The progress on trade is bullish.

Rising tensions in the Middle East increase the potential of risk-off conditions.

2008 was an example of what risk-off periods can do to the copper market.

Inventories are falling.

Protect positions in FCX and other copper producers with trailing stops or options.

Looking for more stock ideas like this one? Get them exclusively at Hecht Commodity Report. Get started today »

Copper is the leader of the pack when it comes to the nonferrous metals that trade on the London Metals Exchange in the forward market, and on the COMEX division of the CME in the futures arena. Chile is the world’s leading producer of the red metal, but output comes from other nations around the globe. When it comes to the demand side of the fundamental equation, China is the most significant consumer of the metal. Chinese demand is a function of its economy. In the years when China experienced double-digit economic growth in 2008 and 2011, the price of copper futures on COMEX rose over the $4 per pound level. Before 2005, the price never traded above the $1.6065 level, the high from 1988.

In early 2020, copper faces bullish and bearish factors pulling the price of the metal in opposite directions. Copper recently probed above the $2.80 per pound level for the first time since May 2019. As markets are facing a volatile period, I suggest protecting long positions in the red metal and the shares of copper producing like Freeport-McMoRan (FCX).

The progress on trade is bullish

Since China is the demand side of the fundamental equation in the copper market, the “phase one” agreement between the US and Chinese has pushed the price of the red metal higher.

As the daily chart of March COMEX copper futures highlights, the price of March futures rose from a low of $2.4935 on September 3 to a high of $2.8565 on December 26, in the aftermath of the “phase one” deal. The continuous contract hit a low of $2.4675.

Price momentum and relative strength indicators were on either side of neutral territory on January 10, with the price at just over the $2.81 per pound level. At the same time, the total number of open long and short positions in the copper futures market rose with the price since early December, which is a technical validation of the bullish price trend.

Rising tensions in the Middle East increase the potential of risk-off conditions

The trade agreement that President Trump will sign with high-ranking Chinese officials on January 15 in Washington is bullish for the price of copper. A de-escalation of the trade war is likely to stabilize China’s economy. Meanwhile, the recent increase in tensions between the US and Iran threatened a risk-off period in markets across all asset classes, and copper is no exception. The US airstrike that killed the most senior Iranian military commander in early January pushed the price of copper to a low of $2.7595 on January 3.

In the aftermath of Iranian retaliation in the form of a missile attack on Iraqi airbases that are home to US troops, the crisis appears to have calmed, pushing the price of the red metal back above the $2.80 level. No Americans died in the Iranian attack during the early hours of January 8. Iran said it was the retribution of the death of General Soleimani, and that they do not wish to go to war with the US. In a speech that followed the attack, President Trump calmed markets as he did not set the stage for further military action.

However, the US president warned that Iran would never have a nuclear weapon on his watch, and he would increase economic sanctions on the theocracy in Teheran. At the same time, the president called on all NATO members to work together to put pressure on Iran to agree to a new nuclear nonproliferation agreement. In the aftermath of comments from Iran and the US, the odds of further military confrontation in the immediate futures appear to have declined, for now.

2008 was an example of what risk-off periods can do to the copper market

Risk-off periods tend to cause the price of copper to take an elevator shaft to the downside. The last dramatic example came during the 2008 global financial crisis.

The monthly chart shows that double-digit economic growth in China lifted the price of copper to a high of $4.2160 in May 2008. The financial crisis that gripped markets across all asset classes took the price to a low of $1.2475 per pound seven months later in December 2008. Risk-off conditions in markets can create price carnage in the copper market.

Time will tell if the tensions between the US and Iran decline or if the apparent de-escalation on January 8 is only temporary. The US and Iran have been at each other’s throats for over four decades, since the start of the Islamic Revolution in 1979. The odds of peace breaking out in the Middle East continue to be slim., which is a warning sign that risk-off conditions in markets could return in the blink of an eye.

