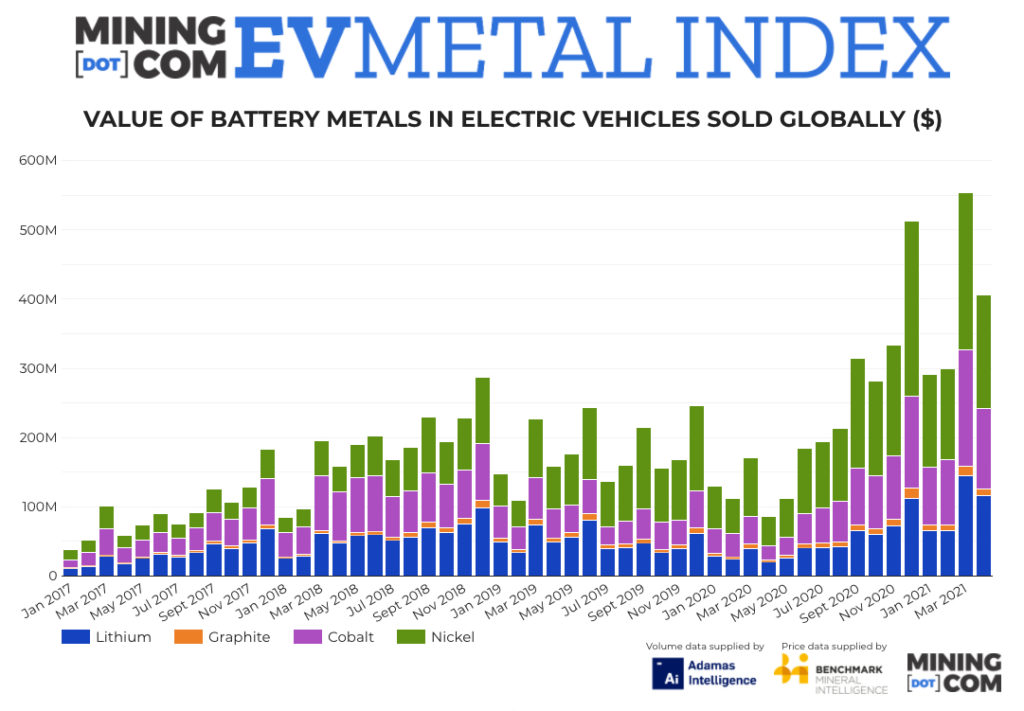

MINING.COM’s EV Metal Index increased almost fourfold from April 2020 but fell back from the record set in March as metals deployment in batteries eased and a slide in prices of cobalt and nickel used in the battery supply chain offset continued gains for lithium.

The EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including hybrids) around the world, came in at $405 million in April, an increase of 374.8% over the same month last year and bringing the first quarter total to $1.55 billion.

The haul for the first four months is up 211% from January to April 2020 and is also higher than total business done during all of 2017, when average lithium and cobalt prices were substantially higher than today.

Total battery capacity of EVs sold during the month increased 223% year on year to just shy of 16 GWh, according to Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 100 countries.

To produce the most accurate data, the monthly battery capacity deployed numbers in the MINING.COM EV Metal Index do not include cars leaving assembly lines, those on dealership lots, or in the wholesale supply chain — only end-user registered vehicles.

