Bolivia cut the ribbon on its first industrial-scale lithium plant, the dawn of what it hopes will be an export boom of the battery metal that could bring it back from the brink of economic crisis. It’s going to be a long road though.![]()

In a ceremony Friday on the world’s largest salt flat, President Luis Arce opened the $100 million facility, designed to churn out as much as 15,000 tons of lithium carbonate a year to fuel electric vehicles in the global shift away from fossil fuels. To be sure, the plant is just starting a gradual ramp-up that will only reach a fifth of its capacity next year.

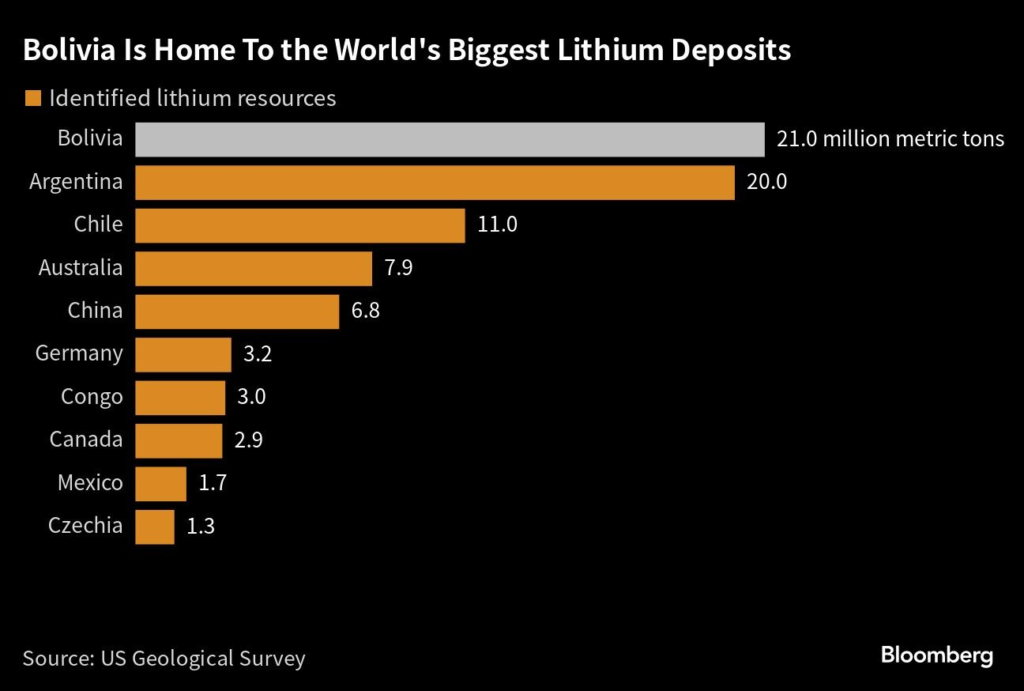

For the land-locked Andean nation, tapping into vast lithium deposits suspended in brine under the remote Uyuni salt flat offers a way to stave of a looming cash crunch as it burns through foreign currency reserves amid dwindling hydrocarbon exports.

But while Bolivia has much more resources of lithium than neighboring Chile, they are not yet deemed economically viable. Uyuni brine has high levels of magnesium, which make its lithium less pure and expensive to produce, and the nearest port is at least 500 kilometers and a border crossing away. A history of political and social unrest and a state-led approach to natural resources are other deterrents to private capital, as is this year’s 80%-plus plunge in prices.

“With the amount of resources Bolivia has, it should have been a power player in lithium long ago,” BNEF metals and mining analyst Sung Choi said. “We will have to see if this time will be different.”

Still, given Bolivia’s massive potential, some foreign companies have been prepared to do business there, with new direct extraction techniques seen as key for Bolivia to circumvent its purity issues and shorten the path to production.

This week, state-owned YLB and the Russian Uranium One Group signed an agreement to build a direct extraction plant for $450 million, while a Chinese consortium led by Contemporary Amperex Technology Co. plans to spend $1.4 billion on plants in the country. Bolivia plans to offer more direct lithium extraction contracts.

A Chinese group was behind construction of the carbonate facility inaugurated Friday in a ceremony attended by workers, soldiers, reporters and authorities. Dressed in a traditional poncho and Alpaca hat, President Arce spoke of a “transcendental step” in Bolivia becoming a major player in the critical mineral.

But the plant, which is three years behind schedule, isn’t expected to reach capacity until 2025, YLB Executive President Karla Calderon said. Initial output won’t be battery grade or continuous and will be sold on the spot market, with no date yet for signing supply contracts.

“This news is a positive step for the lithium market overall as it could help diversify the sources of supply given really robust long term demand,” said Chris Berry, president of House Mountain Partners, an industry consultant. “Still, the onus is on the operators here to prove they can profitably produce significant quantities of lithium to tight customer specifications.”