Today, we at BloombergNEF published our annual Electric Vehicle Outlook. The report looks at how the different segments of road transport could evolve over the coming decades and maps the impact on oil markets, electricity demand, batteries, metals and materials, charging infrastructure and greenhouse gas emissions.

There’s a lot of different angles within a big report like this. Here are a few I’d like to highlight:

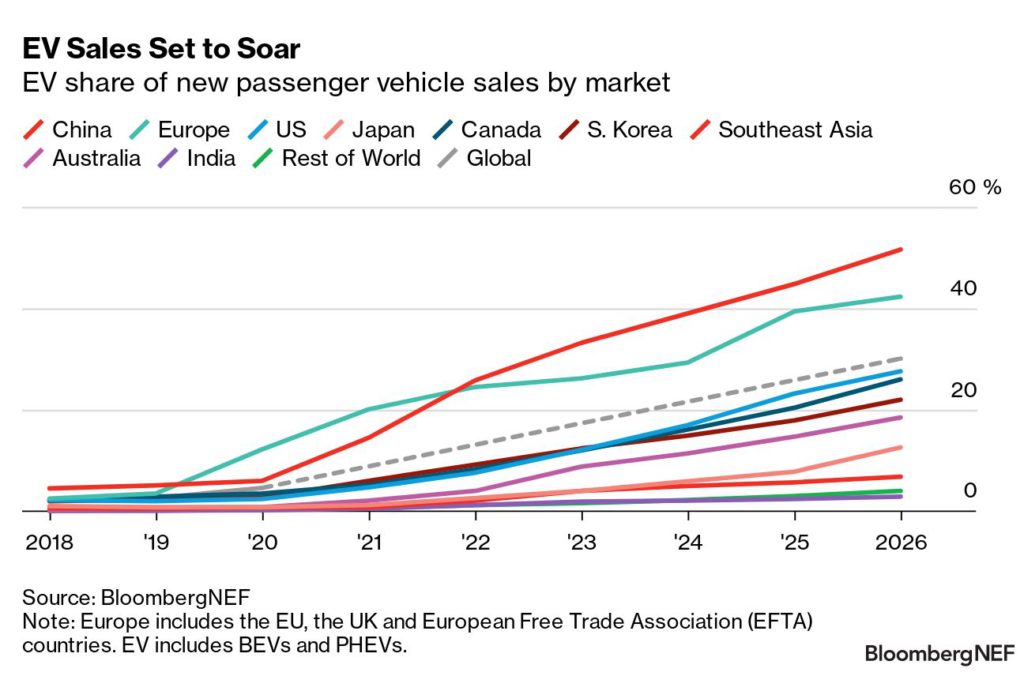

EV sales will surge in the coming years

The share of electric vehicles in sales of new passenger vehicles is set to more than double globally in the next few years — to 30% in 2026. Their penetration in some markets will be even higher, with EVs reaching 89% of sales in the Nordics, 52% in China and 42% in Europe. Our latest near-term EV sales outlook is brighter than what BNEF published last year, mostly due to policy changes in the US, where a major investment push sparked by the Inflation Reduction Act will help more than triple the share of EVs in new sales, to 28% by 2026.

Peaks everywhere

Sales of combustion-engine vehicles peaked six years ago and are now in long-term decline. Oil demand from road transport is also very close to cresting.

EVs of all types are already displacing 1.5 million barrels of oil a day. This will increase dramatically in the coming years, leading to demand for road fuels peaking in 2027. Uptake in the US and Europe has already crested, while it’s expected to peak in China next year. Oil demand from two-wheelers, three-wheelers and buses has also peaked, with demand from passenger cars following in 2025. Commercial vehicles will take longer to shift as heavy trucks continue to rely largely on diesel.

