Many lithium mines, led by Chinese operators, are maintaining production of the raw material needed for electric vehicle (EV) batteries, in defiance of prices weak enough to trigger mass output cuts – providing a boon for battery makers.

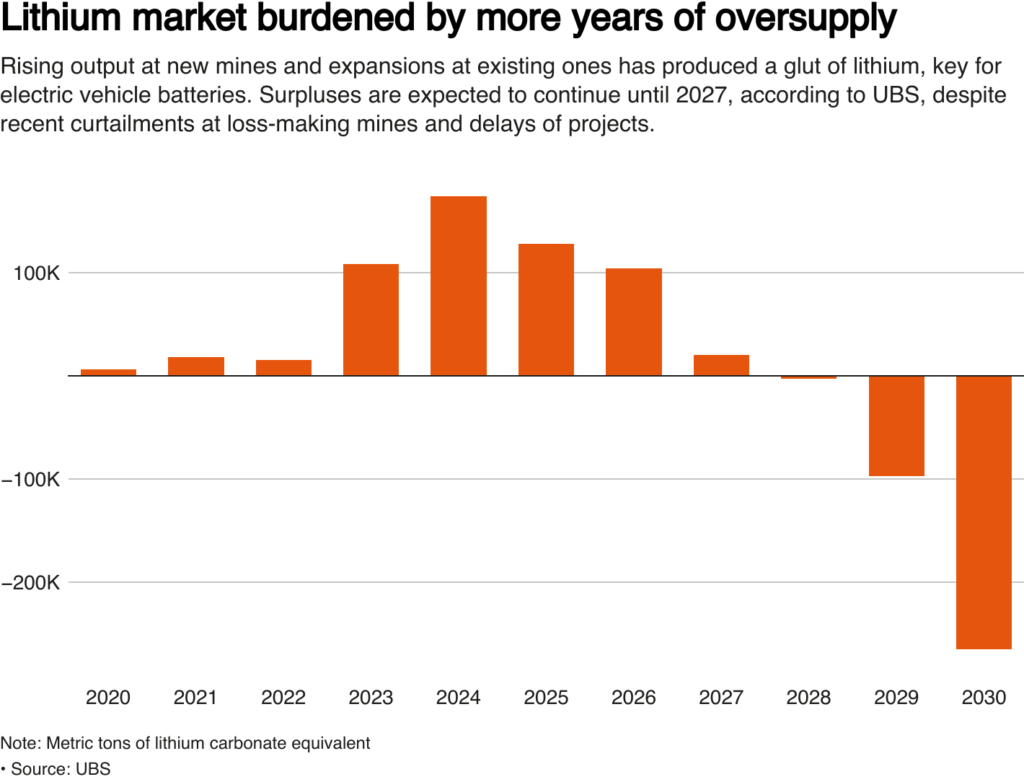

The continued production raises the prospect of years of oversupply and of weak prices.

Some battery makers own mines or have injected cash into operations to keep them operational, company reports show.

Mines were also maintaining production to retain market share and good relations with governments and because closures and restarts can lead to technical issues, according to interviews with miners, consultants and analysts.

So far, around a dozen lithium producers have temporarily shut loss-making mines, trimmed output or delayed expansions.

Many others are still operating, meaning the global supply glut of the mineral needed for batteries for stationary storage, as well as for EVs, is likely to last for several years and keep prices low, the industry insiders and analysts said.

