Chile’s President Gabriel Boric announced on Thursday night his government would nationalize the country’s lithium industry, applying a model in which the state will partner with companies to enable local development.

The long-awaited policy in the world’s second-largest producer of the battery metal includes the creation of a national lithium company, Boric said on national television.

State copper giant Codelco, the world’s No.1 producer of the metal, will be initially in charge of signing up partners for new contracts.

That role will then be undertaken by a dedicated national lithium company, with a mandate will to develop the industry into a pillar for Chile’s economy while protecting its environment.

“This is an opportunity for economic growth that will be difficult to beat in the short term (…) We can’t afford to waste it,” Boric said.

The two lithium miners already operating in Chile, Albemarle (NYSE: ALB) and SQM (NYSE: SQM) will continue to do so until their contracts expire. Without naming them, Boric said he hoped that lithium miners already present in Chile would be open to negotiate state participation before the end of their contracts.

The contract for the world’s no.1 producer, Albemarle, runs out in 2043, while the contract for the second largest, SQM, ends in 2030.

The President noted that future lithium licences will be only issued as public-private partnerships with state control, but no details about state shareholding or other ownership arrangements were disclosed.

Codelco and state miner Enami will be given exploration and extraction contracts in areas where there are now private projects before the national lithium company is formed.

There will be a unit in charge of advancing technology to minimize environmental impacts, including favouring direct lithium extraction (DLE) over evaporation ponds — the method currently used.

Applying DLE is expected to speed up production and avoid vaporizing billions of litres of water. The technique, however, is relatively untested at major scale, which could initially mean less output and profit.

Canada’s Summit Nanotech Corporation, which is developing a DLE technology, welcomed the news and announced on Friday the opening of a facility to test its method in Santiago.

Supply squeeze

Chile’s move adds further pressure to electric vehicles makers, who are scrambling to secure supply of the battery metal.

It follows Mexico’s decision to nationalize its own lithium industry last year. The country is now seeking to create a regional lithium association with Argentina, Bolivia and Chile. The three countries make up the so-called “Lithium Triangle”, which has about 65% of the world’s known resources of the metal and reached 29.5% of world production in 2020.

Argentina, Chile, Bolivia and Brazil, in turn, are exploring the creation of a lithium cartel of sorts in charge of expanding South America’s processing capacity, turning more of their mined lithium into batteries and tapping into the electric vehicle manufacturing sector.

Jordan Roberts, battery raw materials analyst at Fastmarkets NewGen said the immediate impact of Boric’s announcement seemed to be “muted” as market participants digest the news and await Codelco’s plan, which will be released in the second half of the year.

“We do not expect any material impact to established producers … [but]… there may be some hesitation investing in Chile’s lithium space until further details have been released and companies are confident on stability and in how the public-private partnerships will operate,” Roberts said in an emailed statement.

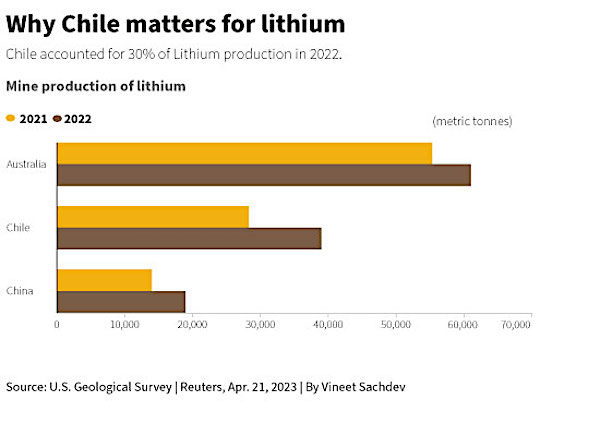

Chile currently generates about 30% of the world’s supply, but it plans to double production by 2025 to about 250,000 tonnes of lithium carbonate equivalent (LCE).

Global demand for lithium, according to the government’s projections, will quadruple by 2030, reaching 1.8 million tonnes. Available supply by then is expected to sit at 1.5 million tonnes.

The country’s Atacama region, which is also home to vast copper mines, supplies nearly one-quarter of the globe’s lithium.

Last year, the state received more than $5 billion from the sector, equivalent to 1.6% of its GDP, figures from the Autonomous Fiscal Council show.

Exports of lithium carbonate reached almost $7.8 billion, an increase of 777% over 2021, according to the Chilean Central Bank.

It means that lithium carbonate surpassed salmon and fruit in the Chilean export basket.