Cobalt’s dramatic demand bump gives rise to novel investment vehicle

Cobalt supply constraints, coupled with a never-before-seen boom in the adoption rate of electric vehicles (EV) across the globe, have conspired to create an ideal market in which a pure-play cobalt investment and participation vehicle’s profits can outpace its peers.

Cobalt, a critical ‘energy metal’ used to make lithium-ion batteries, has become the backbone of the ‘Fourth IndustrialRevolution’ and has seen a 150% price hike over the last 12 months, something Cobalt 27 Capital chairperson, director and CEO Anthony Milewski saw coming a long way off.

“We took a look at cobalt several years ago and worked on a strategy on how best to invest in the EV uprising. Based on the metal’s supply constraints, we expected cobalt would be one of the first movers among the basket of energy metals,” he stated in an interview with Mining Weekly Online.

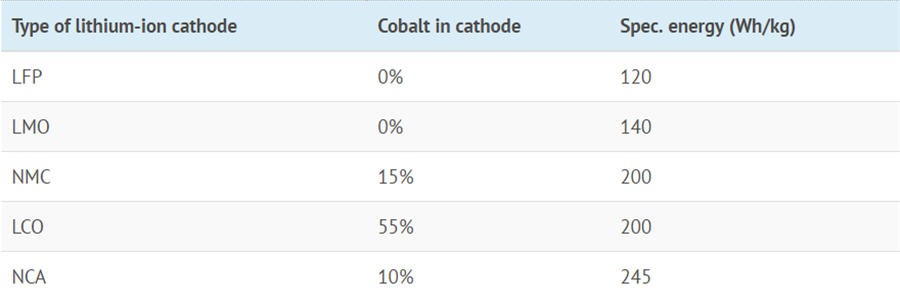

Cobalt is critical to battery chemistries; the cathode represents about 26% of the battery’s cost and is important for improving energy density and performance.

Milewski explained that the rising cobalt price is mainly attributable to political instability in the Democratic Republic of Congo (DRC), which, with about 49% of the global cobalt reserves, is the world’s largest producer. Questions over ethical resource sourcing also swirl around the DRC’s cobaltsupply. Copper and nickel mine closures have further contributed to lower supply, where it is mainly produced as a by-product.

China has tight control over refined output, currently producing more than half of the world’s refined cobalt and 85% of cobalt oxides, salts and other chemicals.

Drawing on his previous involvement and successful ventures, such as creating the Uranium Participation Corporation, which invests substantially all of its funds raised through equity offerings in physical uranium – the primary objective being to profit off of the appreciation in the value of its uranium holdings – Milewski helped create Cobalt 27 to provide a pure-play investment vehicle along similar tenets.

Cobalt 27 has amassed physical cobalt holdings of just under 2 200 t, which is valued at about C$187-million – the largest cobalt holding outside of China. It is not a miner or explorer, and was created specifically to give institutions and retail investors the opportunity to invest directly in the metal, excluding the significant exploration and development risks miners have to deal with.

EXPANDING MARKET

So hot is investment demand in the cobalt space that, when Cobalt 27 made its debut on the TSX-V Exchange in June, it raised C$200-million – the largest initial public offering since 2012.

“Everybody was waiting for India’s gross domestic productgrowth to prop up the next commodity super cycle, but, at the end of the day, no one saw that the next super cycle is indeed being driven by the emerging EV market,” Milewski said.

According to him, lower battery costs and higher productivity will support EV adoption rates going forward, and he is forecasting the deployment of 140-million EVs by 2030, increasing to almost 900-million by 2050, compared with the estimated one-million today.

Milewski also pointed out that the Paris Declaration on Electro-Mobility and Climate Change has set a target to have 100-million EVs on the road by 2030, the construction of which will require about four times the current cobalt output.

Demand is expected to rise by a compounded annual growth rate (CAGR) of about 6.9% from 2016 to 2020, with cobaltdemand in lithium-ion batteries expected to grow at 11.7% CAGR from 2016 to 2022, Milewski said.

The advent of mobile electronic devices such as smartphonespresaged the dramatic rise in cobalt demand, using on average about 5 g to 20 g of the metal per smartphone. However, EVs scaled that demand exponentially, using about 4 kg to 14 kg per vehicle. Seventy-three per cent of EVs sold in 2016 contained cobalt-containing batteries, he said, while massive grid-connected energy storage systems provide another avenue of growth for an already constrained market.

