Tesla executives met last month with Chilean authorities, including the ministers of foreign affairs and mining, as well as representatives for the country’s development agency Corfo, as the electric cars maker redoubles efforts to secure supplies of battery metals, particularly lithium.

The hearings, local newspaper La Tercera reports, also included executives from Albemarle (NYSE: ALB), the word’s top lithium miner and the main competitor of Chile’s SQM (NYSE: SQM) in the Salar de Atacama salt flat, which contains the world’s highest known concentrations of lithium and potassium.

The official minutes of the meeting, disclosed by Corfo, show that Tesla is interested in knowing the agency’s development plans for the sector as well as the opportunities for collaboration with lithium producers such as Albemarle.

Talks come as the Chilean government is planning to take a page out of Mexico’s book and create a state-run lithium company, although authorities are open to let private companies in the sector through tenders.

While the administration has yet to release final details, it has said the proposed national lithium company will seek out minority partners to provide the technical knowledge the government lacks.

Private firms that win tenders may also be allowed to operate individual lithium projects under a minority stake.

The state-run miner’s first main asset would be Codelco’s lithium project at the Salar de Maricunga, a salt flat that hosts Chile’s second-largest reserves of the battery metal.

From mining to refining

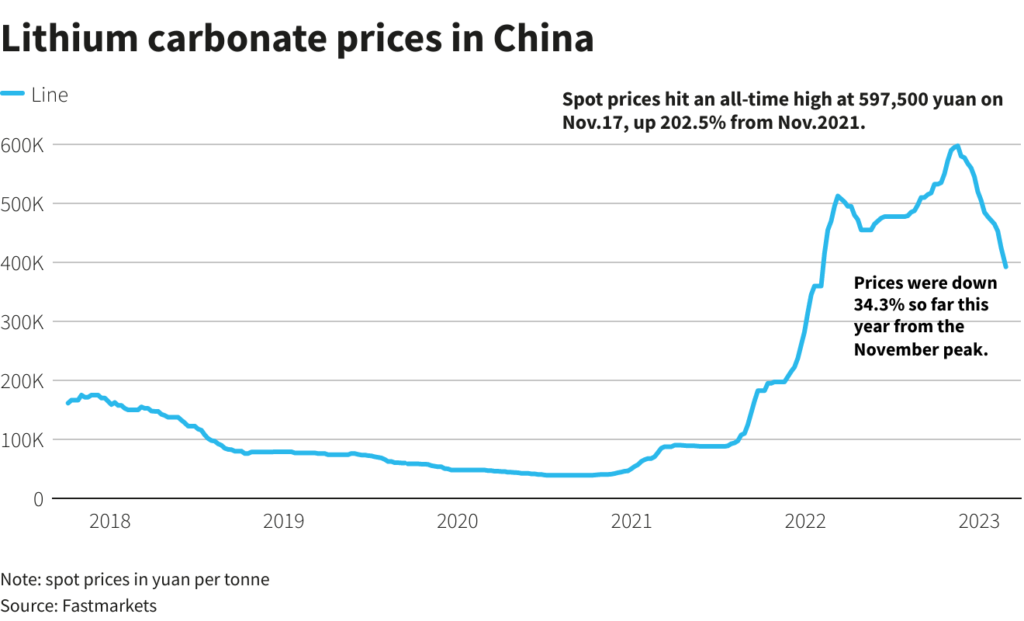

Elon Musk wants more lithium, but only a handful of countries can supply the material key to the electrification of transportation.

While Tesla’s chief executive office has hinted in the past that the company planned to get into mining, he now says the firm is more focused on refining lithium than on extracting the battery metal.

The “limiting factor” is refining the metal, not actually finding it, as no country has a monopoly on deposits, Musk said Wednesday during the EV maker’s investor day.

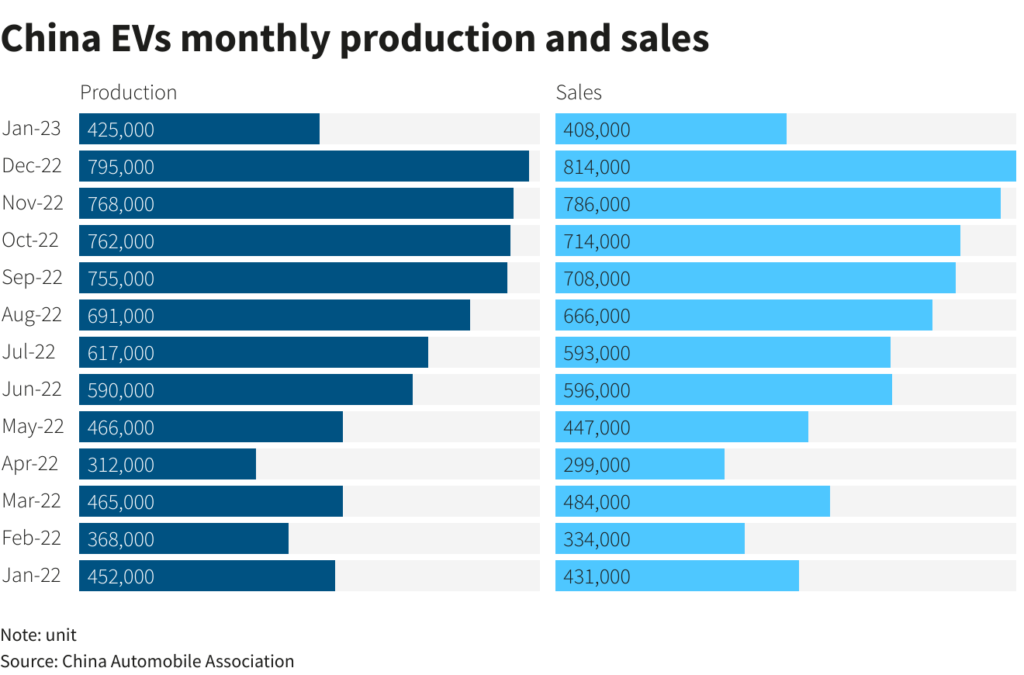

Tesla’s goal is to produce 20 million EVs a year by 2030. It delivering around 1.31 million units in 2022.

Ahead of the 2023 investor day on Tuesday, Mexico’s President Andres Manuel Lopez Obrador said that Tesla had agreed to build a large factory in Monterrey.

The factory will be one of the country’s first that is entirely dedicated to the expensive and complex process of making electric cars.