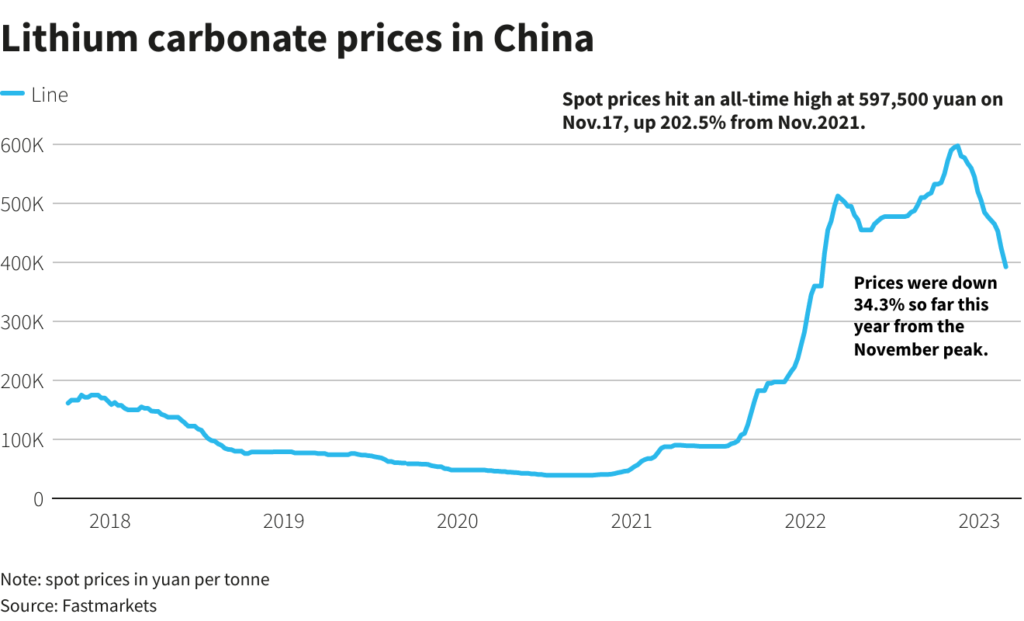

Rare discounts offered by Chinese battery giant CATL to automakers have accelerated a plunge in lithium prices, and the market is set to drop a further 25% with supply growth outpacing demand, analysts and traders say.

After a frenzied rush by electric vehicle makers to secure raw materials over the past two years, which drove prices for lithium carbonate up more than six-fold and spodumene up nearly ten-fold, the bubble has burst.

“Supply is coming on stream faster than you can say ‘boo’,” said analyst Dylan Kelly of Ord Minnett in Sydney.

“Demand remains strong but prices have been unsustainable for some time now.”

