Copper rallied in New York and slumped in London after President Donald Trump pledged import tariffs that risk raising costs for American manufacturers while dampening global demand.

“I’ll also be placing tariffs on steel, aluminum and copper and things that we need for our military things. We have to bring production back to our country,” Trump said in a speech in Miami.

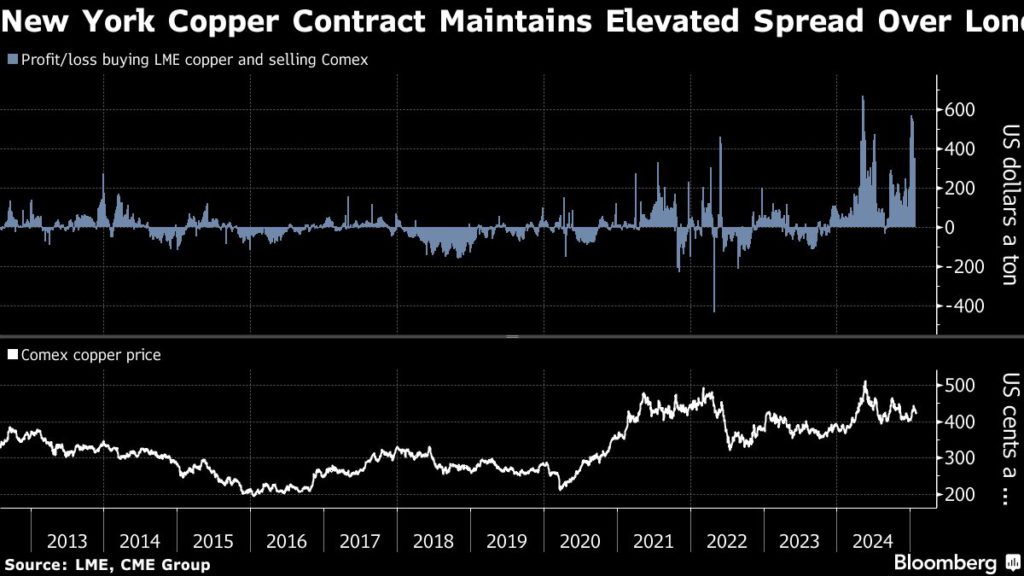

Even before his inauguration, tariff worries have been hanging over metals markets for months, and some traders have been rushing shipments to the US before any levies are imposed. Copper futures traded in New York — which shot above other global benchmarks following Trump’s election victory — climbed on Tuesday, even as contracts fell on the London Metal Exchange.

That price gap between the two exchanges is likely to remain elevated in the short term, according to Natalie Scott-Gray, senior metals analyst at StoneX Group Inc. “Despite much of the price action having been already priced-in, the spread is vulnerable to the upside,” she said.

The longer-run effects of US tariffs on copper prices are less clear. “Fundamentally, everyone wants to be bullish on copper,” said Alice Fox, associate director of commodities strategy at Macqaurie Bank Ltd. “Tariffs are bad for the metal, in terms of slowing global growth, and keeping inflation higher for longer in the US.”

Fox notes that one unknown part of the equation for copper is the reaction of Chinese authorities. “One possibility is that the tariffs are offset, that demand in China is not impacted overall because that loss of exports is met with measures to boost domestic consumption,” she said.

Aluminum and most other metals were also lower on the LME, as investors weighed the broader headwinds that tariffs may create for economic activity in the US and beyond. Meanwhile, the dollar rallied, eroding buying power for importers of commodities in China and other major industrial economies.

Any import tariffs on metals are likely to hit Canada the hardest. The northern neighbor accounted for just over half of US aluminum imports by value in 2023, Morgan Stanley said in a note this month. Canada was second, behind Chile, as a source of copper, and was the US’s No. 1 foreign steel supplier, followed by Mexico and South Korea.

Industrial metals have been under pressure as traders weigh the potential for a prolonged trade conflict, which would slow global growth and hurt demand. In China, factory activity shrank in January after three months of expansion, signaling caution among domestic consumers, while the country’s embattled property sector shows little sign of a sustained rebound.

Copper gained 0.6% on New York’s Comex, while slipping 0.9% to $9,014.00 a ton on the LME as of 2:50 p.m. in London, following a 2% drop on Monday. Aluminum fell 0.8% and zinc was down 1.9%.