Volkswagen AG’s commodity trading profits are outshining carmaking earnings after the company’s nickel hedging position surged in value following last month’s historic short squeeze.

Gains in commodity hedging positions will add 3.5 billion euros ($3.8 billion) to first-quarter earnings, Europe’s biggest automaker said Thursday. Total operating profit before special items is expected to almost double in the period to 8.5 billion euros, with strong operational performance also driving returns.

VW shares fell 2.1% at 1:27 p.m. in Frankfurt, taking the decline since the start of the year to about 17%.

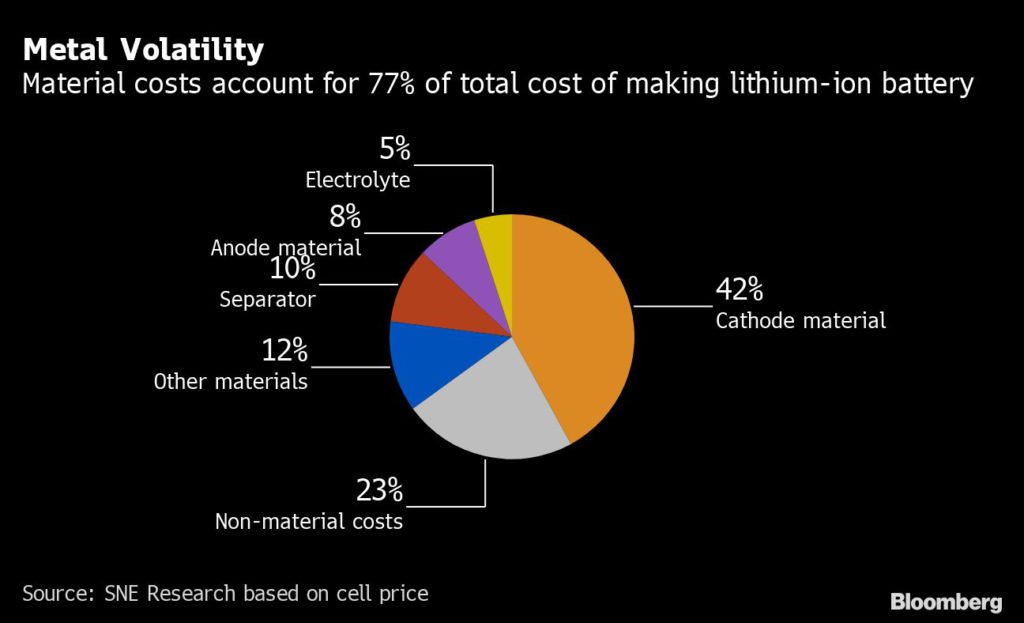

VW has one of the largest long positions in nickel on the London Metal Exchange, where a huge squeeze in March stunned traders before the exchange stepped in. Nickel, important for making electric-vehicle batteries, surged 55% during the first quarter, as concerns over supply also fanned gains.

VW and other major commodities consumers use hedging instruments to shield against often volatile price moves on raw materials they depend on. Russia’s invasion of Ukraine is exacerbating an already tight supply of a range of inputs such as nickel and aluminum as the global economy recovers following the pandemic. Sanctions against Russia, a major source of commodities, are further squeezing supplies.

The illustrative mark-to-market gain on VW’s nickel hedges disclosed in its annual report would have been about 1.5 billion euros, according to Bloomberg calculations. VW’s aluminum position would have gained about 500 million euros, having been valued at 2.5 billion euros at the start of the year. VW also has forward contracts and swaps for copper and coal, alongside price protection on platinum, palladium and rhodium.

Supply issues

The carmaker, hit by a range of component shortages led by semiconductors, also warned of renewed pressure on already fragile supply lines. VW halted a number of plants in Europe following the start of war after manufacturers of wire harnesses in Ukraine were disrupted.

The company’s global deliveries slumped 31.4% last month to end a difficult sales quarter. VW said net cash flow of its automotive division is at around 1.5 billion euros.

There is “still a risk that further developments in the Ukraine war will have a negative impact,” Volkswagen said. “This may also result from bottlenecks in the supply chain.”