The iron ore price fell on Friday, despite reports of China’s support measures for businesses.

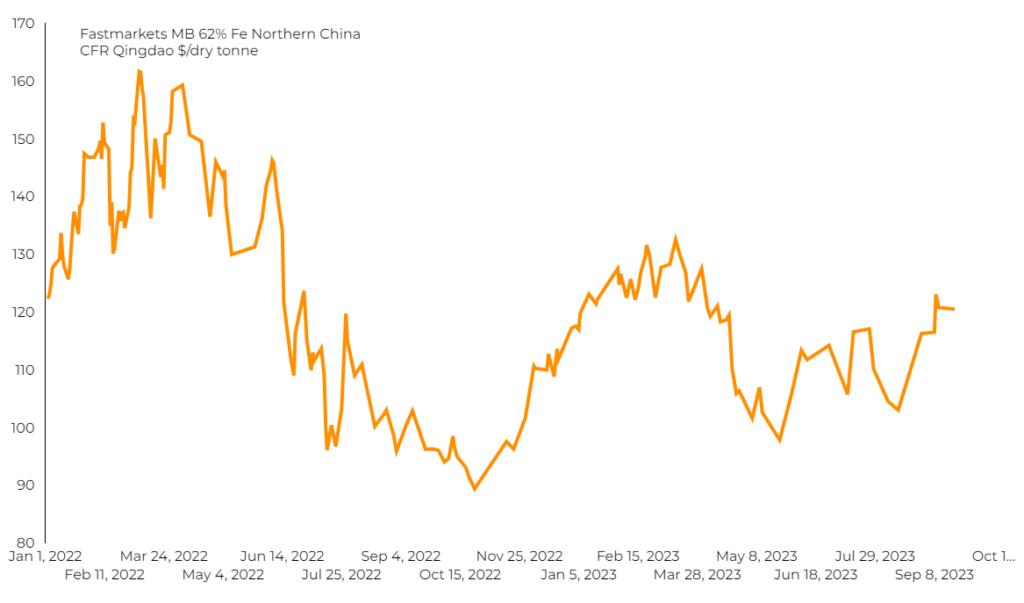

According to Fastmarkets, benchmark 62% Fe fines imported into Northern China fell 3.38% on Friday, to $120.49 per ton.

Iron ore’s benchmark October contract on the Singapore Exchange has fallen more than 2% this week after scaling a six-month peak last week.

The most-traded January iron ore contract on China’s Dalian Commodity Exchange ended morning trade 0.6% higher at 869 yuan ($119.03) per ton.

State media reports said China would continue to break down barriers to market access and increase policy support for the private economy, citing 22 measures issued by the State Administration for Market Regulation.

On Thursday, Rio Tinto said it was pausing work at a Pilbara site in Australia after a Pilbara scrub tree and a one-square-meter rock fell from the overhang of a rock shelter in an area adjacent to the site.

Moody’s on Thursday revised its outlook on four Chinese real estate firms to “Negative” from “Stable”, a week after it revised the view on the country’s crisis-hit property sector to “Negative”.

“China’s sluggish growth and investor concerns over the property and financial sectors look set to persist,” Westpac analysts said in a note.