Milewski advised that forecasts point toward EVs reaching cost parity with internal combustion engines by 2025, and roughly 140 new Tesla-sized gigafactories will be required by 2035 to satisfy battery demand, in an optimistic scenario.

Cobalt 27 has also accumulated cobalt royalties on seven exploration-stage properties containing cobalt, providing another level of value upside for its investors. Milewski favours streams and royalties over other commodity investments, because of the exposure to earnings and dividends, resource growth and production growth, while avoiding direct exposure to increasing capital, as well as operating and environmental costs.

According to Milewski, global cobalt supplies of a hair under 100 000 t entered deficit-territory during 2016 and the supply gap is expected to widen significantly going forward. High-grade cobalt prices on Wednesday escalated sharply to $31.07/lb – the highest in nine years.

“Even significant increases in cobalt demand would likely preclude any material increase in production in the current environment, as new copper and nickel supply has been challenged,” Milewski stated.

Importantly, Milewski stressed that Cobalt 27 boasts one of the lowest expense ratios among its peers at ~0.9%, outperforming the likes of Osisko Gold Royalties, Sandstorm Gold and AuRico Metals.

Since July, Cobalt 27’s equity has gained about 36% on the TSX-V, to change hands at about C$12.40 a share.

Cobalt: A Precarious Supply Chain

How does your mobile phone last for 12 hours on just one charge?

It’s the power of cobalt, along with several other energy metals, that keeps your lithium-ion battery running.

The only problem? Getting the metal from the source to your electronics is not an easy feat, and this makes for an extremely precarious supply chain for manufacturers.

WHAT IS COBALT?

Cobalt is a transition metal found between iron and nickel on the periodic table. It has a high melting point (1493°C) and retains its strength to a high temperature.

Similar to iron or nickel, cobalt is ferromagnetic. It can retain its magnetic properties to 1100°C, a higher temperature than any other material. Ferromagnetism is the strongest type of magneticism: it’s the only one that typically creates forces strong enough to be felt, and is responsible for the magnets encountered in everyday life.

These unique properties make the metal perfect for two specialized high-tech purposes: superalloys and battery cathodes.

Superalloys

High-performance alloys drive 18% of cobalt demand. The metal’s ability to withstand intense temperatures and conditions makes it perfect for use in:

- Turbine blades

- Jet engines

- Gas turbines

- Prosthetics

- Permanent magnets

Lithium-ion Batteries:

Batteries drives 49% of demand – and most of this comes from cobalt’s usage in lithium-ion battery cathodes:

The three most powerful cathode formulations for li-ion batteries all need cobalt. As a result, the metal is indispensable in many of today’s battery-powered devices.

- Mobile phones (LCO)

- Tesla Model S (NCA)

- Tesla Powerwall (NMC)

- Chevy Volt (NMC/LMO)

The Tesla Powerwall 2 uses approximately 7kg, and a Tesla Model S (90 kWh) uses approximately 22.5kg of the energy metal.

THE COBALT SUPPLY CHAIN

Cobalt production has gone almost straight up to meet demand, and production has more than doubled since the early 2000s.

But while the metal is desired, getting it is the hard part:

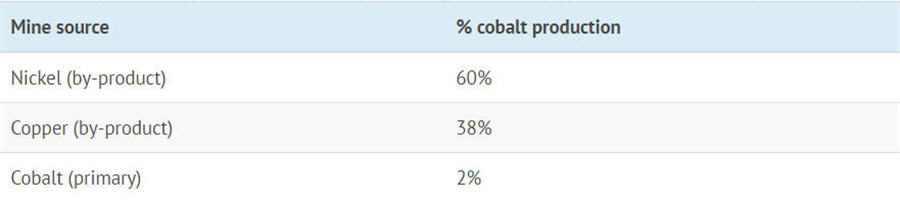

1. No native cobalt has ever been found in nature.

There are four widely-distributed ores that exist, but almost no cobalt is mined from them as a primary source.

2. Most cobalt production is mined as a by-product.

This means it is hard to expand production when more is needed.

3. Most production occurs in the DRC, a country with elevated supply risks:

(Source: CRU, estimated production for 2017, tonnes)

THE FUTURE OF COBALT SUPPLY

Companies like Tesla and Panasonic need reliable sources of the metal, and right now there aren’t many failsafes.

The U.S. hasn’t mined cobalt in significant volumes since 1971, and the USGS reports that the United States only has 301 tonnes of the metal stored in stockpiles.

The reality is that the DRC produces about half of all cobalt, and it also holds approximately 47% of all global reserves.

