Gold scaled yet another record peak on Tuesday as traders snapped up the safe haven asset amid growing Middle East tensions, largely ignoring a stronger dollar and tempered bets for U.S. rate cuts.

Spot gold was up 0.8% at $2,268.44 per ounce by 2:07 p.m. EDT (1807 GMT), after hitting an all-time high of $2,276.89

U.S. gold futures settled 1.1% higher at $2,281.8.

“We’re seeing some safe-haven demand flowing into gold, which relates to the Israeli strikes on Iran’s embassy in Syria,” said Daniel Ghali, commodity strategist at TD Securities.

The latest leg up in gold prices is probably also associated with short covering from family offices and proprietary trading shops, Ghali added.

Iran vowed to take revenge on Israel for an airstrike on the Iranian embassy compound in Damascus.

Saxo Bank’s Ole Hansen said an underlying bid from retail and central banks was being joined by momentum-following speculators who have extended their already elevated longs following gold’s break above $2,200.

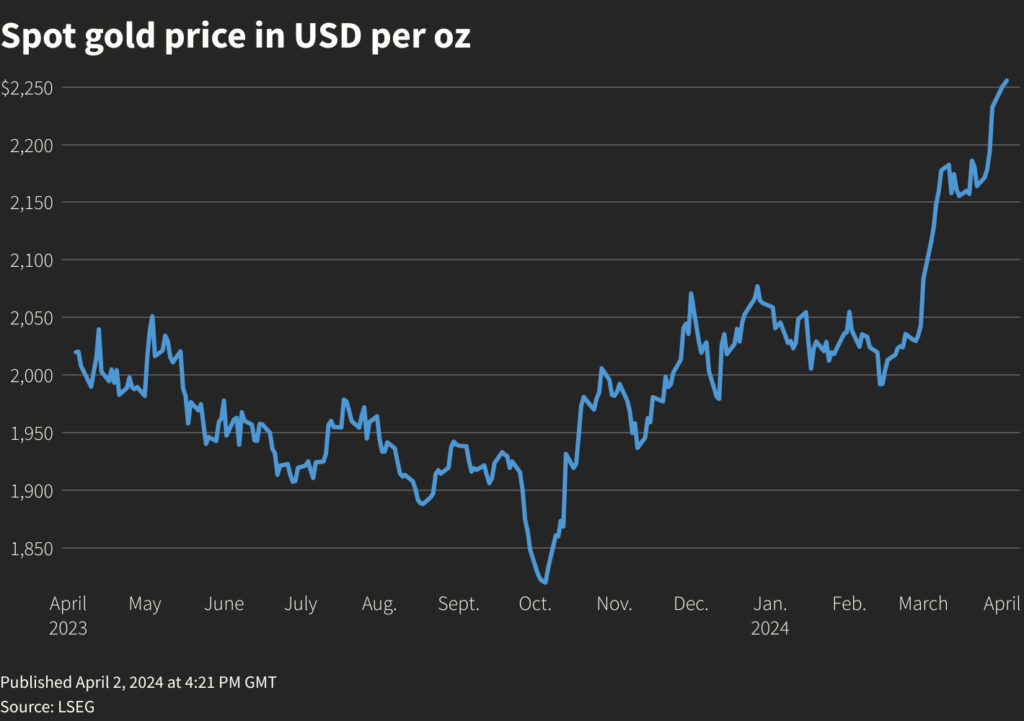

The mix of bullish tailwinds has driven bullion nearly 10% higher so far this year.

“What makes the gold rally so unusual is that it is occurring despite significant traditional headwinds with the U.S. dollar rising, Treasury yields rising, the likelihood of higher for longer U.S. rates increasing,” said independent analyst Ross Norman.

The dollar jumped after Monday’s data showed U.S. manufacturing grew for the first time in 1-1/2 years in March.

Traders pared bets of a June interest rate cut to 58% versus around 60% before the data, which under normal circumstances, would pressure zero-yield bullion.

But while the gold market remains in a “highly bullish mood”, it probably needs to consolidate amid a shift back to a more hawkish view of Federal Reserve policy, said Tai Wong, a New York-based independent metals trader.

Silver rose 3.2% to $25.89 per ounce, platinum added 2.4% to $923.00 and palladium climbed 0.1% to $996.88.