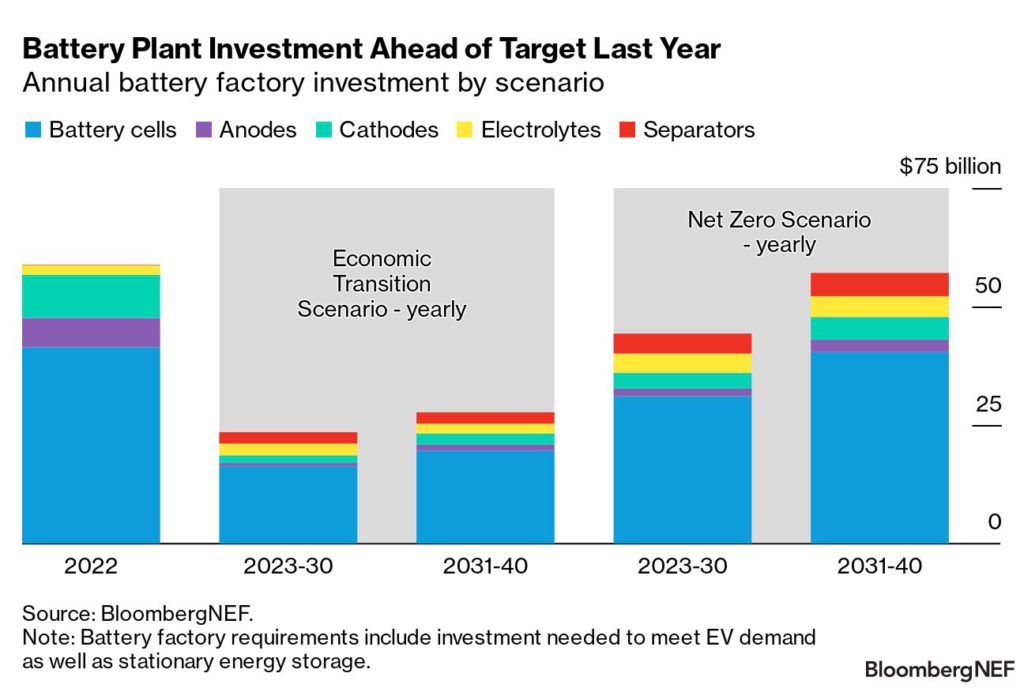

Battery factory spending ahead of plan

BNEF models two main scenarios in its EV outlook. The Economic Transition Scenario — which assumes no new policies and regulations are enacted — is primarily driven by techno-economic trends and market forces. The Net Zero Scenario investigates what a potential route to net-zero emissions by the middle of the century looks like for the road transport sector.

Large investments are needed in all areas of the battery supply chain, but some areas are already running ahead of what’s required to stay on track to eliminate emissions by 2050. BNEF estimates that between $24 billion and $57 billion in battery and component plant investment is needed each year to keep up with demand. It’s looking good: Spending already totaled $59 billion in 2022.

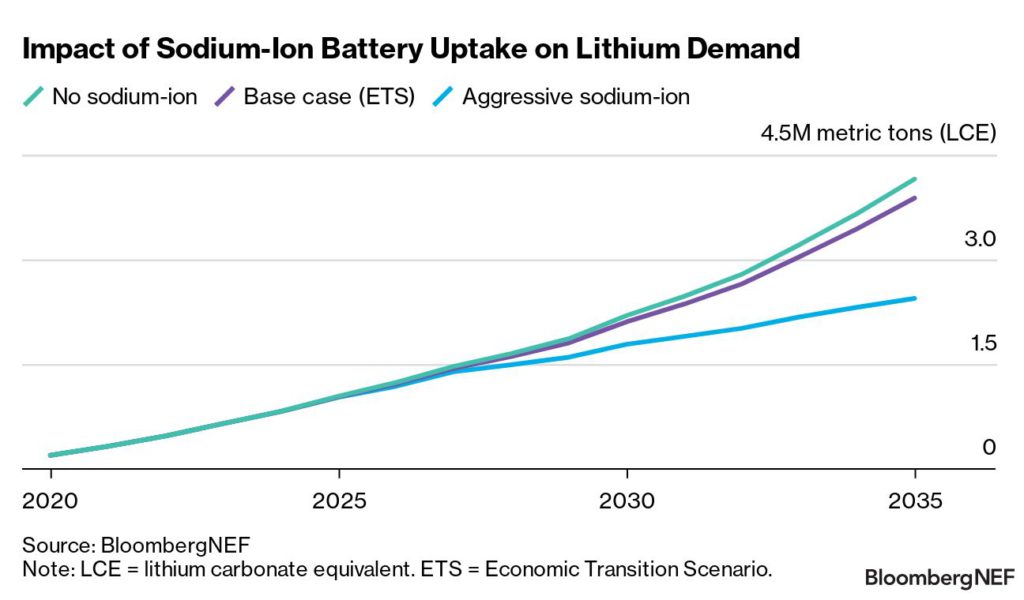

Lithium has a supply challenge

Lithium is the most concerning of the battery metals in terms of supply, with demand increasing 22 times by 2050 under BNEF’s Net Zero Scenario.

Building more public chargers can help consumers feel comfortable with shorter EV ranges and smaller battery packs — which in turn reduces pressure on the supply chain. While battery recycling will also help, it won’t deliver large volumes until the 2030s.

Still, there are reasons for optimism. Sodium-ion ion batteries, which are entering commercialization this year, could reduce lithium demand by nearly 40% in 2035 compared to BNEF’s base case scenario. Advances like solid-state batteries and next-generation anodes are also entering the market.

Electricity demand from EVs

The rising adoption of EVs adds about 14% to global electricity demand by 2050 in the Economic Transition Scenario and only 12% in the Net Zero Scenario — despite more vehicles on the road. That’s because the Net Zero Scenario includes additional consumption from electrification of heating, industry as well as electrolyzer use for hydrogen production in other sectors.

This year’s report includes five new thematic highlights, each of which explores a different part of the transition in markets around the world. The topics are:

- EV price parity under different battery price scenarios

- Will average EV ranges keep rising?

- Emerging battery technologies: sodium-ion batteries, solid-state batteries, and next-generation anode technologies

- High-powered charging for trucking fleets

- The impact of autonomous vehicles