WHY IS THIS A CONCERN FOR END-USERS?

1. The DRC is one of the poorest, corrupt, and most coercive countries in the planet.

It ranks:

- 151st out of 159 countries in the Human Freedom Index

- 176th out of 188 countries on the Human Development Index

- 178th out of 184 countries in terms of GDP per capita ($455)

- 148th out of 169 countries in the Corruption Perceptions Index

2. The DRC has had more deaths from war since WWII than any other country on the planet.

Recent wars in the DRC:

- First Congo War (1996-1997) – A foreign invasion by Rwanda that overthrew the Mobutu regime.

- Second Congo War (1998-2003) – The bloodiest conflict in world history since WW2 with 5.4 million deaths.

3. Human Rights in Mining

The DRC government estimates that 20% of all cobalt production in the country comes from artisanal miners – independent workers who dig holes and mine ore without sophisticated mines or machinery.

There are at least 100,000 artisanal cobalt miners in the DRC, and UNICEF estimates that up to 40,000 children could be in the trade. Children can be as young as seven years old, and they can work up to 12 hrs with physically demanding work, earning $2 per day.

Meanwhile, Amnesty International alleges that Apple, Samsung, and Sony fail to do basic checks in making sure the metal in their supply chains did not come from child labor.

Most major companies have vowed that any such practices will not be tolerated in their supply chains.

OTHER SOURCES

Where will tomorrow’s supply come from, and will the role of the DRC eventually diminish? Will Tesla achieve its goal of a North American supply chain for its key metal inputs?

Mining exploration companies are already looking to regions like Ontario, Idaho, British Columbia, and the Northwest Territories to find tomorrow’s deposits:

Ontario: Ontario is one of the only places in the world where cobalt-primary mines that have existed. This camp is nearby the aptly named town of Cobalt, Ontario, which is located halfway between Sudbury – the world’s “Nickel Capital”, and Val-d’Or, one of the most famous gold camps in the world.

Idaho: Idaho is known as the “Gem State” while also being known for its silver camps in Couer D’Alene – but it has also been a cobalt producer in the past.

BC: The mountains of British Columbia are known for their rich gold, silver, copper, zinc, and met coal deposits. But cobalt often occurs with copper, and some mines in BC have produced cobalt in the past.

Northwest Territories: Cobalt can also be found up north, as the NWT becomes a more interesting mineral destination for companies. 160km from Yellowknife is a gold-cobalt-bismuth-copper deposit being developed.

Clean Energy Transition Will Increase Demand for Minerals, says new World Bank report

A new report released today by the World Bank highlights the potential impacts that the expected continuing boom in low-carbon energy technologies will have on demand for many minerals and metals.

Using wind, solar, and energy storage batteries as key examples of low-carbon or “green” energy technologies, the report, “The Growing Role of Minerals and Metals for a Low-Carbon Future” examines the types of minerals and metals that will likely increase in demand as the world works towards commitments to keep the global average temperature rise at or below 2°C.

According to the report, minerals and metals expected to see heightened demand include: aluminum, copper, lead, lithium, manganese, nickel, silver, steel, and zinc and rare earth minerals such as indium, molybdenum, and neodymium. The most significant example is electric storage batteries, where the rise in relevant metals: aluminum, cobalt, iron, lead, lithium, manganese, and nickel—grow in demand from a relatively modest level under 4°C to more than 1000 percent under 2°C.

The report shows that a shift to a low-carbon future could result in opportunities for mineral-rich countries but also points to the need for these countries to ensure they have long-term strategies in place that enable them to make smart investment decisions. In readiness for growth in demand, countries will need to have appropriate policy mechanisms in place to safeguard local communities and the environment.

“With better planning, resource-rich countries can take advantage of the increased demand to foster growth and development,” said Riccardo Puliti, Senior Director and Head of the Energy and Extractive Industries Global Practice at the World Bank. “Countries with capacity and infrastructure to supply the minerals and metals required for cleaner technologies have a unique opportunity to grow their economies if they develop their mining sectors in a sustainable way.”

The future demand for specific metals is not only a function of the degree to which countries commit to a low-carbon future, it is also driven by intra-technology choices. The low-carbon technologies that emerge as most applicable and beneficial, will play an important role in defining the commodity marketplace of the next 50 years. For example, the three leading forms of alternative vehicles — electric, hybrid, and hydrogen — each have different implications for metal demand: electric vehicles require lithium; hybrid vehicles use lead; and hydrogen-powered vehicles use platinum.

