Battery-material giant Ganfeng Lithium Group Co. said it would set up a derivatives-trading desk, in a sign the industry is seeking to hedge against risks after a period of extreme volatility and geopolitical tensions.

Derivatives will be used to lower the risks of cross-border investments and to enhance financial stability, the Chinese producer said in a statement on Monday, with the largest position for a single day of no more than 8 billion yuan ($1.1 billion). The desk will trade instruments linked to equities, indexes, commodities and rates, it said, without giving details of staffing or location.

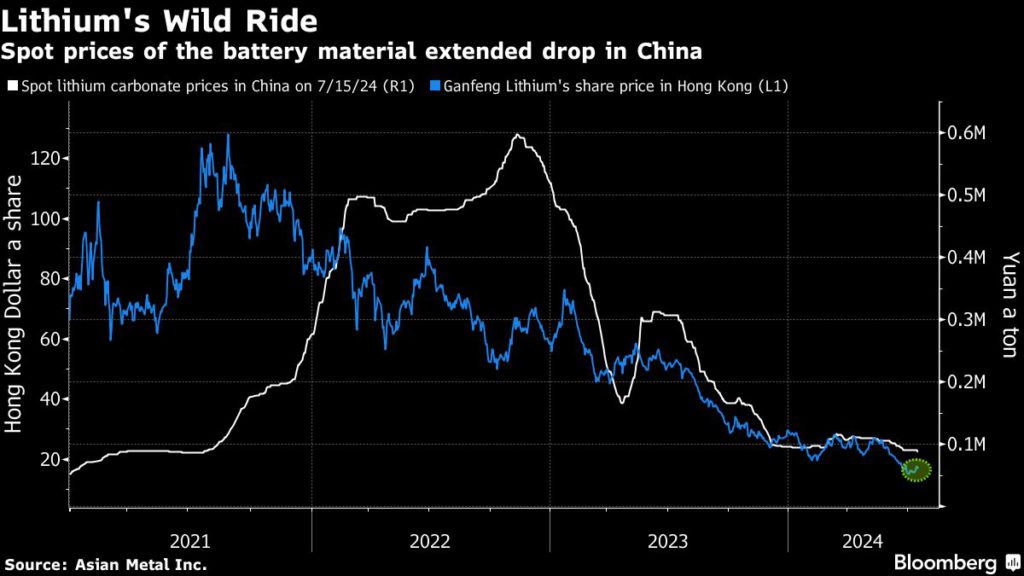

The global lithium market has been extremely volatile in recent years as a wave a of new supply and concerns about demand growth spurred a boom-bust cycle for the battery material. In addition, producers including Ganfeng and rivals have had to contend with geopolitical and regulatory shifts as governments seek to safeguard access to resources.

Ganfeng’s shares in Hong Kong reflect the industry’s roller-coaster ride. After peaking at more than HK$132 in 2021, they then collapsed, and were last at HK$17.10, with the company swinging to a loss in the first half of this year. Bearish bets against the shares reached a record on Friday.

In addition to operations in China, the company has expanded its footprint globally, with resources in Argentina, Australia, Mali, and Mexico. Last month, the company filed an international arbitration case against Mexico after the Latin American nation canceled a potential project valued at more than $1 billion.

Lithium futures remain immature. In China, liquidity is slowly picking up on the Guangzhou Futures Exchange after it launched a carbonate contract last year.

In a separate statement Monday, Ganfeng announced plans to issue five-year overseas bonds up to an equivalent of $200 million for a project in Argentina.