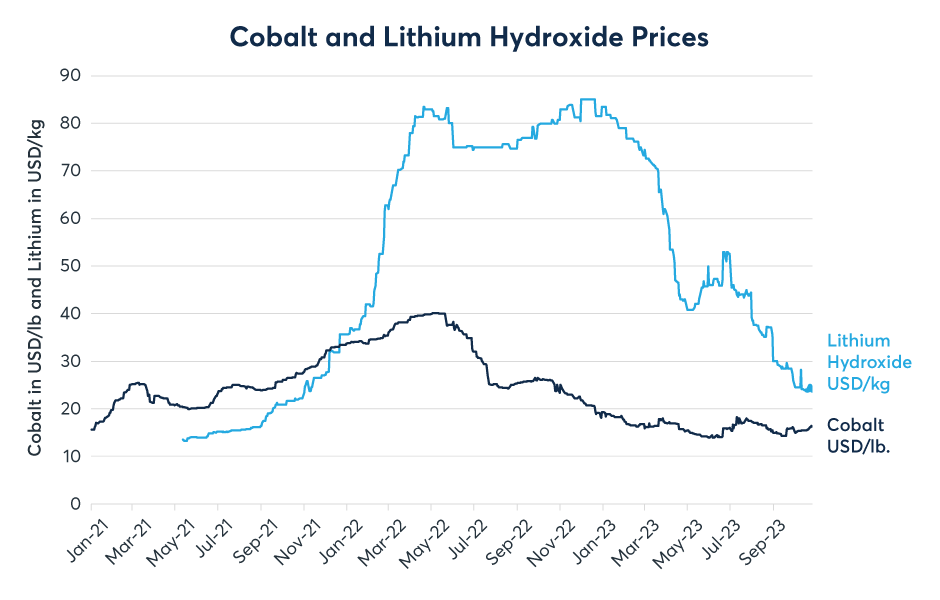

Slower-than-expected consumer adoption of electric vehicles (EVs) in 2023, wavering economic growth in China since the pandemic and burgeoning lithium and cobalt supplies have sent prices of both metals lower even as producer/hedger interest in futures contracts has expanded dramatically. China is the biggest market for EVs, while lithium and cobalt are used in the manufacture of EV batteries. Since their 2022 peaks, cobalt prices have fallen by over 50% from $40 to $16.5 per pound, while the price of lithium hydroxide has fallen nearly 75% from $85 to $23 per kilogram (Figure 1).

Figure 1: Lithium prices have fallen by about 75% while cobalt is down by over 50%

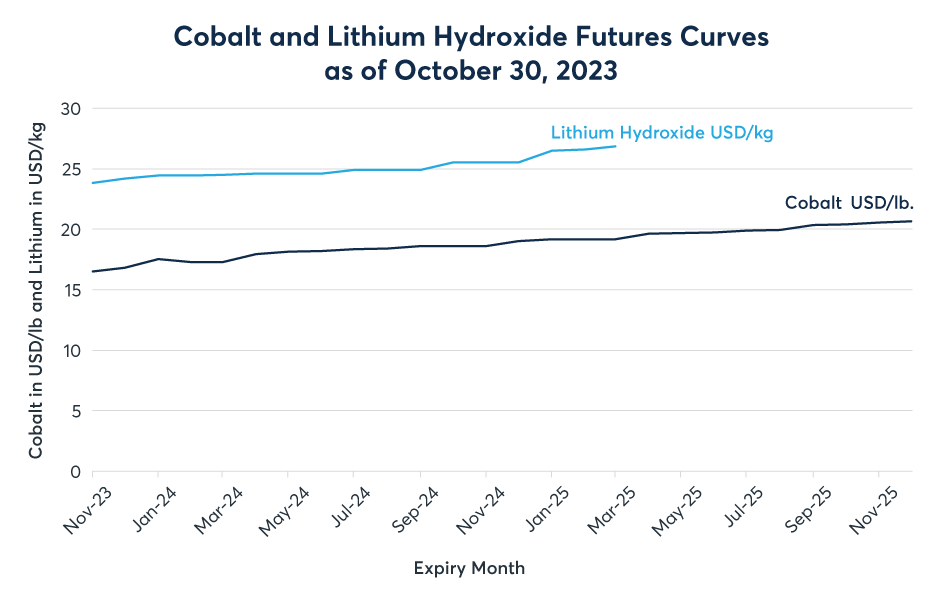

Open interest (OI) in both lithium hydroxide and cobalt has increased significantly amid the price declines, stretching out well into 2025, which is more than typical in the metals complex. As of the end of October 2023, lithium and cobalt futures had open interest as far out as March and December 2025, respectively. These futures curves point towards only a modest hope of recovery in cobalt prices, with December 2025 contracts pricing at around $20.68 per pound compared to $16.50 for November 2023. It was a similar story in lithium, with March 2025 contracts closing in October at $26.85 compared to $23.83 for the November 2023 contract (Figure 2).

