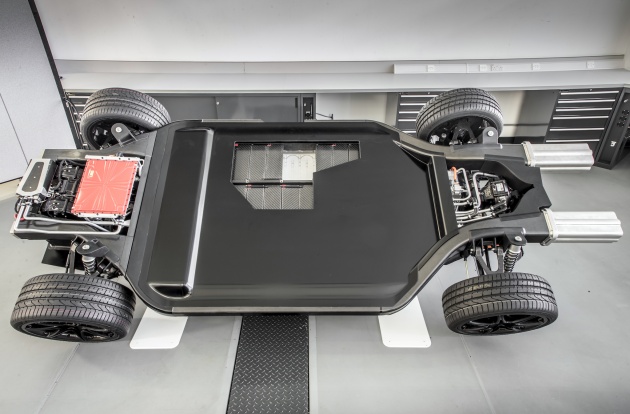

Containerised battery energy storage system deployed in the UK by Anesco. Image: Anesco.

Containerised battery energy storage system deployed in the UK by Anesco. Image: Anesco.Mis-selling, insurance risk and the failure of associated costs to fall alongside sell prices could hold back greater battery storage deployment in Britain, a panel discussion has revealed.

Last week’s Energy Storage Summit in London, England, organised by our publisher Solar Media, brought together more than 350 representatives from the battery storage industry.

The opening day of the conference saw discussions on different deployment and co-location strategies and, in particular, what has been preventing more battery storage projects from being realised.

Steve Shine, chairman at energy efficiency solutions company Anesco, which has deployed a number of co-located or combined solar and storage sites and recently developed the UK’s first ‘subsidy-free’ solar farm at Clayhill, said that one issue that was currently preventing greater deployment of battery storage was the failure of associated costs to fall in line with technology costs.

While battery technology sell prices have declined sharply, Shine said this was not being supported by similar reductions in other costs associated with battery deployment, such as accompanying components like switchgears and labour costs. Shine remarked that the core battery components are now “not even one-third” of the total development cost in some projects.

The most recent Lazard Levelised Cost of Storage Analysis from November last year forecast that lithium-ion capital costs could fall by 36% over the next five years, but warned that further cost reduction efforts should be focused on balance of system, components and other costs such as planning and permitting.

Talk amongst the panel quickly turned to the potential of mis-selling storage or incorrectly explaining system capabilities, something which there is a “huge opportunity” for in the industry’s early days, Matt Allen, chief executive at C&I storage developer Become Energy, said.

Allen said there was particular risk of battery storage systems being proposed with uninterrupted power supply (UPS) capabilities factored in for systems not suited or incapable of providing such power. He feared that “all it would take” would be for one incident involving a hospital relying on an inaccurately sold battery storage facility to provide UPS in the event of a blackout or power failure –an event that would “put lives at risk” – for the battery storage sector to be set back years.

It drew other members of the panel to discuss further and continuing problems convincing insurance companies to cover battery storage technologies.

Harry Vickers at Camborne Capital, a financier-turned project developer which installed the UK’s first 500kWh Tesla Powerpack, now providing frequency regulation and other services, remarked that insurance companies are still reticent to back battery storage following a widely recognised incident involving a lithium-ion battery at the Kahuku wind farm in Hawaii more than five years ago.

The 30MW wind farm was combined with a 15MW battery before it developed a fault, triggering a fire that was estimated to cause more than US$30 million worth of damage. Firefighters did not combat the fire until seven hours after the incident started due to concerns surrounding how to combat a fire involving the energy-dense technologies.

Such concerns have been popularised by problems Samsung experienced with its Galaxy Note 7 smartphone, a product line which was discontinued after just two weeks following numerous reports of battery fires, while a 2013 fire incident set back the rollout of Boeing’s 787 ‘Dreamliner’ in another high profile case.