The London Metal Exchange will enter 2023 with the smallest available warehouse stockpiles in at least 25 years, setting the stage for future squeezes and spikes if demand turns out stronger than expected.

Available inventories of the six main metals traded on the LME plunged by two thirds in 2022, with aluminum’s 72% decline accounting for the bulk of the drop, while zinc shrank by 90%. Collectively, inventories not already marked for withdrawal hit the lowest level in data going back to 1997 on Thursday, and finished the year only fractionally higher.

While most of the world’s metal never sees the inside of an LME warehouse, exchange inventory levels are important because every short seller who holds a contract to expiry must deliver physical metal registered in an LME warehouse. The LME has introduced new rules to allow deferral to prevent future squeezes, but the exemptions come with costly fees.

The tight stockpiles also reflect a tension that has gripped metals markets for much of this year, between constrained supplies on the one hand, and worries about weakening demand due to recessionary threats in the world’s key economies on the other.

For traders on the LME, the dwindling inventories represent another in a litany of headaches following one of the most dramatic years in the exchange’s 145-year history. The LME is facing regulatory probes and lawsuits over its actions during a runaway short squeeze in the nickel market in March that pushed several LME dealers to the brink of default, and is due to soon publish the results of an independent review into the crisis.

Heading into 2023, a key debate across metals markets is whether a worldwide downturn in industrial activity and rebounding supply will help to replenish the industry’s threadbare reserves, while China’s recent reopening from Covid lockdowns adds further uncertainty.

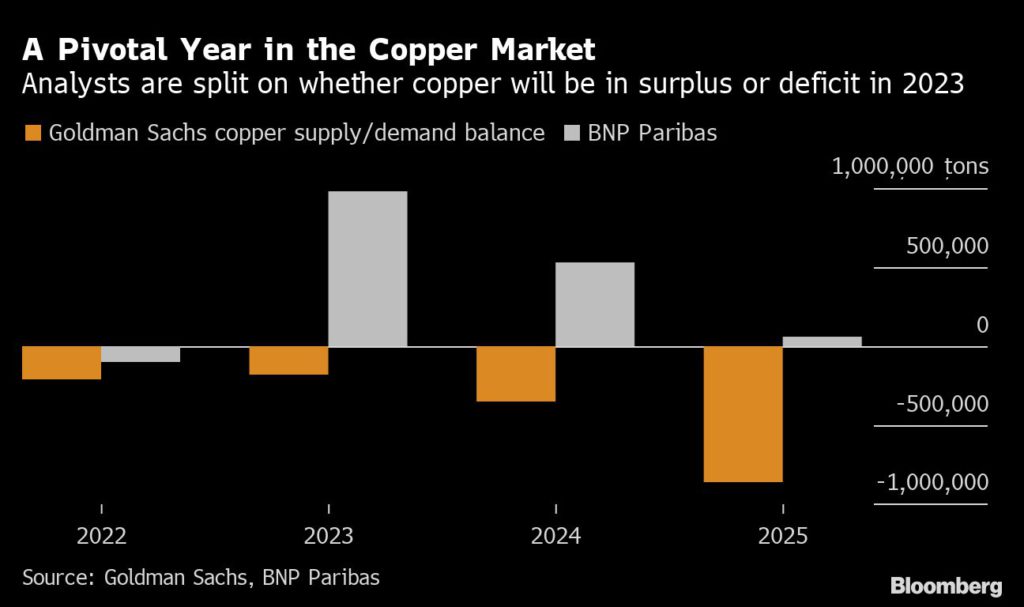

The debate over the outlook for metals supply and demand is particularly contentious in copper, where some analysts are predicting ongoing deficits while others see the market swinging into a rare and historic period of oversupply.

That’s feeding into a sharp divergence over the outlook for prices, with analysts at Goldman Sachs Group Inc. predicting copper will hit a record high of $11,000 a ton within 12 months, while BNP Paribas says prices will drop to $6,465 a ton by the middle of next year as the market swings into a huge surplus. Prices were little changed at $8,402.50 as of 1:58 p.m. local time on the LME on Friday.

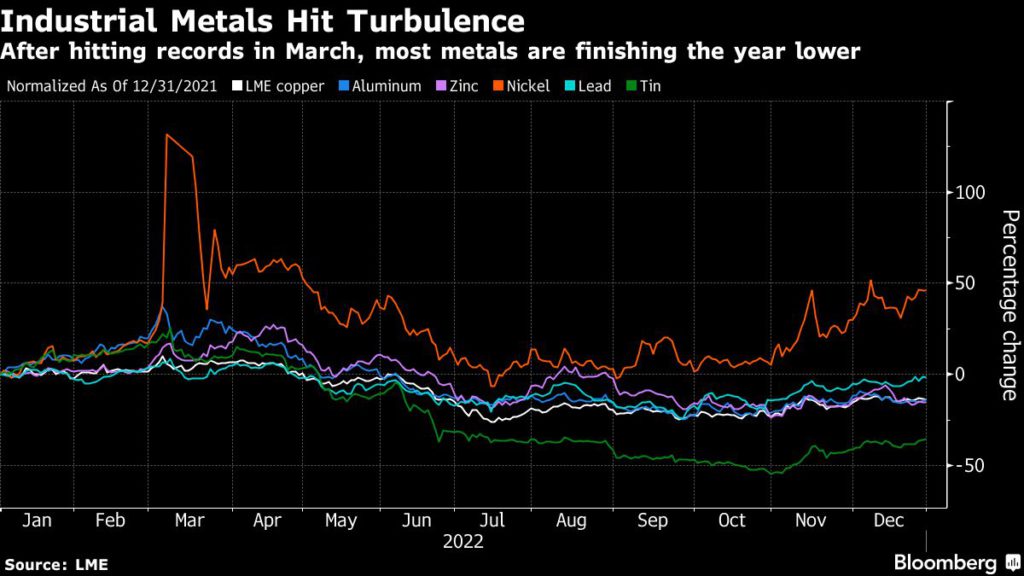

As the year draws to a close, only nickel is trading in positive territory. The market remains hamstrung by low liquidity since the crisis, with regular sharp swings.

Copper, zinc and aluminum are all down more than 10% this year, while tin, the worst performer, has plunged by more than a third and is set for the biggest annual decline since at least 1990.

A historic squeeze in the tin market seen during the early stages of the pandemic has unraveled this year, with cooling demand from the electronics sector coinciding with a recovery in supply. Still, worries about low levels of inventory persist, and prices have been staging a comeback over the past two months as buyers move to secure stocks in anticipation of a rebound in demand.