BMI – a unit of Fitch Solutions – is maintaining its nickel price forecast for 2024 at $18,000/tonne as excess supply continues to drag prices down from 2022 levels, the analyst said in its latest market report

Despite a brief rally earlier in the year that pushed prices to a year-to-date high of $21,615/tonne on May 20, nickel prices closed at $17,291/tonne on June 28, weighed down by deteriorating investor sentiment, Fitch noted.

This level represents a ytd increase of 4.3% but also a significant 15.5% m-o-m contraction as market optimism eases. The dramatic reversal in market sentiment since early June has the potential to pressure nickel prices further over Q3 2024.

Despite the pressures on nickel prices at present, Fitch expects upside risks – including but not limited to potential supply disruptions and a weakening of the US dollar later in the year – to place a floor under prices throughout the year, preventing a significant decline from current levels.

On the supply side, Fitch anticipates that a significant increase in 2024 (as seen in 2023), fed by heightened production in Indonesia and Mainland China, will be the core driver of price losses. Fitch projects a surplus of 253kt in the global nickel market in 2024, up slightly from a surplus of 209kt estimated for 2023.

This glut is primarily attributed to Indonesia’s increased production of nickel pig iron and intermediate nickel products, a direct consequence of heightened investment in its nickel sector following the imposition of a nickel ore export ban in 2020, Fitch noted.

In the first quarter of 2024, Indonesia’s refined nickel production rose 24.7% to 383kt, up from 307kt during the same period in 2023. Fitch expects an annual nickel production growth rate of 17.0% in 2024. Outside Indonesia, the world’s second-largest producer of refined nickel, Mainland China, registered growth of 2.3% y-o-y in the first quarter of 2024 to 220kt, up from 215kt in 2023.

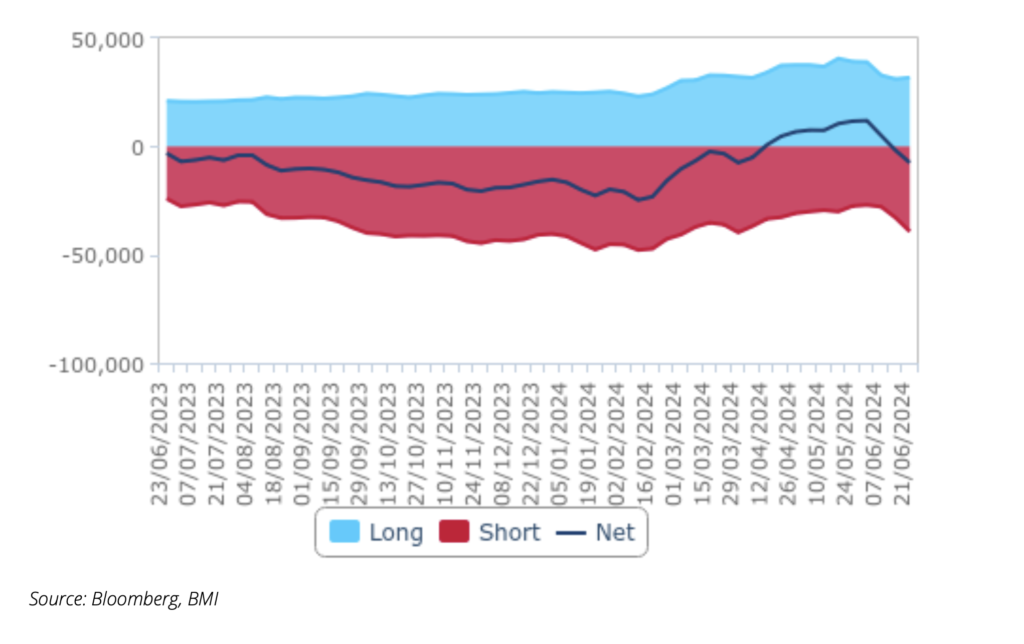

Short, long, net LME investment funds nickel positions

The approval of new nickel brands on the LME was a strategic response to address low inventories and reduce the threat of price volatility, Fitch pointed out.

“Along with the unraveling of Xiang Guangda’s short position that led to prices momentarily breaching US$100,000/tonne, low stocks were a factor that contributed to the price spike in March 2022 and which continue to pose upside price risks,” Fitch reported.

To correct low inventory levels and build up liquidity, Fitch noted, the LME resumed Asian trading hours in March 20 2023, after halting them last year after the price surge on March 2022. This goes alongside other measures aimed at stabilizing the market, such as setting daily trading limits and accelerating the process by which new nickel brands can be delivered on LME contracts.

Long-term outlook

Beyond 2024, Fitch expects nickel prices to increase steadily to 2028, rising to $21,500/tonne as the market surplus narrows on the back of surging demand for nickel along with the rise in the production of EV batteries.

Upwards pressure on prices will be partially offset by the continued ramp-up of output in Indonesia, driven by technical advances in converting lower- grade Class 2 nickel ore that is abundant in Indonesia into higher-grade Class 1 nickel that can be used in the battery industry.

Fitch forecasts prices to reach $26,000/tonne in 2033 as the market surplus narrows significantly to 24.5kt, putting upward pressure on prices.