Figure 2: Lithium and cobalt futures curves display modest contango

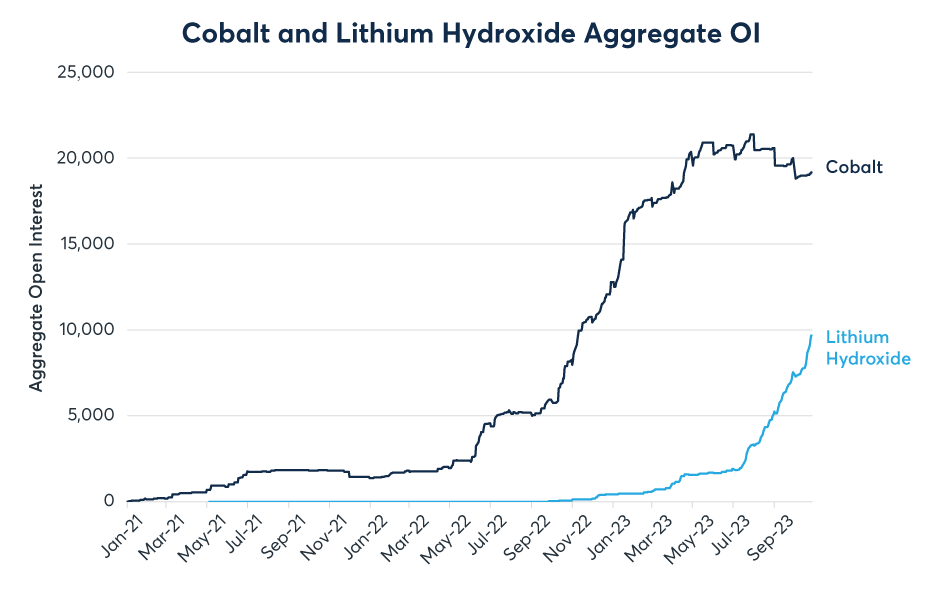

Neither the steep decline in prices over the past 18 months nor the modest expectations for a recovery in prices over the coming 18-24 months have prevented either contract from seeing dramatic growth in aggregate OI. Indeed, OI has soared to nearly 10,000 contracts for lithium hydroxide and to around 20,000 for cobalt in recent months (Figure 3).

Figure 3: Open interest has soared for both lithium hydroxide and cobalt futures

Part of the reason for the strong growth in OI may have to do with the needs of producer hedgers to manage their price risk. Both cobalt and lithium have seen explosive growth in global production in recent decades as well as strong increases in battery use. This is especially the case for lithium, whose mining production has grown 20-fold from 6,100 metric tons in 1994 to 130,000 by 2022 (Figure 4).

Figure 4: Lithium mining output has grown by over 2000% since 1994.

Much of this increased production has been directed to the battery sector. As recently as 2012 only 23% of lithium was used to make batteries. Today, its 80% (Figure 5).

Figure 5: Lithium battery demand has grown from 20% to 80% of use in the U.S.