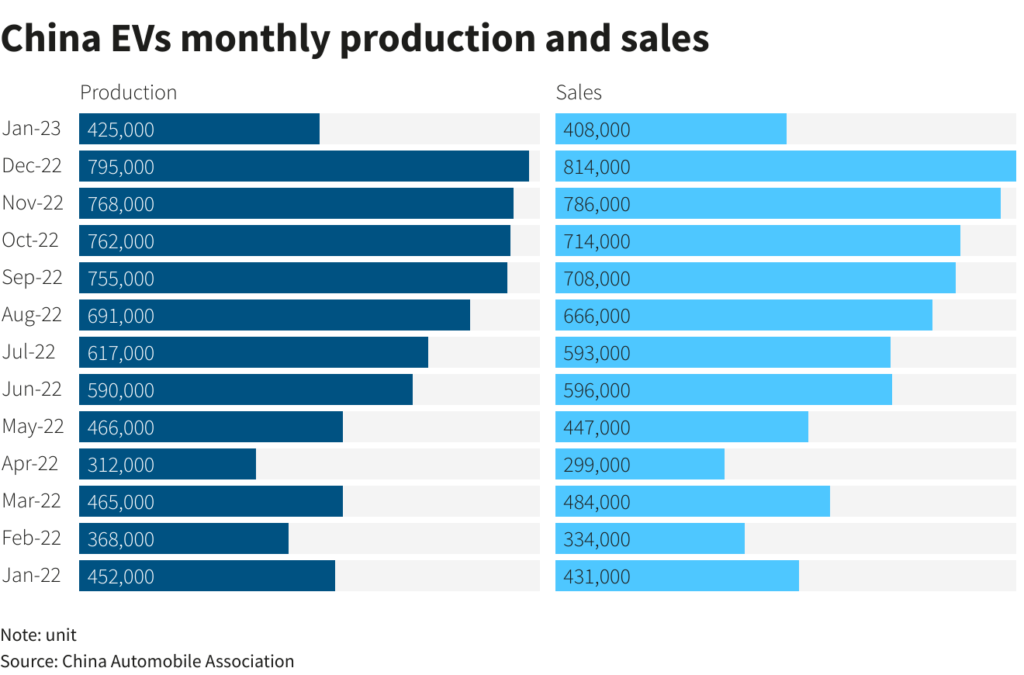

The turning point for lithium prices came late last year as electric vehicle demand in China slowed sharply ahead of Beijing’s planned halt to subsidies for the $87 billion industry, the world’s biggest and fastest growing.

The slide steepened, analysts say, as investors were spooked by a drop in China’s January electric vehicles sales and by CATL’s discount terms, which included an assumption that prices of lithium carbonate, a key component in auto batteries, would more than halve.

But even as demand worries have rocked markets, it is the looming supply from China, Australia and Chile that will bring prices back down to earth, analysts say.

Rystad Energy sees the global market deficit of lithium shrinking to around 20,000 to 30,000 tonnes of lithium carbonate equivalent (LCE) this year, from 76,000 tonnes LCE in 2022.

Given growing supply, Goldman Sachs sees spot prices of lithium carbonate, a precursor to the compound used in making lithium-ion batteries, sinking to $34,000 a tonne in the next 12 months, from an average of $53,304 this year.

Out to 2025 it expects lithium supply to grow on average by 34% a year against an annual demand growth rate of 25%.

“The likely supply surge and downstream overcapacity are set to bring lithium prices down subsequently in the medium term,” it said in a Feb. 23 note.

Demand fears

A 6.3% drop in sales of new energy cars, including fully electric cars and plug-in hybrids, in China in January, after they grew by 90% in 2022, sparked concerns of softening growth that would crimp demand for batteries and battery materials.

“While we remain positive on the long-term outlook for lithium, the short-term outlook is less clear, with a clear acceleration in China EV sales needed to allay market fears,” Barrenjoey analysts said in a research note on Feb. 17.

Some, including lithium giant Albemarle, ascribed lower car sales to temporary weakness given the early Lunar New year. Albemarle sees China’s EV market growing 40% this year. But prices have continued to fall.

“Demand is still healthy, but battery and EV makers are currently destocking instead of placing new orders. The subdued spot demand therefore is weighing on sentiment and pressing down prices,” said Susan Zou, Shanghai-based vice president at consultancy Rystad Energy.

Miners unfazed

The decline in lithium prices in China, the world’s biggest consumer, has hit lithium producers overseas. Shares in Albemarle and Australia’s Pilbara Minerals are both down by a quarter since November, while Allkem is down around 30%.

However Allkem’s chief sales and marketing officer, Christian Barbier, said the price slide in China “needed to happen” and was “helpful”, and said it was exacerbated by the country’s battery makers jostling for market share.

Miners’ profitability remained very strong, he told analysts on an earnings call on Feb. 23.

“So that’s why we’re not too concerned about the overall fundamentals and the future direction of prices,” Barbier said.

S&P analysts see the average cash operating cost of lithium carbonate production at $4,563 per tonne LCE and total cash cost $7,540 per tonne LCE, which is a fraction of the prices that analysts are forecasting for lithium carbonate.

“Therefore it is quite a stretch to find the bottom for lithium prices because lithium producers will remain profitable under much lower prices,” S&P Global Commodity Insights analysts said in comments to Reuters.

Lithium carbonate sinks

The price decline has been sharp. Chinese spot prices for lithium carbonate have fallen from near an eyewatering 600,000 yuan ($86,207) a tonne in mid-November to below 400,000 yuan currently.

They are likely to drop below 300,000 yuan by the end of this year, about half the level they peaked at in November 2022, said four China-based analysts and five traders, buyers and producers.

“A lithium carbonate price of 200,000-300,000 yuan per tonne is where both upstream and downstream will feel comfortable,” said Rystad’s Zou.

Even support from supply disruptions such as an investigation into illegal mining in China’s lithium is likely to prove only temporary, analysts said.

Prices for lithium raw material spodumene have hit five-month lows.

RBC Capital Markets sees spodumene prices, last at $5,800, slumping to an average of $4,275 a tonne in 2024.

“The decrease in spodumene prices has been quicker than what we anticipated,” said RBC analyst Kaan Peker.