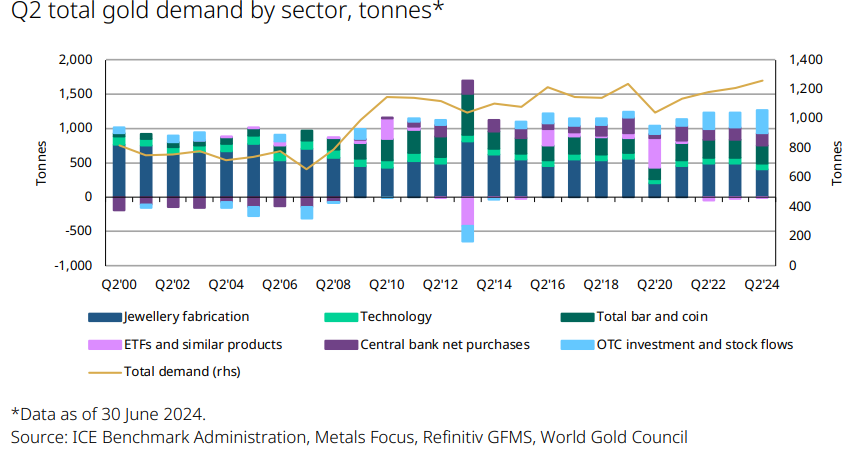

The latest publication by the World Gold Council showed global demand for the precious metal increased 4% year-on-year to 1,258 tonnes in the second quarter, the highest ever of any Q2 on record.

Total increased demand, says the Council, was supported by healthy over-the-counter (OTC) transactions, which were up a notable 53% year-on-year at 329 tonnes.

Central banks and official institutions also increased global gold holdings by 183 tonnes, a slower rate than the previous quarter but still reflecting a 6% increase year-on-year.

The surge in OTC demand and continued buying from central banks, plus a slowdown in ETF outflows, helped drive gold prices to a record $2,427/oz. during the quarter. Gold averaged $2,338/oz. for the three-month period, 18% higher year-on-year.

The WGC central bank survey confirmed that reserve managers believe gold allocations will continue to rise over the next 12 months, driven by the need for portfolio protection and diversification in a complex economic and geopolitical environment.

“The rising and record-breaking gold price has made headlines as strong demand from central banks and the OTC market supported prices, which has been a consistent trend throughout the year,” Louise Street, senior markets analyst at the WGC said in the report.

Demand breakdown

Global gold investment remained resilient during Q2, marginally higher year-on-year at 254 tonnes, concealing divergent demand trends. Bar and coin investment decreased 5% to 261 tonnes, due to a sharp decline in demand for gold coins.

Strong retail investment in Asia was counterbalanced by lower levels of net demand in Europe and North America, where profit-taking surged in some markets, WGC said.

Global gold ETFs saw minor outflows of 7 tonnes during the quarter. Asian growth continued, sizable European outflows in April turned into nascent inflows in May and June, and North American outflows slowed significantly compared to the previous quarter.

Record high prices drove down jewellery demand by 19% year-on-year in Q2, but H1 demand remains resilient compared to the same period last year, thanks to a stronger-than-expected first quarter.

In addition, demand for gold in technology continued to increase, jumping 11% year-on-year driven primarily by the AI boom in the electronics sector which saw an increase of 14% year-on-year.

Meanwhile, gold supply rose 4% year-on-year, with mine production increasing to 929 tonnes. Recycled gold volumes increased 4% compared to the same quarter in 2023, marking the highest second quarter since 2012.

Outlook

Looking ahead, the question is: “What will be the catalyst to keep gold front and centre in investment strategies?” Street said.

“With a long-awaited rate cut from the US Fed on the horizon, inflows into gold ETFs have increased thanks to renewed interest from Western investors. A sustained revival of investment from this group could change demand dynamics in the second half of 2024.

“In India, the recently announced import duty cut should create positive conditions for gold demand, where high prices have hampered consumer buying,” she noted.

“While there are potential headwinds for gold ahead, there are also changes taking place in the global market that should support and elevate gold demand.”