A research team led by Oregon State University is planning to develop a new rechargeable battery that could reduce the need for environmentally destructive mining of rare minerals like nickel and lithium and accelerate the clean energy transition.

The U.S. Department of Energy awarded OSU $3 million to explore the development of a new rechargeable battery technology that would accelerate the clean energy transition without relying on rare finite minerals such as lithium, cobalt and nickel. OSU chemistry professor Xiulei “David” Ji, who will lead a battery research team, said it could be a game-changer.

“It’s a new paradigm,” he told Oregon Public Broadcasting. “We are very excited and very grateful to have this opportunity to work on this project.”

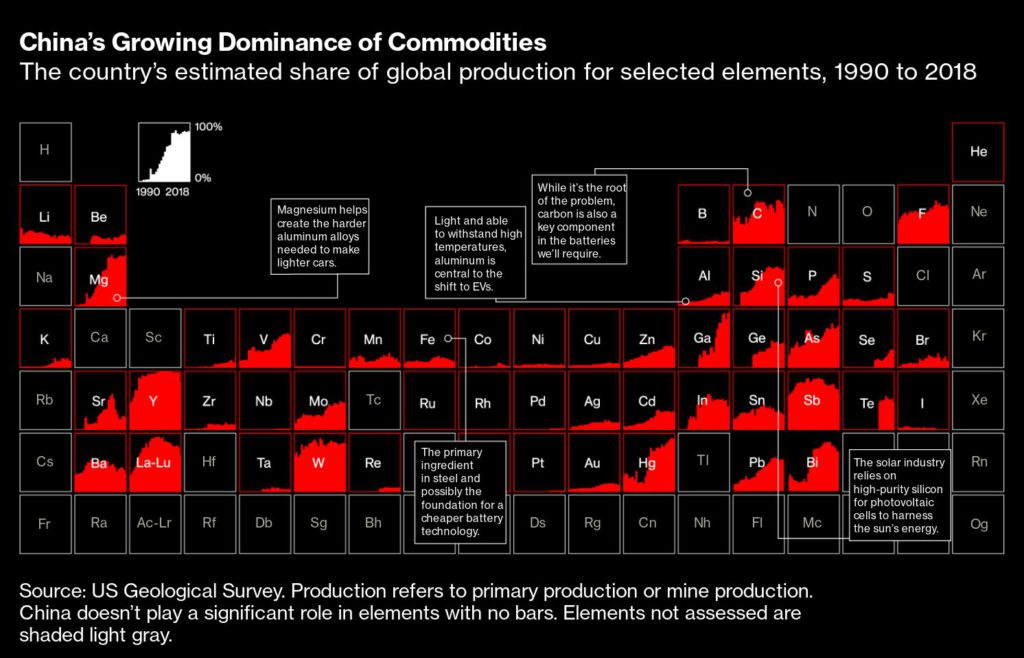

As the world transitions from fossil fuels to clean energy to reduce contributions to climate change, there is a growing need for batteries to store renewable energy and power electric vehicles. The resulting battery boom has generated environmental concerns because of the impacts of mining battery materials such as lithium, and it has driven up prices and demand for the minerals used to make batteries.

According to the International Energy Agency, an organization that provides data analysis for global energy policies, the world could face lithium shortages by 2025. The price of lithium has soared, tripling in 2021. Nickel, a mineral used for lithium-ion batteries, has also grown in demand and seen price hikes.

Ji, who will lead a team of researchers from Howard University, the University of Maryland and Vanderbilt University, said depending on these minerals is unsustainable and expensive. He said meeting clean energy goals soon will require a move away from relatively rare, finite minerals.

His plan is to explore anion batteries that provide the necessary components without using limited minerals like the ones lithium batteries use and that could potentially increase how much energy a battery can hold.

“The new battery chemistry does not have to rely on these elements,” Ji said. “That’s the benefit of the new chemistry. It’s a game changer.”

Ji said the primary market for these batteries would be electric vehicles, but he doesn’t rule out the possibility of anion batteries being used by large-scale utilities, like Portland General Electric’s solar, wind and battery facility. He also said they could be commercialized soon and be used in homes.

That’s something Meredith Connolly, executive director of the environmental nonprofit Climate Solutions, is looking forward to.

She said powering the economy with 100% clean electricity from wind and solar is a key part of reducing fossil fuels, and batteries are a critical part of achieving a clean energy transition.

“Part of the technological magic that batteries provide is the ability to store wind energy when the wind is blowing and solar energy when the sun is shining, and then deploy that renewable energy when there’s no wind or the sun goes down,” she said.

As EV production is ramping up, Connolly said, batteries need to be sustainably sourced and recycled to reuse the raw materials.

Oregon is one of many states providing generous incentives and rebates to switch from gas-powered vehicles to electric. Recently, the state started offering qualified residents up to $7,500 for a new EV. So far, more than 50,000 EVs are registered in the state. Oregon is also investing $100 million in building out charging infrastructure on major roadways and in rural areas to meet the demand of electric vehicles on the road.