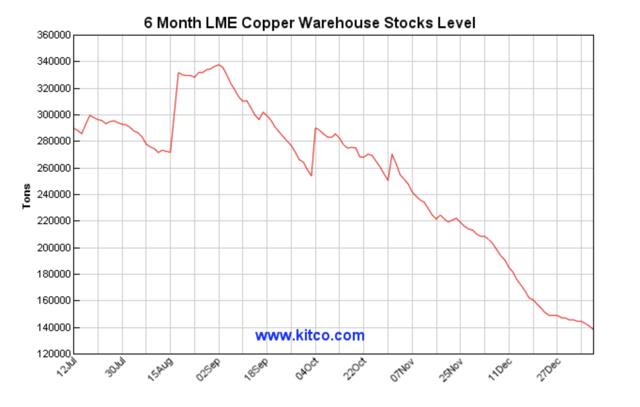

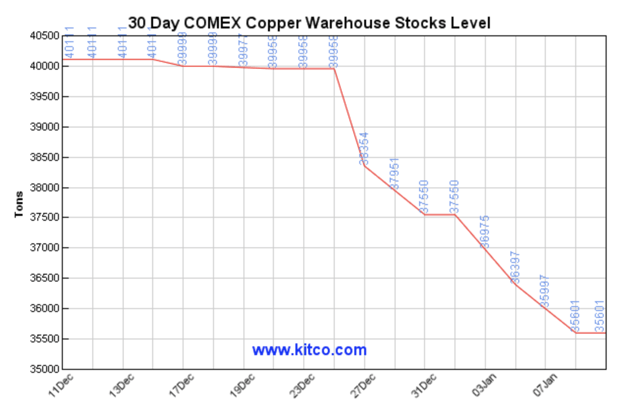

Inventories are falling

In a bullish sign for the copper market, warehouse stocks on both the London Metals Exchange and COMEX have been falling.

The chart shows that LME inventories fell from almost 340,000 metric tons from early September 2019 to 135,800 tons as of January 9, a drop of over 60%.

Warehouse stocks on COMEX fell from 40,111 tons in mid-December to 35,601 tons, most recently, a decline of over 11%. Falling inventories are often a sign of increasing demand. The trend in stockpiles of copper in LME and COMEX warehouses is bullish for the price of the nonferrous metal.

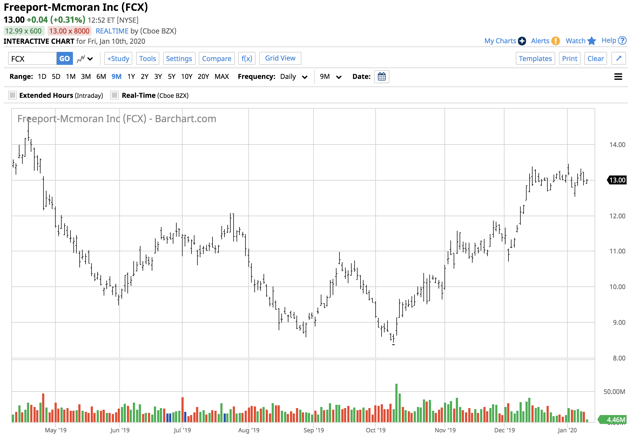

Protect positions in FCX and other copper producers with trailing stops or options

We could be in for a volatile year in markets across all asset classes, if the price action over the first two weeks of January 2020 is an example of what we can expect. The price of Freeport-McMoRan shares have rallied significantly since the stock reached a low of $8.43 on October 9.

The chart shows that FCX rose to a high of $13.45 on January 2, an increase of over 59.5%. At $13.00 on January 10, the shares were just below the recent high. FCX pays shareholders a 1.56% dividend at $13.00 per share, and the prospects for the stock look bullish as it does for the price of copper. A continuation of progress on trade between the US and China could lift the price of copper to the $3 per pound level or higher. At the same time, a comprehensive trade deal may cause the price to revisit the all-time peak at well over the $4 per pound level. $4 copper could put FCX shares at many times the current price of the stock. In 2011, when copper hit its all-time high of $4.6495 per pound, FCX rose to $61.34 per share.

Meanwhile, a risk-off period always has the potential to create price carnage in the copper market. Using trailing stops on profitable long positions in FCX stock will protect capital. Long put options could protect profits as they serve as price insurance for any risk-off periods that suddenly appear. FCX was a bargain at under $10 per share. With the stock near its recent high, risk management tools such as stops and put options will let copper bulls sleep at night and maintain their long exposure to the red metal.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!