Nickel, cobalt use sideways as LFP batteries gain market share

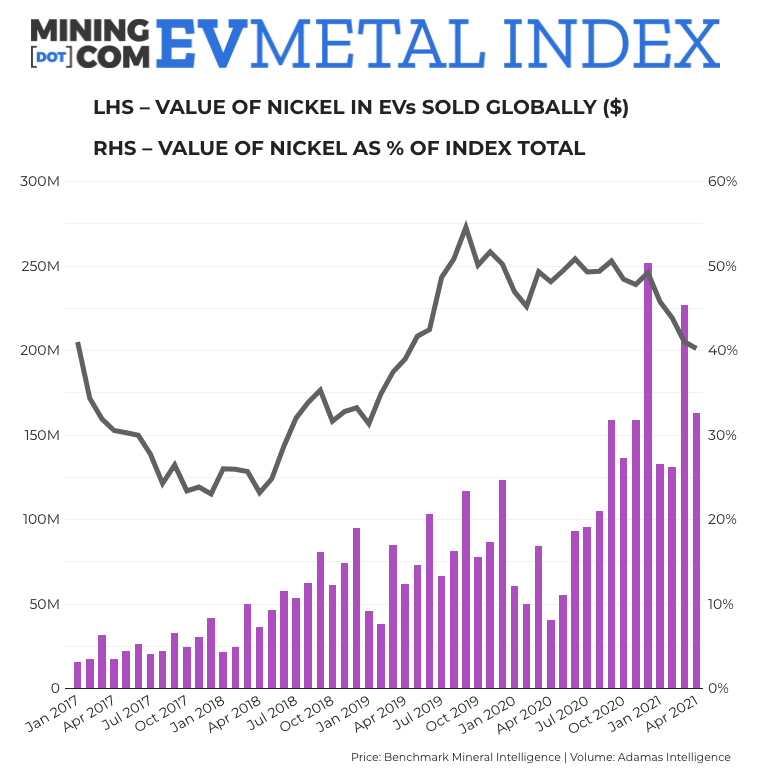

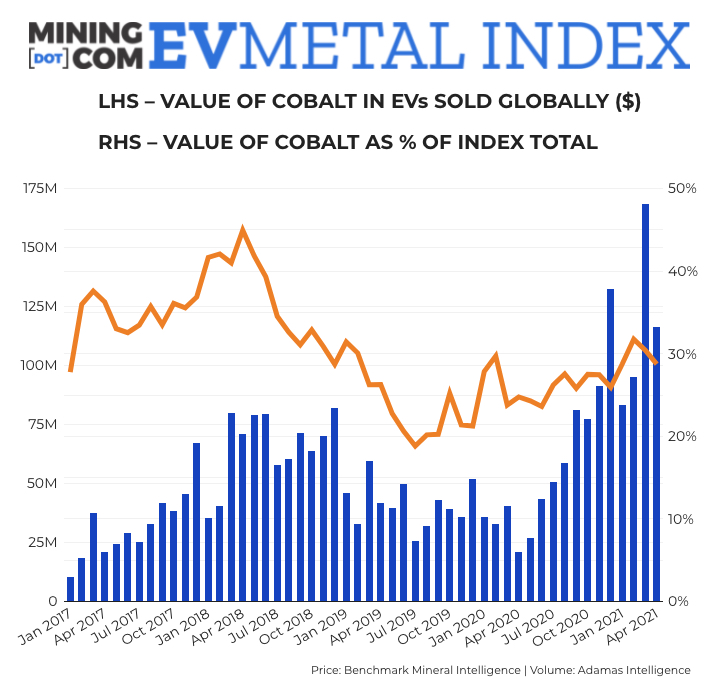

Cobalt and nickel deployment tripled compared to the same month last year, but on a per vehicle basis use of these cathode materials is trending sideways.

Adamas says the global sales-weighted average amounts of nickel per vehicle (including hybrids) increased 1% year on year on the back of strong sales of BEVs powered by LFP (lithium-iron-phosphate) cells such as the Tesla Model 3 made and sold in China and exported to Europe and the BYD Han EV, among others.

LFP-equipped cars are making inroads globally and a number of Chinese automakers are targeting western markets with LFP-equipped vehicles. From just a fraction before the made-in-China Model 3 launched, the technology has now reached 15.7% market share based on Q1 2021 battery capacity deployed. The LFP Model 3 on its own captured 7.2% of the global electric car market.

While Volkswagen has said LFP would be its go-to battery for its entry level models, BYD confirmed last month that it is going all-in on LFP batteries, and scrapping NCM (nickel, cobalt, manganese) technology from its model line-up entirely.

High nickel content in NCM cathodes improves energy density, but BYD and other LFP battery manufacturers have been closing the gap in terms of range and charging performance.

Lithium rally, graphite steady, cobalt and nickel wobbly

Average cobalt use in March was up an anemic 5% year on year and contrasts with a 198.7% jump in total tonnage deployed of the metal that provides thermal stability for high nickel batteries. The top user of cobalt was German automaker Mercedes-Benz.

Nickel sulfate prices have wiped out all its 2021 gains while cobalt used in the battery supply chains, according to Benchmark Mineral Intelligence, declined to an average of $55,000 a tonne for the month.

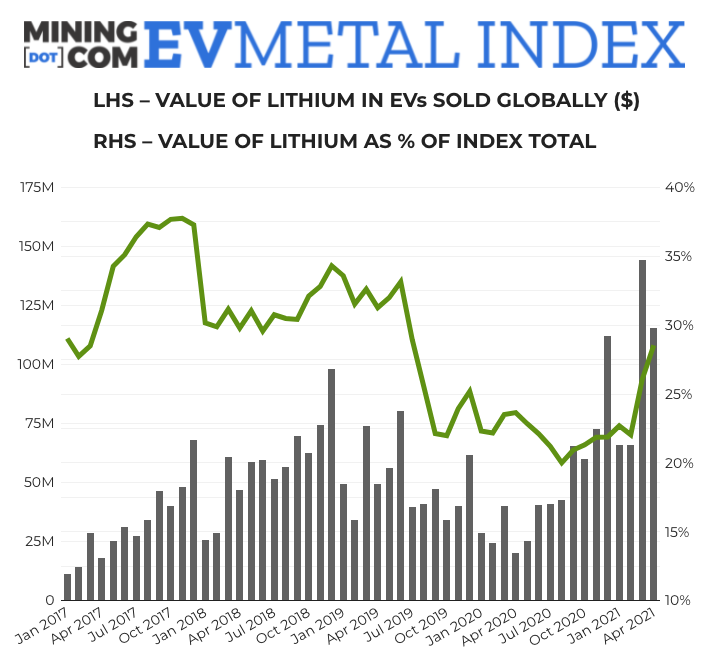

Average lithium use was up 15% year over year while total material deployed was up 240% over last year with carbonate making up 55% of the total versus hydroxide, with the latter favoured in the manufacture of high-nickel content batteries. Lithium prices continued to recover, hitting a two-year high of $11,664 a tonne (LCE) in April.

As a percentage of the overall index value, lithium represents 28.5% up from a low of 20% in August last year.

In April 2021, just over 14,0000 tonnes of synthetic and natural graphite were deployed globally in batteries of all newly-sold passenger EVs combined, a 233% jump over the same month last year.

Graphite prices have held steady above $700 a tonne in 2021, after spending all of 2020 below that mark and hitting a low of $644 in September.