Demand for individual metals and minerals will reflect the component mix of low-carbon technologies, corresponding with economic changes and technical developments. To position themselves well, countries will need reliable sources of economic data and market intelligence, as well as the capacity to turn that information into plans, investments, and sustainable operations.

Based on current trends, it is expected that Chile, Peru, and (potentially) Bolivia, will play a key role in supplying copper and lithium; Brazil is a key bauxite and iron ore supplier; while southern Africa and Guinea will be vital in the effort to meet growing demand for platinum, manganese, bauxite, and chromium. China will continue to play a leading role in production and reserve levels in practically every key metal required under low-carbon scenarios. India is dominant in iron, steel, and titanium, while Indonesia, Malaysia, and Philippines have opportunities with bauxite and nickel.

A “green” technology future has the potential to be materially intensive, the report states. Increased extraction and production activities could also have significant impacts on local water systems, ecosystems, and communities. As countries develop their natural resource endowments, it will be critical that sustainability, environmental protection, and options to recycle materials be integrated into new operations, policies and investments.

“The Growing Role of Minerals and Metals for a Low-Carbon Future” report is intended to contribute to a richer dialogue around the opportunities and challenges for resource-rich countries that a low-carbon future presents. The analysis is designed to support policy-makers and other stakeholders in the areas of extractives, clean energy and climate change to better understand the issues involved and identify areas of common interest.

An increasingly precious metal

Amid a surge in demand for rechargeable batteries, companies are scrambling for supplies of lithium

SQM, Chile’s biggest lithium producer, is the kind of company you might find in an industrial-espionage thriller. Its headquarters in the military district of Santiago bears no name. The man who for years ran the business, Julio Ponce, is the former son-in-law of the late dictator, Augusto Pinochet.

He quit as chairman in 2015, during an investigation into SQM for alleged tax evasion. (The company is co-operating with the inquiry.) Last month it emerged that CITIC, a Chinese state-controlled firm, may bid for part of Mr Ponce’s controlling stake in SQM, as part of China’s bid to secure supplies of a vital raw material.

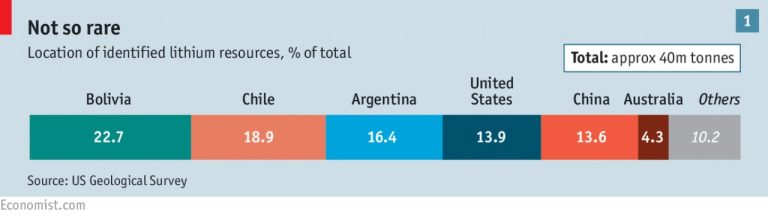

The focus of CITIC’s interest appears to lie on a lunar-like landscape of encrusted salt in Chile’s Atacama desert. It is a brine deposit washed off the Andes millions of years ago, containing about a fifth of the world’s known lithium resources. (Even more are in adjacent Bolivia but they are mostly untapped; see chart 1.) Just weeks before, CITIC had bought a stake in a Hong Kong electric-vehicle maker that uses lithium-ion batteries, indicating its growing interest in clean-energy technologies.

At SQM’s facilities the brine is pumped from an underground reservoir into hundreds of ponds. As it evaporates it turns into shades of blue and green, making the plant resemble a giant artist’s palette. It produces mostly potassium compounds but also a viscous liquid, lithium chloride. This is taken by tanker to a plant near the coast where it is turned into finely powdered lithium carbonate and hydroxide, which are then shipped around the world.

It is not a big business: lithium accounts for only about 5% of the materials in some car batteries, and for less than 10% of their cost. Worldwide sales of lithium salts are only about $1 billion a year. But the element is a vital component of batteries that power everything from ca

rs to smartphones, laptops and power tools. With demand for such high-density energy storage set to surge as vehicles become greener and electricity becomes cleaner, Goldman Sachs, an investment bank, calls lithium “the new gasoline”.

SQM is part of a global scramble to secure supplies of lithium by the world’s largest battery producers, and by end-users such as carmakers. That

has made it the world’s hottest commodity. The price of 99%-pure lithium carbonate imported to China more than doubled in the two months to the end of December, to $13,000 a tonne (see chart 2).

The spike mostly reflected concerns about the future liquidity of China’s spot market. China gets much lithium from spodumene rock in Australia, an alternative to South American brine. Albermarle, an American miner, and Tianqi, its Chinese joint-venture partner, plan to use spodumene from a big Australian mine to process more battery-grade lithium carbonate and hydroxide. That will mean less ore available on the spot market in China.

