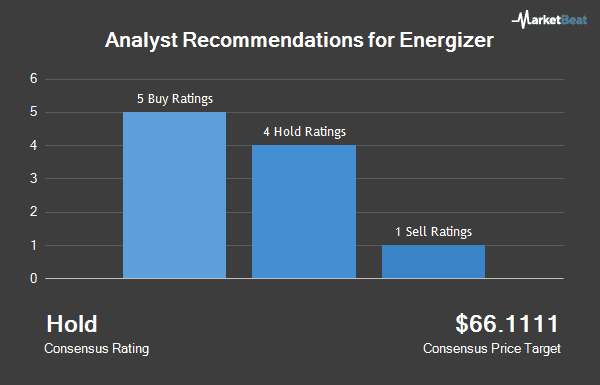

Energizer Holdings Inc (NYSE:ENR) has been given a consensus rating of “Hold” by the thirteen research firms that are currently covering the firm, Marketbeat Ratings reports. Two analysts have rated the stock with a sell rating, four have given a hold rating and six have issued a buy rating on the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $68.25.

Several brokerages recently issued reports on ENR. Zacks Investment Research lowered Energizer from a “hold” rating to a “sell” rating in a research report on Monday, June 18th. Deutsche Bank lowered Energizer from a “buy” rating to a “hold” rating in a research report on Monday, April 2nd. Jefferies Financial Group reiterated a “buy” rating and issued a $70.00 price objective on shares of Energizer in a research report on Thursday, June 14th. ValuEngine upgraded Energizer from a “hold” rating to a “buy” rating in a research report on Thursday, May 31st. Finally, UBS Group began coverage on Energizer in a research report on Thursday. They issued a “neutral” rating and a $68.00 price objective for the company.

In other Energizer news, VP Emily K. Boss sold 7,500 shares of the business’s stock in a transaction that occurred on Wednesday, June 27th. The stock was sold at an average price of $63.00, for a total value of $472,500.00. Following the sale, the vice president now owns 2,208 shares in the company, valued at approximately $139,104. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 1.79% of the company’s stock.

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Foundry Partners LLC lifted its stake in Energizer by 0.5% in the 2nd quarter. Foundry Partners LLC now owns 202,248 shares of the company’s stock valued at $12,734,000 after acquiring an additional 965 shares in the last quarter. Hartford Investment Management Co. bought a new stake in shares of Energizer during the 2nd quarter worth approximately $721,000. Nisa Investment Advisors LLC bought a new stake in shares of Energizer during the 2nd quarter worth approximately $1,587,000. Reilly Financial Advisors LLC raised its stake in shares of Energizer by 10,390.2% during the 2nd quarter. Reilly Financial Advisors LLC now owns 22,449 shares of the company’s stock worth $1,413,000 after purchasing an additional 22,235 shares in the last quarter. Finally, Deprince Race & Zollo Inc. raised its stake in shares of Energizer by 13.1% during the 2nd quarter. Deprince Race & Zollo Inc. now owns 712,732 shares of the company’s stock worth $44,874,000 after purchasing an additional 82,708 shares in the last quarter. Hedge funds and other institutional investors own 99.13% of the company’s stock.

Shares of Energizer stock traded up $0.85 during trading on Friday, hitting $64.22. 12,076 shares of the company were exchanged, compared to its average volume of 530,249. The firm has a market capitalization of $3.80 billion, a P/E ratio of 21.53, a PEG ratio of 2.44 and a beta of 0.84. Energizer has a 1-year low of $40.64 and a 1-year high of $64.93. The company has a current ratio of 1.90, a quick ratio of 1.37 and a debt-to-equity ratio of 21.86.

Energizer (NYSE:ENR) last posted its earnings results on Wednesday, May 2nd. The company reported $0.45 earnings per share (EPS) for the quarter, topping the Thomson Reuters’ consensus estimate of $0.42 by $0.03. The company had revenue of $374.40 million during the quarter, compared to analyst estimates of $374.32 million. Energizer had a return on equity of 292.85% and a net margin of 7.13%. The company’s revenue for the quarter was up 4.3% compared to the same quarter last year. During the same period in the previous year, the company earned $0.50 EPS. research analysts anticipate that Energizer will post 3.36 EPS for the current fiscal year.