Surging demand for battery metals is offsetting increased costs to build PolyMet Mining’s copper-nickel project in northeastern Minnesota, according to new estimates.

Developing the first phase of the NorthMet open-pit operation about 100 km north of the Lake Superior port of Duluth is forecast at $1.2 billion in an updated feasibility study released Friday. That’s greater than a quarter more expensive than the $945 million estimated in a 2018 technical report. PolyMet wants production to start in 2026.

Phase two is to cost $325 million, the St. Paul, Minnesota-based company said Friday, compared with $259 million in the 2018 report, another one-quarter increase.

Still, the global demand for copper and nickel means the new forecasts reaffirm the project’s technical and financial viability, Jon Cherry, PolyMet chairman, president and chief executive officer, said in a news release on Friday.

“An improved market forecast created by soaring demand for clean energy metals such as copper, nickel and cobalt more than offsets inflationary pressures and improves the project’s valuations and returns,” Cherry said.

The project aims to mine 29,000 tonnes of ore a day for an after-tax net present value of $304 million at a 7% discount rate during a 20-year mine life, the study shows. It forecasts an after-tax internal rate of return of 10.5%

Commodity gains

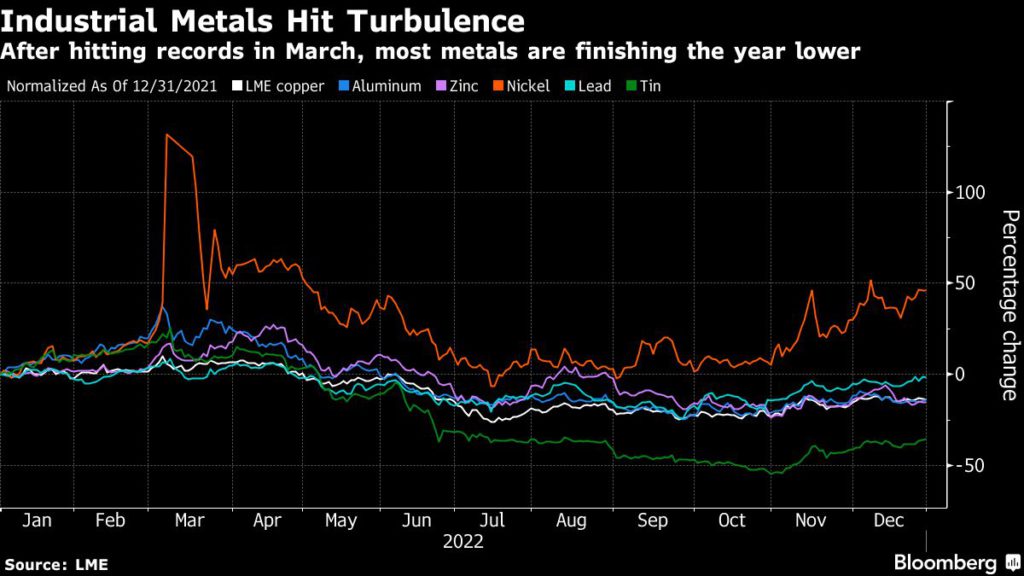

Copper has increased in price by about 18% over the last five years while nickel has more than doubled as automakers and technology companies scramble to secure supplies of materials used in electric vehicle batteries and other widespread modern gadgets.

PolyMet, which is 70% owned by Glencore (LSE:GLEN), agreed in July to a joint venture with Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) to develop NorthMet and Teck’s nearby Mesaba deposit.

The companies expect the deal, which keeps Glencore in control of the venture called NewRange Copper Nickel, to close by the end of March.

NorthMet has 289 million tons (254 million tonnes) proven and probable mineral reserves grading 0.597% copper equivalent after dilution, according to the updated feasibility study.

Phase one includes rehabilitating the former LTV Steel Mining processing plant and using modern wastewater treatment to clean up former iron ore operations, the company said.

Phase two is building and operating a hydrometallurgical plant to treat nickel sulphide concentrates into upgraded nickel-cobalt hydroxide and recover additional copper and platinum-group metals, PolyMet said.

It forecasts phase two’s net present value at C$487 million with a 7% discount rate, and an after-tax internal rate of return of 11.5%.

Court challenges

Both phases have all necessary permits, but face court challenges from groups opposed to the project. In June, PolyMet won one case threatening to revoke an environmental permit for air quality. More litigation is pending, PolyMet said.

Teck’s Mesaba project is in an early stage of studying potential development options.

The deposit has a measured mineral resource of 340 million tons (308 million tonnes) grading 0.497% copper, 0.115% nickel, 36 parts per billion (ppb) platinum, 101 ppb palladium, 28 ppb gold, 74 parts per million (ppm) cobalt and 1.2 ppm silver, according to a November filing by the company.

The NorthMet and Mesaba projects account for about half of the known resources of copper, nickel, cobalt and platinum group metals in Minnesota’s Duluth Complex, the company said. The complex north of Lake Superior east of Duluth formed 1.1 billion years ago by upwelling magma flows during North America’s mid-continental rift.