Gold’s record-setting rally may have captured the headlines this year, but it’s silver that’s running harder and faster as the less glamorous metal benefits from robust financial and industrial demand.

Silver has soared by almost a quarter in 2024, outpacing gold and making it one of the year’s best-performing major commodities. Yet in relative terms, silver is still cheap. It currently takes about 80 ounces of silver to buy 1 ounce of gold, compared with the 20-year average of 68.

The two metals move largely in tandem as both offer similar macro- and currency-hedging properties. With gold hitting a record on central-bank buying, retail interest in China, and a resurgence in bets lower US interest rates are on the way, silver’s gone along for the ride. Although there’s been scant interest from investors in silver-backed exchange-traded funds, physical sales have picked up, including at Singapore-based dealer Silver Bullion Pte.

“Even clients who are interested in buying gold are starting to say ‘well, maybe I’ll buy silver first, and wait for the ratio to sort of rebalance’,” said founder Gregor Gregersen. Between April 1 and 25, the outlet sold 74 ounces of physical silver for each ounce of gold, compared with an average of 44 in 2023.

The white metal has already been making headway against its dearer cousin, in relative terms. Back in January, the gold-silver ratio was above 90, the most stretched since September 2022. Citigroup Inc. reckons that if the Federal Reserve proceeds with interest-rate cuts and economic growth stays strong in the second half, the ratio could move to around 70, although it cautioned that a slowdown would push it the other way, according to a note.

