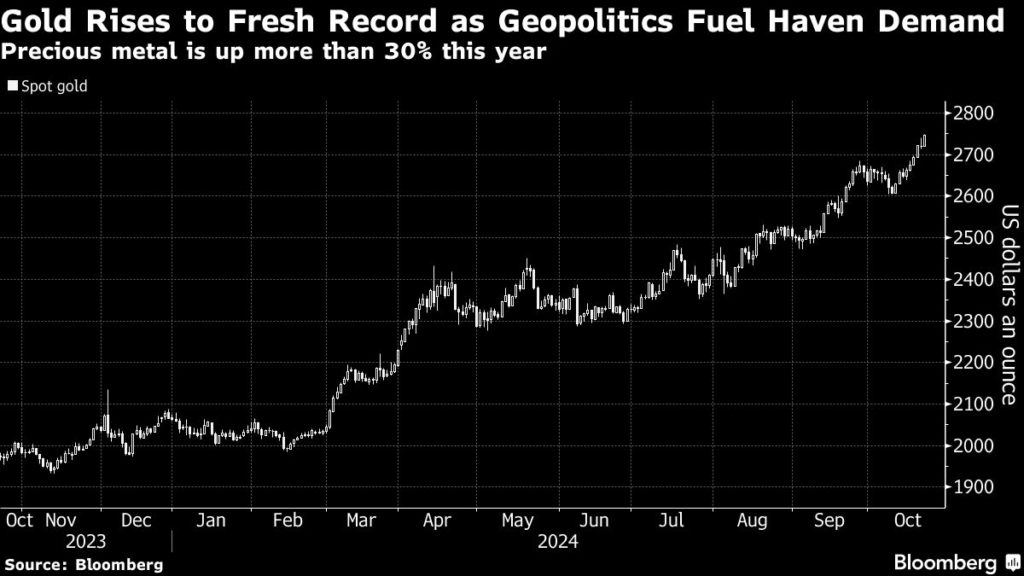

Gold climbed to a fresh record as the approaching US election and conflict in the Middle East boosted haven demand.

Bullion hit an all-time high of $2,748.36 an ounce, topping Monday’s record. Traders have flocked to the market amid a tight US presidential vote and persistent concern that violence in the Middle East may escalate into a wider war. The sentiment spilled over to the silver market, with prices of the white metal climbing for its sixth-straight session to within striking distance of $35 an ounce.

Robust central-bank buying and expectations of US interest-rate cuts have also underpinned gold’s 33% run this year. Federal Reserve officials continue to opine on the path forward, with Jeffrey Schmid favoring a slower pace of rate reductions and Mary Daly forecasting more cuts.

“Haven demand amid heightened geopolitical risks, as well as uncertainty ahead of the US election in November, have also supported gold’s record-breaking rally,” ING Bank NV wrote in a note.

While the outcome of the US election remains uncertain, Saxo Bank A/S Head of Commodity Strategy Ole Hansen suggests gold and silver are getting caught up in bets of a Republican victory.

Meanwhile, money managers have increased net-long positions in gold, while investors have added to holdings in exchange-traded funds. Citigroup Inc. analysts boosted their three-month price forecast by 3.7% to $2,800 an ounce amid expectations that further labor-market deterioration will drive demand.

Spot gold rose 1% to $2,746.41 an ounce at 2:01 p.m. in New York. The Bloomberg Dollar Spot Index was little changed. Palladium, platinum and silver all gained.