growing rapidly – with 60% of all arbitrations over the last fifty years filed in the last decade.

Between 2013 and 2022 the number of treaty arbitrations almost doubled from the prior period to 68 cases, with South America and Africa responsible for a growing number of disputes. Since 2016 nearly 80% of all cases filed originated in these two regions and the number of cases in Africa and Latin America are up 167% and 57% since 2016.

The analysis covered 118 investor-state arbitrations, 80% of which were administered by the International Centre for Settlement of Investment Disputes, a World Bank organisation. 78% led to an award while 22% were settled by the parties. A third of these are still pending, and of the concluded cases 18% were discontinued.

Overall, gold and copper assets are involved in half of all cases followed by coal at 8%.

The ‘S’ in ESG

CRA also conducted a survey of professionals engaged in mining arbitrations including in and outside counsel and mining company management and found more than 80% of respondents expect greater government intervention and regulation over the next 12 months.

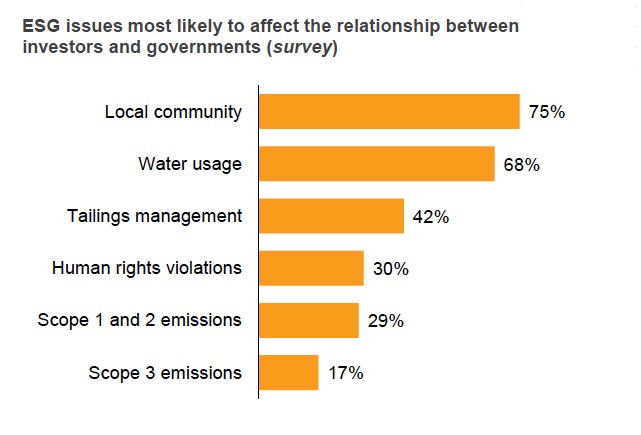

Three-quarters believe interventions related to ESG will increase. It’s not surprising that environmental issues – particularly water – will be the main source of disputes and a full 86% expect governments will more frequently use allegations of environmental breaches as either a defence or counterclaim in disputes.

The authors note that the ESG emphasis is shifting towards social aspects including local community involvement and the focus on all stakeholders in a project rather than simply the shareholders of the company. That would include the thorny issue of artisanal or small scale mining. In short, a social licence to operate.

Critical minerals

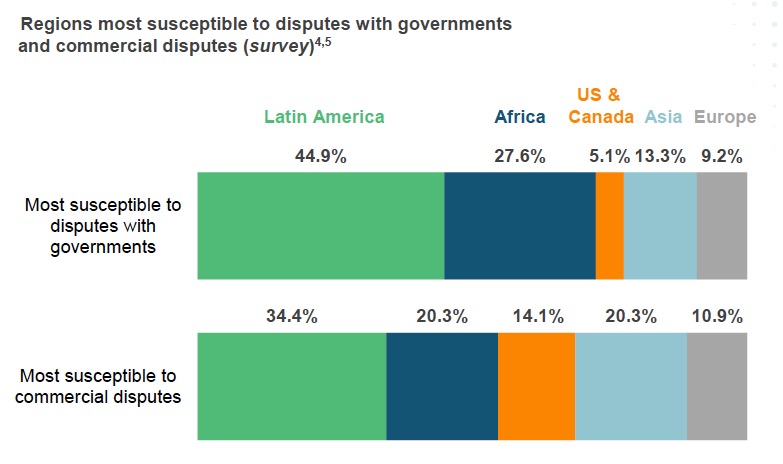

Latin America, according to respondents in the CRA survey, could be responsible for 45% of disputes with the state followed by just under 28% in Africa over the next 12 months. The green energy transition is attracting significant investment in copper, nickel, lithium and cobalt extraction with these regions expected to play an outsize role thanks to their mineral endowment.

While gold has been the subject of the majority of disputes in the past, the CRA survey showed among industry professionals base metals are expected to make up 65% of expected disputes as the green energy transition shifts investment in the mining sector.

Called critical minerals (the US just added copper to its list) are facing increasing state intervention and rare earth elements are perceived as at high risk by 52% of respondents. Both Mexico and Chile recently fundamentally changed the legal regime for lithium mining, showing just how exposed mining is to political developments.

The expectation of a shift to industrial minerals is also underpinned by CRA analysis that show rising metal prices correspond with an increase in disputes.

Most industry professionals surveyed believe during economic recessions the number disputes tend to rise as governments try to find ways of shoring up its finances and help struggling citizens. However, a fifth think there’s an inverse relationship.

All stages of development at risk

When it comes to susceptibility to commercial disputes it is more evenly spread around the world – Latin America still leads with nearly a third of expected cases, but one-fifth of disputes are likely in Asia and Africa respectively.

Off-take and royalty agreements, which have proliferated as non-mining players like auto and battery makers race to secure long term supply, are cited as a major source of commercial disputes as the parties wrangle over pricing, quantity and quality as supply and demand dynamics change over the course of agreements.

Given the inherent instability of the mining industry with regulatory regimes, market conditions, technology all capable of fundamentally changing the economic value of a project over its lifespan – often counted in decades if not generations – without tight investment treaties, stabilisation or freezing clauses in contracts, disputes are almost inevitable to arise.

CRA notes that 68% of mining arbitrations involve properties that have reserves – and contrary to expectations it is not early stage projects that face most opposition.

Practitioners expect disputes to arise in properties at all stages of development, from exploration to production, with risk spread equally over the life of a project.

Plain old politics

The average time from filing to award is five years, according to CRA, which not only illustrates how much effort and time disputes of this nature are required from boards and counsel but it also has obvious outcomes for financing.

According to the CRA just under 80% of respondents in the survey said disputes lower the likelihood of obtaining financing for projects and mines.

The most likely cause of a dispute between investors and governments arising is identified as politics (75%) while 57% cite disagreement on financial compensation.

Only 8% think higher compensation through arbitration is what leads to disagreements, which is reflective of the gulf between claims and awards. On average, the dollar amount claimed was 26 times the amount awarded with a median of four times. In cases where details are known, awards ranged from a mere $1 million to $1.2 billion.

In 44% of cases the money demanded exceeded the awarded compensation by a factor of ten. At the same time in only a quarter of cases the claimants were ordered to pay arbitration costs and 48% of cases associated costs were spread equally.