The industry is fairly concentrated, which adds to the worry. Last year Albermarle, the world’s biggest lithium producer, bought Rockwood, owner of Chile’s second-biggest lithium deposit. It and three other companies—SQM, FMC of America and Tianqi—account for most of the world supply of lithium salts, according to Citigroup, a bank. What is more, a big lithium-brine project in Argentina, run by a joint venture of Orocobre, an Australian miner, and Toyota, Japan’s largest carmaker, is behind schedule. Though the Earth contains plenty of lithium, extracting it can be costly and time-consuming, so higher prices may not automatically stimulate a surge in supply.

Demand is also on the up. At the moment, the main lithium-ion battery-makers are Samsung and LG of South Korea, Panasonic and Sony of Japan, and ATL of Hong Kong. But China also has many battery-makers. Adam Collins of Liberum, another investment bank, talks of an “inflection-point” in Chinese demand for lithium salts. Its government is stepping up the promotion of lithium-ion batteries and electric vehicles, with the biggest emphasis on buses. Sales of “new energy” vehicles in China almost tripled in the first ten months of 2015 compared with the same period in 2014, to 171,000 (though they remain less than 1% of total vehicle sales).

Tesla Motors, an American maker of electric cars founded by Elon Musk, a tech tycoon, is also on the prowl. It is preparing this year to start production at its “Gigafactory” in Nevada, which it hopes will supply lithium-ion batteries for 500,000 cars a year within five years. J.B. Straubel, Tesla’s chief technical officer, says the firm wants to secure supplies of many battery materials, not just lithium. “There’s so much hype in the lithium market right now…people look at it as this magical element,” he says. Nonetheless, in August Bacanora, a Canadian firm, said it had signed a conditional agreement to supply Tesla with lithium hydroxide from a mine that it plans to develop in northern Mexico. Bacanora’s shares jumped on the news—though analysts noted that shipping fine white powder across the United States border would need careful handling.

Bigger carmakers also have a growing appetite for lithium. In a recent shift, Toyota has begun offering lithium-ion batteries instead of heavier nickel-metal hydride ones in its Prius hybrid. Mr Collins notes that tougher emissions standards in Europe and America are likely to boost carmakers’ need for lithium.

Another big source of demand may be for electricity storage. The holy grail of renewable electricity is batteries cheap and capacious enough to overcome the intermittency of solar and wind power—for example, to store enough power from solar panels to keep the lights on all night. Tesla says that next month it will start installing “Powerwall” battery packs in American and Australian homes to store solar energy, at a cost of $3,000. Enel, an Italian utility, is launching similar storage products this year in South Africa, where homes and businesses suffer frequent black-outs.

Power utilities will increasingly use giant battery packs, charging them at times of low demand and tapping them to provide short bursts of electricity at peak times, an alternative to building a fossil-fuel plant that will sit idle the rest of the time. AES Energy Storage, a big provider of energy storage, won a contract in 2014 to provide a “peaker plant” in Southern California that will provide up to 100 megawatts (MW) of power into the grid at moments of maximum demand. In December, the firm agreed to buy, over several years, enough lithium-ion batteries from LG to provide ten times this level of peak power—that is, 1 gigawatt, or more than the output of an entire, typical-size coal-fired power station. “We’re hybridising the power grid,” says John Zahurancik, its boss.

Lithium-ion technology nonetheless attracts legions of sceptics—and not just petrolheads. In a paper published last month, researchers linked to the federally-funded Argonne National Laboratory in Chicago wrote that large-scale batteries need to offer hundreds of miles of driving range, be rechargeable in minutes instead of hours, and provide power at costs comparable with natural gas. These demands are “beyond the reach” of lithium-ion technology, they argued. Tesla’s Mr Straubel, however, foresees at least another doubling in the performance of lithium-ion batteries, and thinks lithium will continue to shape the battery of the future.

The juice still to be squeezed from lithium-ion batteries can be seen at the Angamos power plant on Chile’s northern coastline. It uses 1m lime-green battery cells in ten shipping containers to regulate the electricity grid across the Atacama region at times of peak demand, including at SQM’s lithium-mining operations hundreds of miles away across the desert. For the lithium the power plant uses, it is a homecoming. Extracted at SQM, it was sent to China to be turned into cells, put into battery packs in America, and shipped back to Chile by AES Energy Storage. That is a long journey for a tiny element of a little battery cell—but one that may embody the future of the world’s energy supplies.

