Prices for gallium are close to their highest since 2011 as China’s export restrictions crimp global supply and hurt buyers of the metal used in a swathe of high-tech applications.

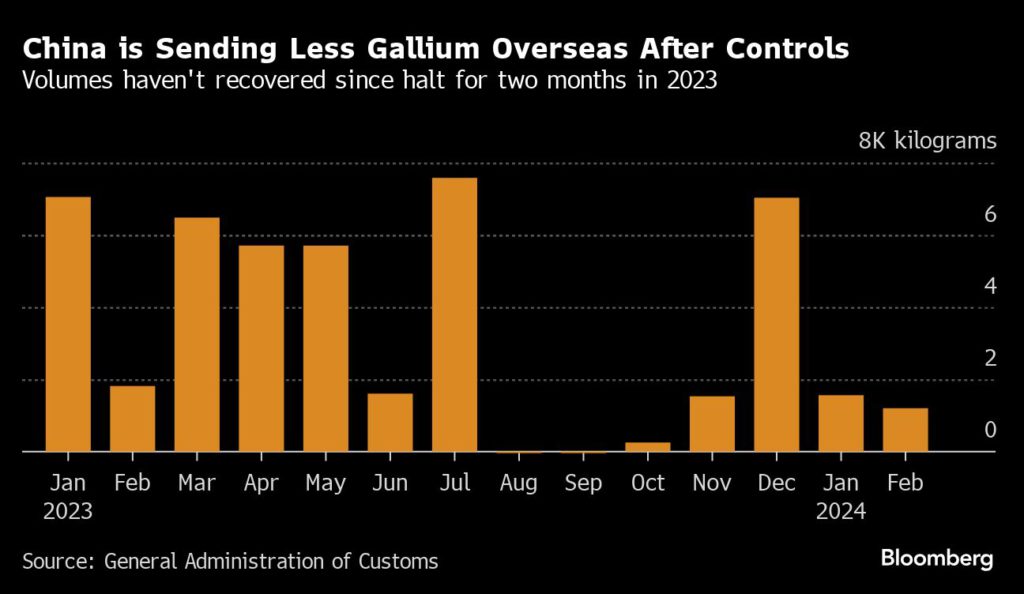

Beijing last year placed gallium and germanium under stricter government oversight — largely seen as a tit-for-tat response to the US-China trade war on technology. Gallium exports ground to a halt in August and September of 2023 and, while flows have restarted since then, volumes are still significantly lower.

International prices for gallium are now more than double where they were when Beijing’s new export curbs were announced, according to Fastmarkets data. That means higher costs for making equipment where gallium is a crucial material, from semiconductors and radar devices to solar panels and smartphone screens.

Gallium metal by end-March was selling at $575 a kilogram delivered to Rotterdam — more than 100% higher than when China announced the export controls.

Gallium chips find widespread use in defense and aerospace equipment, and China hinted that at a desire to ensure exports went only to civilian applications. Rather than facing an outright ban, gallium shipments are now subject to licensing requirements. China later also put graphite under the same export scrutiny and halted outbound sales of a range of rare-earth technologies.

The Asian nation refines some 94% of the world’s gallium, according to EU figures. That makes it among the minerals most dependent on Chinese supply, just as Western nations seek to reduce their reliance.

China shipped out about 2,760 kilograms of gallium in the first two months of 2024, down from 8,865 kilograms a year earlier. The biggest buyers were Japan at 1,000 kilograms, South Korea at 900 kilograms and Germany at 500 kilograms.