Expectations of a rebound in steel production in China, along with signs of softening demand, are combining to cast a shadow over the valuation of listed Chinese steel companies.

Steel prices in China have weakened this year following a two-year bull run, with Shanghai-traded steel rebar falling 15 percent from a peak in December amid worries of renewed production growth and tepid demand.

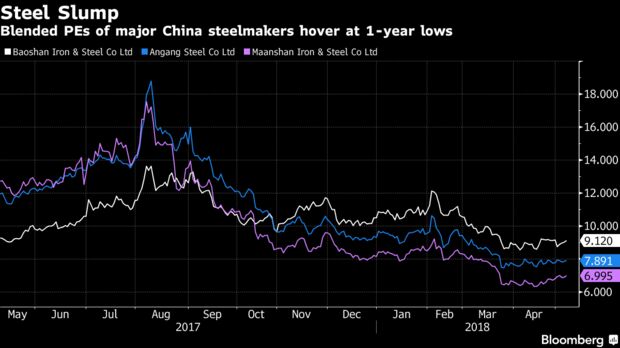

Shares of most Chinese steelmakers like Baoshan Iron & Steel Co Ltd, Angang Steel Co Ltd and Maanshan Iron & Steel Co Ltd saw a sharp correction in February and March before staging a minor rebound. Reflecting investor caution over the sector’s outlook, price-to-earnings ratios of the shares of Baoshan, Angang and Maanshan are still hovering around one-year lows.

“I don’t see a lot of opportunities in steel sector,” said Pan Jiang, chief executive officer of private investment fund Shanghai V-Invest Co. “The supply-side reform has created a lot of positive effect in the last few years but does not look likely to gain much further momentum this year.”

Driven by Xi Jinping’s supply-side reform aimed at reducing industrial capacity and tackling emissions, China closed many illegal and polluting plants across the country in the last two years. The move sparked a major rally in prices of commodities from steel to aluminum as well as Hong Kong and mainland-listed shares of Chinese steel mills, which have long been plagued by overcapacity. Major steelmakers like Baoshan, Angang and Maanshan were the main beneficiaries of the reform as they gained more pricing power.

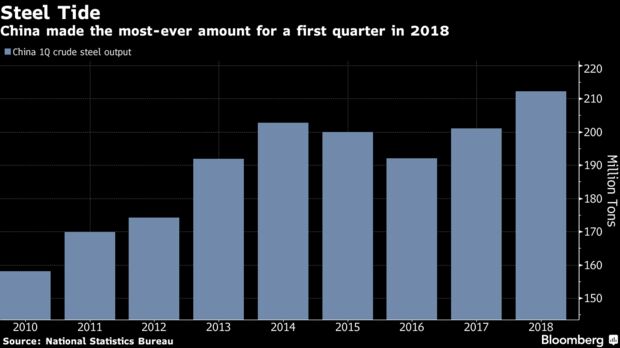

Now rising production and falling steel prices have started to weigh on the profits of steelmakers. China’s iron and steel industry, the biggest in the world, posted a slide in its profits for the first quarter. Baoshan and Angang are expected to see a drastic slowdown in their earnings growth this year, according to data compiled by Bloomberg. Maanshan Iron & Steel is likely to post a drop in earnings.

“The overall steel demand is falling from last year. We are relatively pessimistic,” said Yang Kunhe, an analyst with Pacific Securities Ltd, adding that China’s real estate and infrastructure spending are now in a downward trend, and that is unlikely to be offset by a recovery in manufacturing.

The A-shares of most Chinese steelmakers weakened on Monday, under-performing a slight increase in the benchmark Shanghai composite Index. Shares of Baoshan continued to rise after the company announced a price hike for some hot-rolled steel products last week. The stock gained 1.4 percent on Monday.

Yang’s industry view is largely in line with what Mysteel Research forecast at the end of last year. The consultancy expected the Chinese market to swing to surplus from deficit this year. It said steel production in China is likely to rise while demand would remain flat as a price rally to the highest in nine years prompts a surge in supply.

Citigroup is a bit more optimistic, expecting China’s steel demand growth to slightly outpace production increase. According to an April 15 note from the U.S. bank, China’s steel output is expected to rise 1.4 percent to 855 million metric tons this year, while demand will expand 1.5 percent to 752 million metric tons.