Lithium prices in China halted a five-month slide on signs that demand growth among battery makers may finally gather pace.![]()

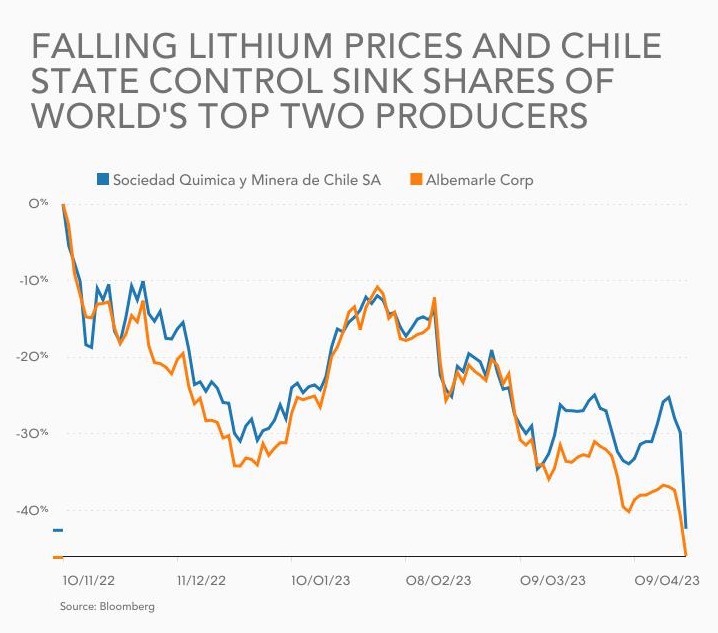

Chinese lithium carbonate ticked up 1.2% Wednesday, the first gain this year. Prices had tumbled more than 70% since mid-November as companies across the battery supply chain drew down inventories rather than buying afresh, while an end to Chinese electric-vehicle subsidies curtailed demand.

Data now point to improved EV sales prospects, while lithium stockpiles have been thinning.

“There’s some pickup in buying from traders who think prices have bottomed, which supported lithium this week,” said Jesline Tang, a non-ferrous metals pricing analyst at S&P Global Commodity Insights. “There’s also talk of declining inventories at battery makers, which could drive restocking activity.”

Prices edged up to 167,500 yuan a ton on Wednesday, according to data from Asian Metal Inc.

That may hint at respite for some smaller Chinese producers of the material, which have seen profit margins dented by the price crash. Yet even with this year’s collapse, lithium carbonate remains four times more expensive than in 2020.

There is also acquisition activity in the industry, with top US producer Albemarle Corp. seeking to buy Australian miner Liontown Resources Ltd. in recent months, signaling optimism over prices in the long term.

Major Chinese producers Ganfeng Lithium Group Co. and Tianqi Lithium Corp. are due to report annual earnings on Thursday and Friday, respectively, and may give investors fresh insights into supply-side conditions.

Prices of spodumene, the lithium-bearing rock mined in Australia, have fallen 16% from last year’s all-time highs, data from Benchmark Mineral Intelligence show.