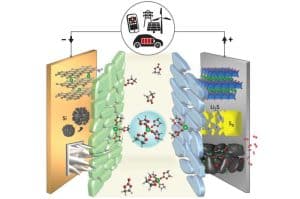

Designing a battery is a three-part process. You need a positive electrode, you need a negative electrode, and—importantly—you need an electrolyte that works with both electrodes.

An electrolyte is the battery component that transfers ions—charge-carrying particles—back and forth between the battery’s two electrodes, causing the battery to charge and discharge. For today’s lithium-ion batteries, electrolyte chemistry is relatively well-defined. For future generations of batteries being developed around the world and at the U.S. Department of Energy’s (DOE) Argonne National Laboratory, however, the question of electrolyte design is wide open.

“While we are locked into a particular concept for electrolytes that will work with today’s commercial batteries, for beyond-lithium-ion batteries the design and development of different electrolytes will be crucial,” said Shirley Meng, chief scientist at the Argonne Collaborative Center for Energy Storage Science (ACCESS) and professor of molecular engineering at the Pritzker School of Molecular Engineering of The University of Chicago.

“Electrolyte development is one key to the progress we will achieve in making these cheaper, longer-lasting and more powerful batteries a reality, and taking one major step towards continuing to decarbonize our economy.”

In a new paper published in Science, Meng and colleagues laid out their vision for electrolyte design in future generations of batteries.

Even relatively small departures from today’s batteries will require a rethinking of electrolyte design, according to Meng. Switching from a nickel-containing oxide to a sulfur-based material as the main constituent of a lithium-ion battery’s positive electrode could yield significant performance benefits and reduce costs if scientists can figure out how to rejigger the electrolyte, she said.

For other beyond-lithium-ion battery chemistries, like rechargeable sodium-ion or lithium-oxygen, scientists will similarly have to devote considerable attention to the question of the electrolyte.

One major factor that scientists are considering in the development of new electrolytes is how they tend to form an intermediary layer called an interphase, which harnesses the reactivity of the electrodes. “Interphases are crucially important to the functioning of a battery because they control how the selective ions flow into and out of the electrodes,” Meng said. “Interphases function like a gate to the rest of the battery; if your gate doesn’t function properly, the selective transport doesn’t work.”

The near-term goal, according to the team, is to design electrolytes with the right chemical and electrochemical properties to enable the optimal formation of interphases at both the battery’s positive and negative electrodes. Ultimately, however, researchers believe that they may be able to develop a group of solid electrolytes that would be stable at extreme (both high and low) temperatures and enable batteries with high energy to have much longer lifetimes.

“A solid-state electrolyte for an all-solid battery will be a game changer,” said Venkat Srinivasan, director of ACCESS, deputy director of the Joint Center for Energy Storage Research, and co-author on the paper. “The key to a solid-state battery is a metal anode, but its performance is currently limited by the formation of needle-like structures called dendrites that can short out the battery. By finding a solid electrolyte that prevents or inhibits dendrite formation, we may be able to realize the benefits of some really exciting battery chemistries.”

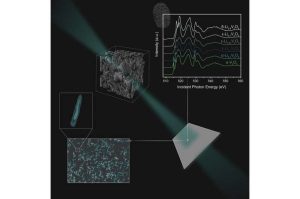

In order to speed up their hunt for electrolyte breakthroughs, scientists have turned to the power of advanced characterization and artificial intelligence (AI) to search digitally through many more possible candidates, accelerating what had been a slow and painstaking process of laboratory synthesis.

“High performance computing and artificial intelligence are allowing us to identify the best descriptors and characteristics that will enable the tailored design of various electrolytes for specific uses,” Meng said. “Instead of looking at a few dozen electrolyte possibilities a year in the lab, we’re looking at many thousands with the aid of computation.”

“Electrolytes have billions of possible combinations of components—salts, solvents and additives—that we can play with,” Srinivasan said. “To make that number into something more manageable, we’re beginning to really use the power of AI, machine learning and automated laboratories.”

The automated laboratories to which Srinivasan referred will incorporate a robot-driven experimental regime. In this way, machines can perform unassisted ever more carefully refined and calibrated experiments to eventually determine which combination of components will form the perfect electrolyte. “Automated discovery can dramatically increase the power of our research, as machines can work around the clock and reduce the potential for human error,” he said.

Meng, Srinivasan and Army Research Laboratory scientist Kang Xu discuss the electrolyte challenge in a paper entitled “Designing better electrolytes,” which appeared in Science on Dec. 8.