Base metals on the London Metal Exchange were steady on Friday after solid U.S. data helped calm worries over the outlook for the global economy, although a strong U.S. dollar put some downward pressure on prices.

Thursday’s U.S. economic data was upbeat as initial claims for jobless benefits fell more than expected and mid-Atlantic factory activity rebounded sharply.

FUNDAMENTALS

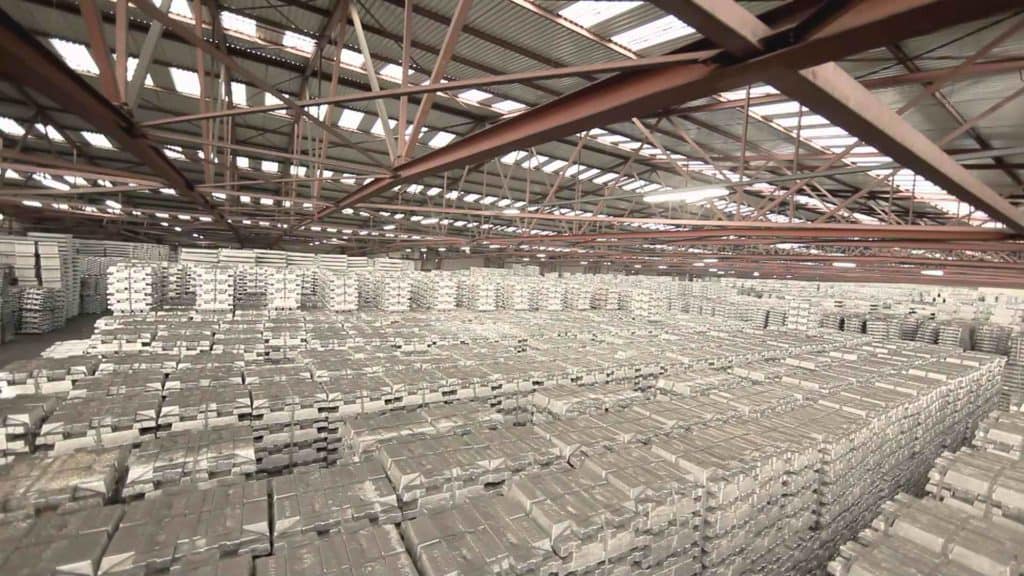

* COPPER, ALUMINIUM: Three-month copper on the London Metal Exchange was almost flat at $6,423.5 a tonne by 0335 GMT, while aluminium edged up 0.2 percent.

* COPPER OUTLOOK: “We are looking at three months and I think copper will go up … because we are going to have more demand as part of a cyclical trend,” said CRU analyst Chris Wu, referring to seasonally higher growth in China in the second quarter.

* ZINC: Both London zinc and Shanghai zinc fell, despite depleting inventories in LME warehouses MZNSTX-TOTAL.

* AUSTRALIA: Commodity giant Glencore on Friday said it had suspended operations at its McArthur River zinc mine in northern Australia as a cyclone approaches.

* NORSK HYDRO: Norsk Hydro, one of the world’s largest aluminium producers, said one of its key units is operating at only 50 percent of capacity following a cyber attack on the company this week.

* SHANGHAI: The most-traded copper contract on the Shanghai Futures Exchange fell 0.8 percent to 48,940 yuan ($7,300.77) a tonne, while aluminium lost 0.4 percent and nickel fell 2.3 percent.