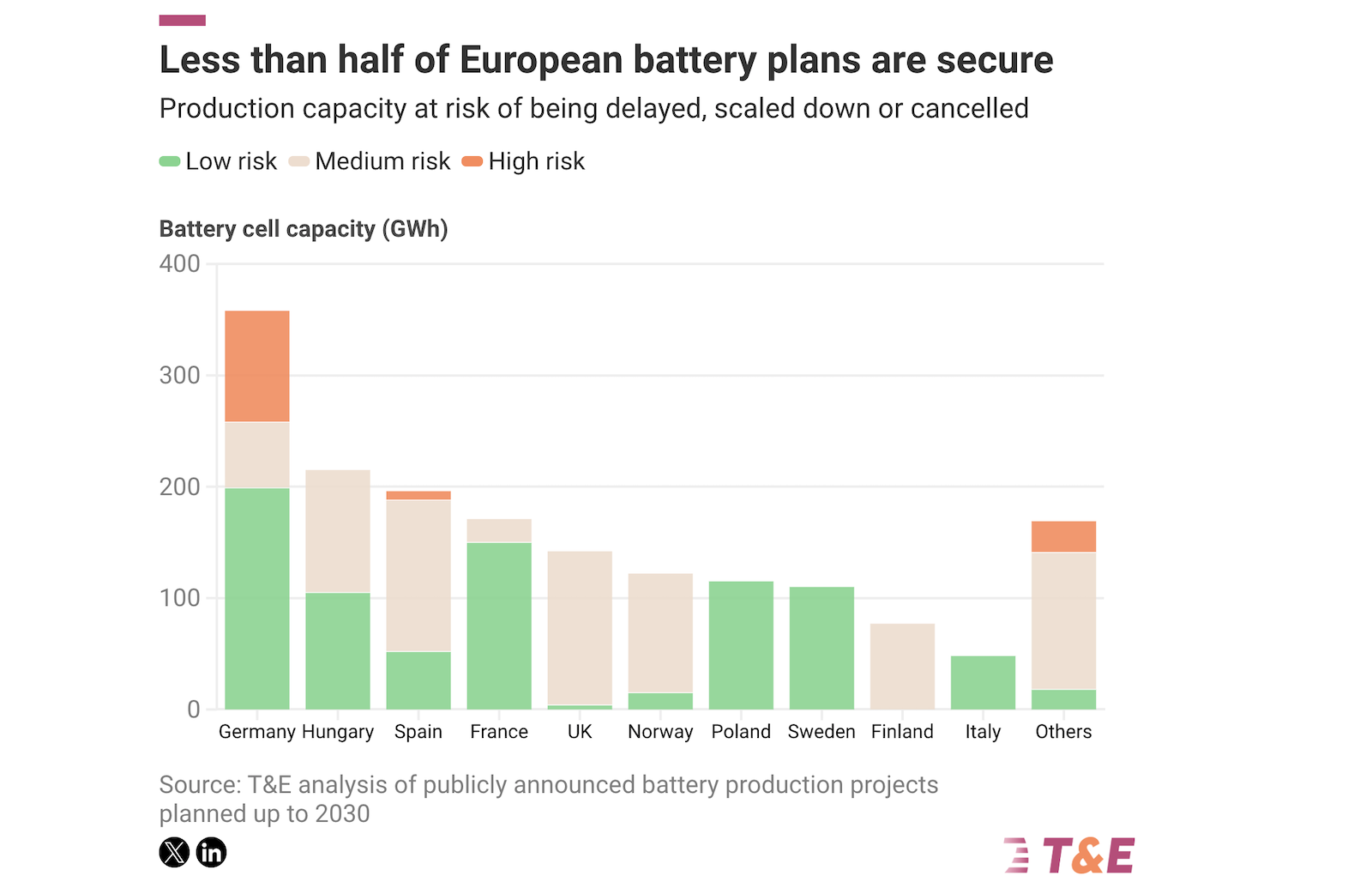

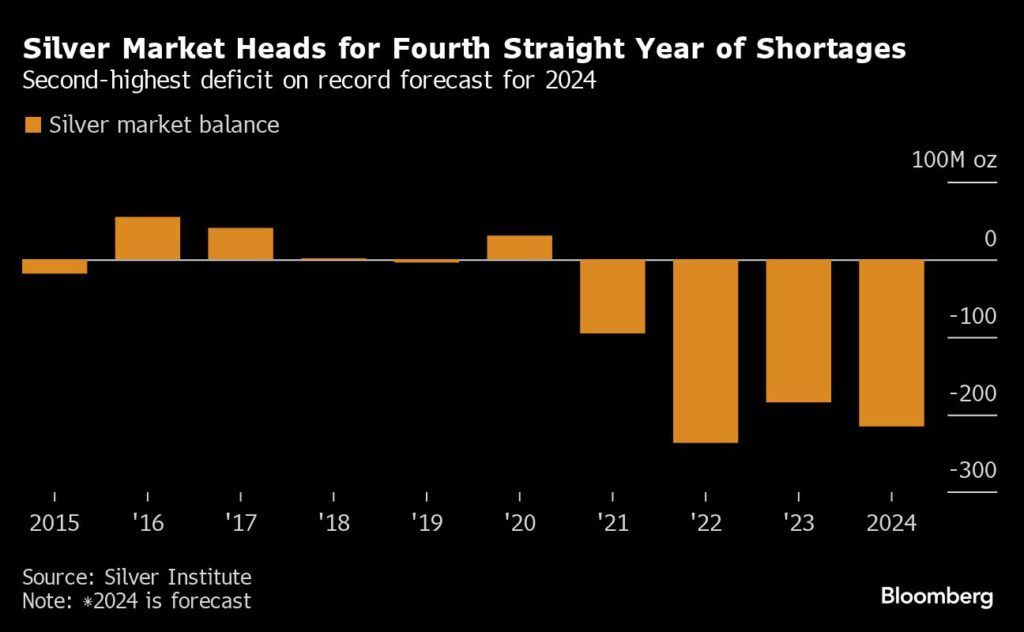

Silver has a dual character, valued both for its uses as a financial asset and an industrial input, including clean-energy technologies. The metal is a key ingredient in solar panels, and with robust growth in that industry, usage of the metal is expected to reach a record this year, according to the Silver Institute. Against that backdrop, the market is headed for a fourth year in deficit, with this year’s shortage seen as the second biggest on record.

That’s led industrial users – which typically rely on miners for supply – to seek ounces by draining the world’s major inventories, according to Silver Bullion’s Gregersen. Stockpiles tracked by the London Bullion Market Association fell to the second-lowest level on record in April, while the volumes at exchanges in New York and Shanghai are near seasonal lows.

Over the next two years, the LBMA stockpiles may be depleted given the current pace of demand, according to TD Securities. The headline figure overstates the available volume of metal given that it includes exchange-traded fund holdings, Daniel Ghali, a commodity strategist, said in an April note.

“We are slowly going to see supplies tightening because industrial demand is set to go higher,” Gregersen said. “If investors are also starting to buy, then I think in two or three months’ time, my biggest problem might end up being ‘Where do I find supply?’ rather than ‘How do I sell the silver?’”