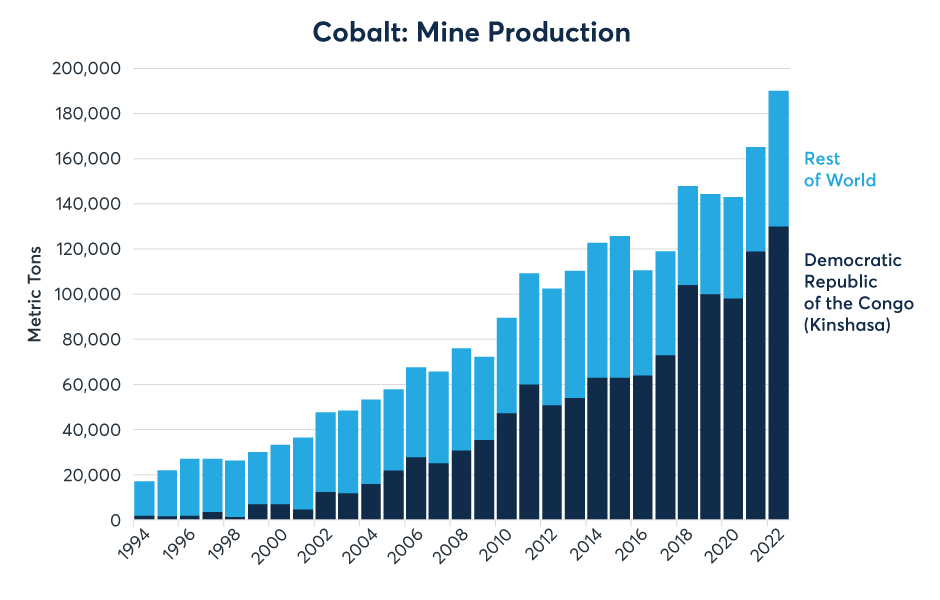

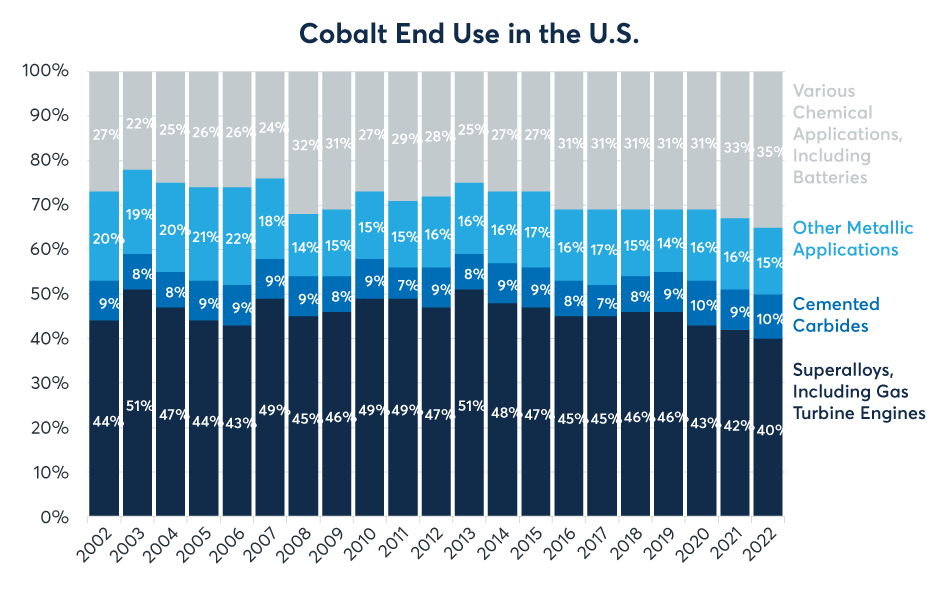

Cobalt’s growth in production hasn’t been as fast as lithium’s but has still seen a spectacular 10-fold increase from 17,000 metric tons to over 190,000 between 1994 and 2022 (Figure 6). Battery usage has grown from around 25% to around 35% of cobalt use in the U.S. (Figure 7).

Figure 6: Cobalt mining production has grown by over 1000% since 1994.

Figure 7: Batteries are taking up a greater share of cobalt end use as well.

The recent declines in lithium and cobalt prices have been mirrored in other metals. Both aluminum and hot-roll coil steel prices have fallen by around 50% since their respective highs in 2021 and 2022. Both metals are closely connected to the pace of growth in China, which has disappointed expectations for strong growth following the country’s sudden reopening from Covid-19 lockdowns late last year. That said, not all is gloomy in China when it comes to the prospects for battery metals: EVs accounted for nearly 40% of vehicle sales in China so far this year.

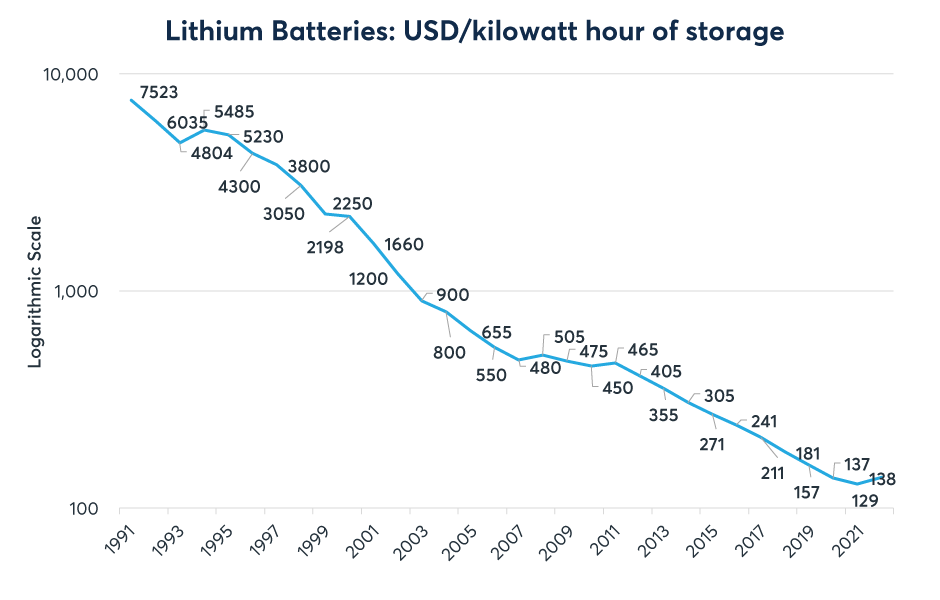

While EV sales have disappointed expectations in the U.S. prompting some automakers to delay investments in lithium battery plants, sales continue to expand. In 2020, there were only 50,000 EVs sold in the U.S. per quarter. That figure has now grown to over 300,000 per quarter. Moreover, the revolution in battery technology continues apace. Since 1991, the cost of storing one kilowatt hour of electricity in a lithium battery has plunged by over 98% from over $7,500 to around $100 (Figure 8). That number ticked higher in 2022 from 2021, perhaps owing to the surge in lithium prices between March 2021 and May 2022. However, the recent 75% drop in lithium hydroxide prices as well as the more than 50% decline in cobalt prices might set the cost of lithium battery storage back on its downward trend, fuelling greater adoption and ultimately a renewed surge in demand. The main question is can any renewed rise in demand keep pace with growing supplies?