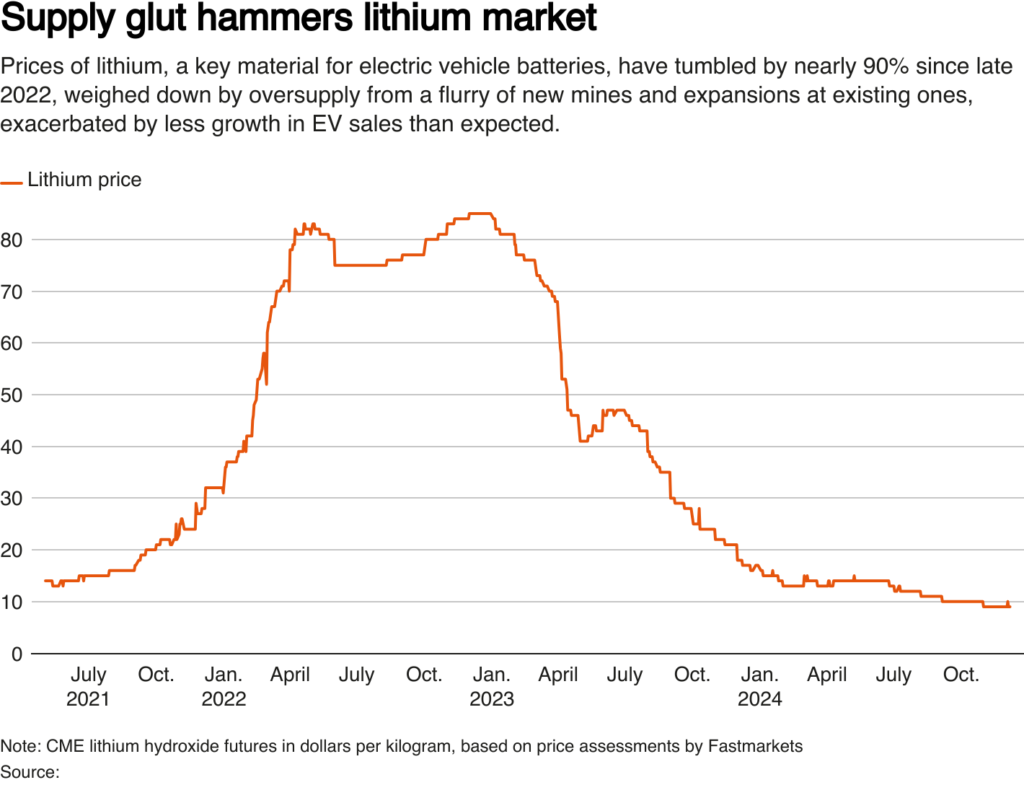

The lithium hydroxide price has slid nearly 90% since touching a peak of $85 per kilogram in December 2022, after soaring by more than sevenfold during the previous 18 months.

Global lithium supply is forecast to rise by 25% this year and 15% in 2025, UBS said.

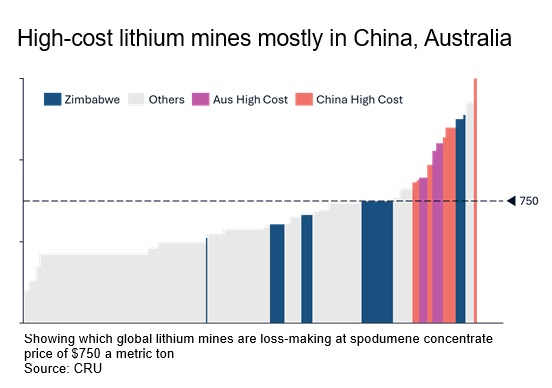

“There are some assets in production that shouldn’t really be, but for their own reasons, they’re ploughing on,” Martin Jackson, head of battery raw materials at CRU, said.

He estimated about 10% of production is loss-making.

China has some of the highest lithium mine costs, but many Chinese-owned lithium mines at home and in Australia and Africa are unlikely to close because they are integrated into downstream supply chains, analysts and consultants said.

They noted China’s government regards its world leading EV and battery sector as strategic and is keen to keep it thriving with steady raw material supplies and low costs.

China’s Zimbabwe mines

An expected surge in EV sales and a spike in lithium prices in 2021 and 2022 ago led to an increase in new mines.

After prices fell in response to oversupply and weaker-than-expected EV sales, investment in lithium mines continued, and last year jumped by 60%, the International Energy Agency said.

Some of the investment stemmed from China’s quest to ensure lithium supplies abroad, including Zimbabwe, which has become the world’s fourth biggest supplier of mined lithium in the space of a few years.

All four operating mines are majority-owned by Chinese companies but are making scant profit or suffering losses, according to Cameron Perks, product director of lithium at consultancy Benchmark Mineral Intelligence.

None of them has shut down despite costs ranging from $600 to $1,000 per metric ton of material sold compared to a price of $765 per ton, said Perks, who visited mines in the country in recent weeks.

The price is based on spodumene concentrate containing 6% lithium (SC6), a semi-processed material resulting from separating other minerals from lithium ore.

“There’s a common understanding that Chinese parent companies could absorb some costs downstream,” he said.

“There’s also the political aspect in China, wanting to secure their supply chains outside of Australia and Canada, where they’ve had some pushback.”

He said the highest cost mine in Zimbabwe, Arcadia, is owned by Zhejiang Huayou Cobalt, which also produces downstream battery cathode materials.

Australia mines get outside support

In Australia, where costs are also high, some companies plan to tough it out with support from battery makers, rejigging mine plans and offsetting losses in lithium with profitable production of iron ore, copper or nickel.

Mineral Resources (MinRes) last month said it was putting its Bald Hill mine under care and maintenance.

However, it also left two other mines producing, although at lower levels, including Mt. Marion, which has higher costs than Bald Hill on an SC6 basis due to lower grades, according to Luke Allum at consultancy Project Blue.

The two other mines are jointly owned so MinRes has to consult with its partners. Mt. Marion mine is 50% owned by China’s Ganfeng Lithium, which manufactures batteries as well as being a lithium producer.

“The sweetener for MinRes at Mt. Marion is the mining services contract from Ganfeng, where they get a little extra revenue,” said Allum.

Australia’s Liontown Resources has kept its new Kathleen Valley mine in operation by trimming output during its ramp-up.

Liontown, which posted an annual net loss after tax of A$64.9 million, has been supported by South Korean battery maker LG Energy Solution (LGES), which supplied $250 million in funding in July.

LGES, which got a 10-year extension to its lithium supply deal from Liontown, has benefited from weak lithium prices, with an official telling an earnings call in July: “Due to weak metal prices, the advanced automotive battery division posted an increase in revenue.”