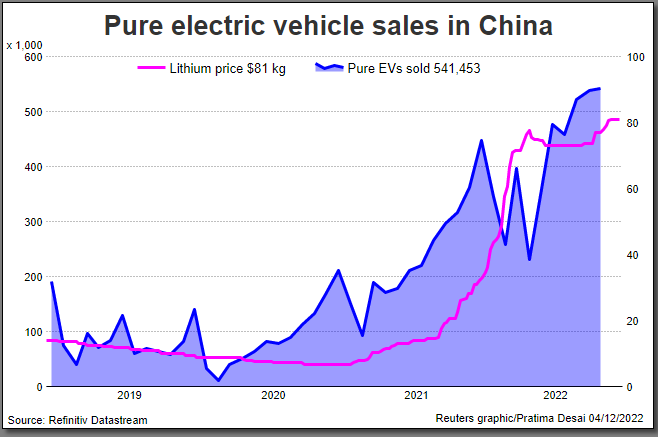

Healthy demand from battery manufacturers and shortages have propelled lithium prices to records, but rising supplies and China removing subsidies for electric vehicles mean a retreat is on the cards.

Battery grade lithium prices trading near $85,000 a tonne are more than double the levels seen at the start of 2022 and four times the levels seen in September 2021.

China, which bought one of every two electric vehicles sold last year, is expected to remain by far the top single country for electric vehicle sales for many more years. But the pace of demand growth is slowing.

“November and December are usually very big months for electric vehicle sales in China,” said Benchmark Mineral Intelligence (BMI) analyst Caspar Rawles.

“There is normally a large fall in electric vehicle sales in January, which next year will be exacerbated by subsidy cuts in China. We expect a demand drop in the first quarter.”

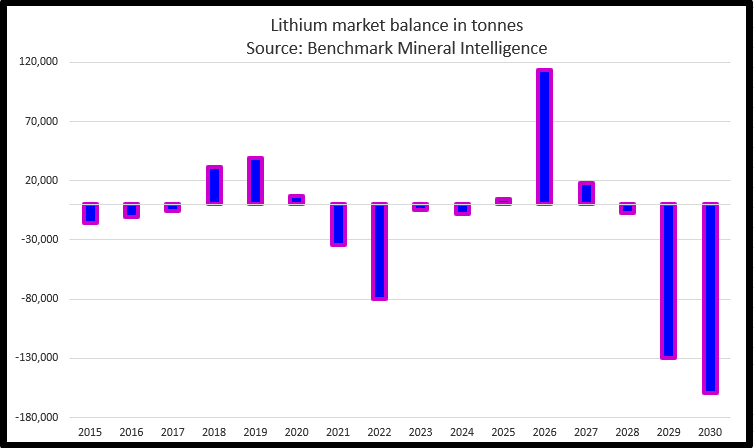

BMI forecasts supply next year at nearly 863,000 tonnes, up 36% from this year. The consultancy sees the deficit in 2023 narrowing to 5,000 tonnes from 80,000 tonnes this year.

Most of the lithium produced around the world – 80% of more than 710,000 tonnes this year, according to BMI – will be used to make electric vehicle batteries. Lithium is also used as a lubricant and in medicines to treat mood disorders.

Rising inventories at lithium-consuming firms will also pressure prices, but not to the extent they fall back to levels around $6,000 a tonne seen in November 2020, analysts say.

Bank of America analyst Michael Widmer expects supplies to grow 38% next year to 880,000, and a surplus of more than 16,000 tonnes in 2023 from a shortfall of 62,000 tonnes this year.

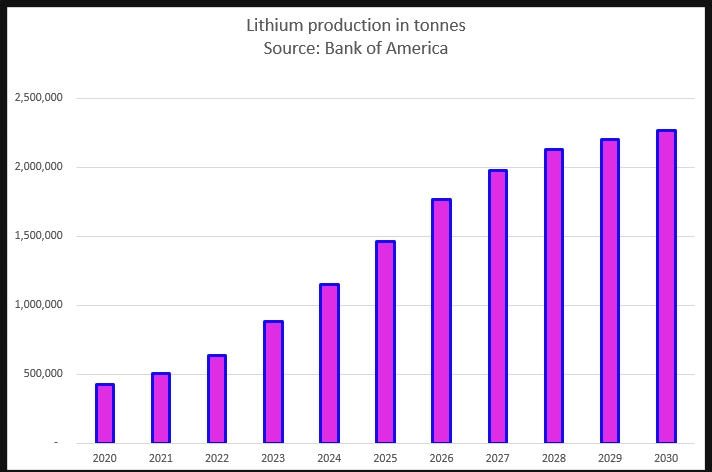

“While the project pipeline is sizeable and might help alleviate shortages, virtually every site needs to come online at the volumes and within the time frames promised to prevent sustained shortfalls,” Widmer said.

“Unfortunately, accidents and disruptions happen, so delays are the norm in the mining industry.”

Overall, producers are rushing to bring new projects online, as lithium demand is expected to grow at an exponential pace alongside accelerating demand for electric vehicles.

Widmer estimates global production will rise to 2.26 million tonnes by 2030.