Copper prices rose on Tuesday as the dollar lost ground, but trading volumes were thin as markets in top metals consumer China were closed for the week-long Lunar New Year holiday.

“Trading will be relatively quiet throughout the whole week because of the Chinese New Year. But at the moment base metals are supported by benign equity markets and dollar pushing metals up,” said Commerzbank commodity analyst Daniel Briesemann.

A weaker dollar supports demand for commodities it is priced in, while firmer stock markets point to a higher risk appetite from investors.

The industrial metal, considered an economic bellwether, was set for its biggest monthly loss since September as markets braced for higher U.S. interest rates.

But it was on track for a monthly gain of more than 9%, the biggest rise since November 2020, on lower output, solid demand and concerns that an escalation of the Ukraine conflict could disrupt exports from major producer Russia.

Growth in top metals consumer China’s factory activity slowed in January as a resurgence of covid-19 cases and tough lockdowns hit production and demand, but the slight expansion offered some signs of resilience as the world’s second-largest economy enters a likely bumpy new year.

“With Chinese demand unlikely to bounce back meaningfully this year, we continue to expect sharp falls in industrial metals prices by year-end,” said Capital Economics in a note.

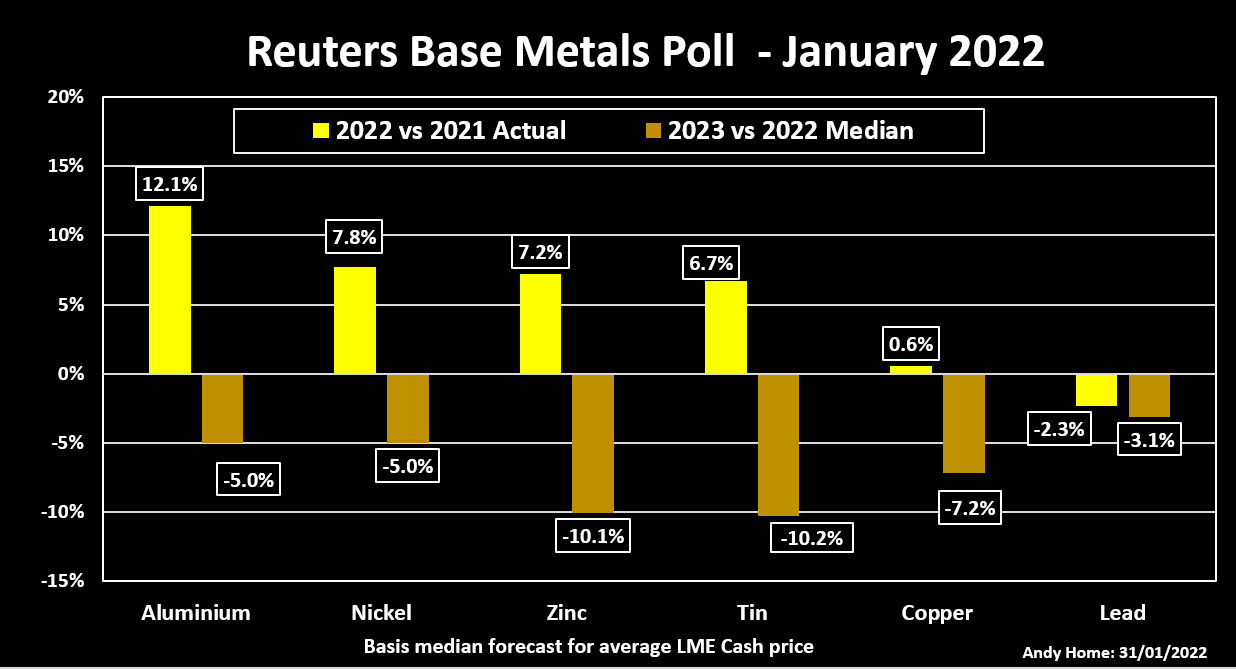

Copper prices are set to languish this year, a Reuters poll of analysts showed, weighed down by weaker demand as rising interest rates curb economic growth, while mines churn out more supply.