In the quest for electrification and cleaner energy sources, all eyes are on lithium, a.k.a. white gold, and how the market strives with battery prices continuing to fall.

According to BloombergNEF, the dramatic lithium price dropping trend will persist for several years, making battery technology economically viable for global decarbonization efforts. Benchmark Mineral Intelligence echoes this sentiment, highlighting the impending lithium market expansion driven by surging EV demand.

What Drives Lithium Battery Prices Down?

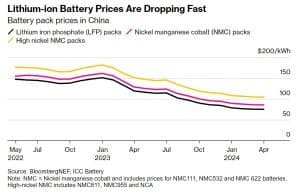

In the past year, the price of lithium iron phosphate (LFP) battery cells in China has dropped 51% to an average of $53 per kilowatt-hour (kWh), which is significantly lower than the global average of $95/kWh last year, per BloombergNEF.

This price decrease is driven by several factors, including:

- Falling Raw Material Prices: Raw material costs, particularly for the cathode, have sharply declined. The cathode’s share of total costs for LFP cells in China dropped from 50% in early 2023 to under 30% this year.

- Overproduction: China’s battery production capacity exceeds global electric vehicle (EV) demand, leading manufacturers to cut prices to maintain market share. Average capacity utilization in Chinese battery plants fell from 51% in 2022 to 43% in 2023 and is expected to decrease further.

- Technological and Manufacturing Improvements: Companies like CATL and BYD are investing heavily in R&D, automation, and new factories, launching new products rapidly.

One of the most essential ingredients in the production of batteries, lithium powers some of the most important devices in our everyday lives. Dramatic lithium price dropping trends will persist for several years making battery technology economically viable for global decarbonization efforts. Li-FT Power Ltd. (TSX-V: LIFT | US: LIFFF) is the fastest developing North American lithium junior. Click here to learn more about their vast lithium assets including their flagship project, a 100%-owned Yellowknife Lithium project.

A Bright Prediction for Lithium Batteries

BloombergNEF predicts that low lithium battery prices will persist for several years, significantly impacting the automotive and power sectors. At $50/kWh, battery technology is already economically viable for decarbonizing road transport globally.

A major evidence is on point. In China, pack-level prices for the most common battery chemistries have been below the $100/kWh benchmark since October 2023. Lithium iron phosphate (LFP) pack prices are now at $75/kWh, making EVs competitive with combustion cars in most segments.

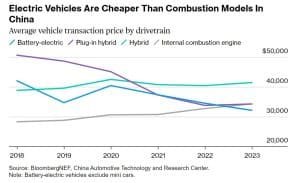

Additionally, Chinese EVs are now the cheapest drivetrain by average transaction price, even excluding mini-city cars. This shift will gradually reflect outside China, benefiting commercial EV manufacturers and reducing the premium they pay for batteries.

With the lithium battery prices dropping fast, another market stands to gain a lot from it – energy storage.

Turnkey energy storage systems are 43% cheaper than a year ago. Global stationary storage installations are projected to rise to 155 GWh this year, up 61% from last year, according to BNEF data.

The narrative of perpetual battery and battery metal shortages has been challenged by recent developments. For instance, Toyota’s assertion last year that there were not enough batteries to meet global demand now appears outdated as battery prices continue to fall.

In fact, the substantial drop in battery prices in China could revolutionize the global automotive market by making EVs more affordable and accelerating the transition to renewable energy storage solutions.

More notably, it signals that the lithium market is on the verge of a significant expansion in the coming years, as what the Benchmark Mineral Intelligence highlights in its Q2 2024 Lithium Market Overview. Benchmark is a prominent provider of independent data and advisory services for the lithium-ion battery and EV supply chain.

On the Brink of a Major Expansion

While short-term volatility is expected, long-term prospects indicate a structural deficit as the lithium supply struggles to keep pace with the accelerating EV revolution.

According to Benchmark’s latest report, global lithium demand is projected to reach 1.15 million tonnes of lithium carbonate equivalent (LCE) by 2024, with an astounding 87% driven by batteries, particularly EVs—the dominant end-use application.

Looking ahead, demand is forecasted to more than double, reaching 2.89 million tonnes LCE by 2030. Batteries account for a staggering 94% of consumption, while industrial uses like glass and ceramics decline to just 6% of the total.

Simon Moores, CEO of Benchmark Mineral Intelligence remarked on this trend, saying:

“The lithium market is facing a demand tsunami from the rise of EVs that will put immense pressure on supply. Every auto maker has ambitious EV targets, and lithium-ion batteries are the enabling technology.”

On the supply side, Australia led lithium production in 2023 with a 40% global market share from hard rock mines, followed by Chile at 24%. However, Chinese production is anticipated to surpass Chile by 2025 as new projects come online.

Geographical diversification in lithium mining will increase as the market expands, yet the concentration of lithium chemical production remains high in China and South America. Significant capital investments are deemed necessary to expand current operations and meet future demand.

Benchmark’s price forecast sees spodumene concentrate, a key driver of lithium chemical prices, to average $5,000 per tonne longer-term. This translates to a lithium carbonate price of around $30,000 per tonne.

What All These Mean for Investors?

For investors, the lithium market’s growth trajectory presents opportunities across producers like Albemarle, SQM, Ganfeng Lithium, and Pilbara Minerals, as well as battery manufacturers, EV makers, and ETFs focusing on the EV supply chain. Moores emphasized that white gold is pivotal in unlocking the EV and clean energy revolution. This calls for unprecedented scaling that hinges on significantly higher prices.

Investors must meticulously navigate opportunities and threats in this dynamic market.

Despite recent challenges such as oversupply and lower-than-anticipated EV sales in China, which led to substantial price declines for lithium carbonate, the long-term outlook remains optimistic. Anticipated strong rebound in demand with accelerating global EV adoption suggests potential price recovery from 2025 onwards.

But the caveat? Sustained high prices are necessary to incentivize new supply to meet future demand for lithium through the decade.