Next mining boom in Australia will be driven by tech metals for renewable energy and technologies

The Australian mining industry is on the verge of a new mining boom based around so-called tech metals.

And as the race cranks up across the nation to find new deposits of rare earths and other metals, industry itself is calling for the development of a value-adding component.

Australia’s two largest mineral commodities, iron ore and coal, are shipped offshore in bulk form where other countries, most notably China, value add by using them to manufacture many different products.

These include a lot of imported products Australia buys that are made from the very minerals it exported.

The tech metals complex is made up of rare earths and other minerals and metals that are used in what is referred to as the new economy.

They are essential to making high technology componentry such as mobile phones, solar cells and autonomous vehicles.

They are also used to make the different kinds of batteries needed to store power from renewable sources, and new types of lightweight engines to replace traditional combustion engines.

Lessons from the last mining boom

Australian Vanadium has a high-grade vanadium deposit in central Western Australia, and chief executive Vincent Algar insists there is every opportunity to create new value adding businesses.

He said the way the last mining boom petered out quickly should be a salutary lesson.

“I don’t think that anyone in the lithium space, or the vanadium space, or the cobalt space for that matter, should not do that given our experience in the last boom, where we shipped a lot of tonnes away overseas,” Mr Algar said.

Vanadium is a metal that has traditionally been used as a strengthening agent for steel in the form of rebar, but Mr Algar said its real value in the technological age was as a key component in redox batteries, also known as flow batteries.

“We’ve got this new developing industry with growing demand, and I think we should be able to make the redox flow batteries in Australia because we do have a lot of technology,” he said.

“We’ve already successfully produced our first batch of vanadium electrolyte, needed for the batteries, at the University of Western Australia.”

The company has already entered into a venture with the world’s largest flow battery producer, German company Gildermeister.

Rare earth hunters also want local value-adding industry

There are 17 rare earth elements on the periodic table, falling into the heavy rare earths or light rare earths depending on their atomic weight.

Up until recently, all rare earths were mined and exported from China, which has had a stranglehold on the industry and its pricing.

Given their global importance, the race is well and truly on to find more rare earth deposits, and Australia is a favoured hunting ground.

“They’re actually quite ubiquitous in the Earth’s crust,” Arafura Resources managing director Gavin Lockyer said.

“Why they’re associated with the term rare is the fact that it’s rare to find them in an economically recoverable quantity.”

Australia the perfect place for processing

Arafura Resources has done that with its Nolans Bore project 135 kilometres north-west of Alice Springs in the Northern Territory.

The find is considered significant, featuring a 56-million-tonne deposit with a 40-year mine life.

It is full of neodymium and praseodymium, which is used to make magnets, the bulk of which are now sourced from China.

“We really think there’s much more value-add to be had by doing downstream processing, and Australia is the perfect place to do that.

“We’ve got an existing regulatory environment that covers things like water usage, environmental aspects, air pollutants, transport and disposal.

“There’s already a well-established regime and bureaucracy in place to regulate that, and we think it’s better to do that at the mine site where it all happens, rather than trying to do it offshore and making it somebody else’s problem.”

Politics and technology the key to new industries

Historical and contemporary drilling and grade results show that without a doubt, there is an abundance of rare earth metals in Australia.

But George Bauk, of Northern Minerals, said the problem with growing the industry, and value adding, was a lack of political will.

“It’s not only business. Governments should be asking how do we maximise the value for Australia,” he said.

“How do we do what the Chinese did, set up an industry downstream to make sure we capture as much value as possible?”

The Northern Minerals rare earths project, Browns Range, is in the central northern Australia Tanami desert, and runs across WA and the NT.

It contains the rare earth dysprosium, another key ingredient in modern magnets that China has the monopoly on.

“But we can compete with the Chinese if we look at the quality of the product that is here.

“Their grades are a 10th of what we have. Our grades are about 6,600 parts per million. Their grades are about six parts per million.

“We’ve got the product, now we need the collaboration and the political leadership and look beyond existing systems and look to the future.”

Jobs growth through developing a supply chain

Mr Bauk said a rare earth mine itself could employ 100 people, but if a supply chain could be developed for in-demand products, it could employ 1 million people.

“It has to be cost competitive, but it can be,” he said.

“It’s a journey that’s not going to happen tomorrow, but we need leadership and direction to extract more value,

“They’re part of it, but there’s so many opportunities in this sector. We’ve got some brilliant people in Australia, but we’re not levering off it.”