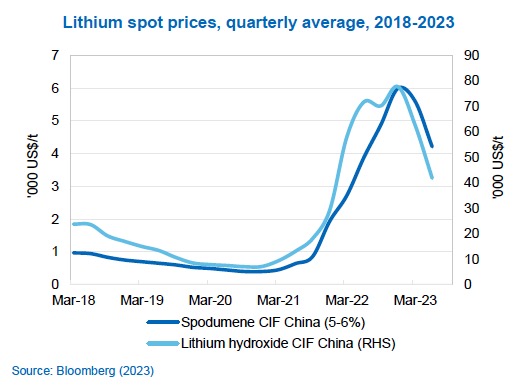

The lithium market has been in turmoil with dramatic price swings over the last five years as demand from electric cars take off and global supply growth struggles to keep up.

In its quarterly report released on Monday, the Australian government said it expects spodumene prices to decline slightly from an average of $4,368 a tonne in 2022 to average $4,357 a tonne in 2023 as the precipitous decline from record spot prices in the second half of last year take time to feed into long-term supply contracts.

However, 2024 will see a dramatic drop-off in contract value for Australia’s hard rock miners with prices declining nearly 40% year-on-year to $2,740 a tonne on average during the year and fall further to $2,149 a tonne in 2025.

That compares to an average of just $671 a tonne over the three years to 2021 according to the Department of Industry, Science and Resources. Some 96% of Australian exports are destined for China.

Lithium hydroxide prices in 2023 are forecast to be almost a third below last year’s average of $69,370 a tonne and will decline further next year to $35,415 a tonne before easing to just above $30,000 in 2025.

Mid-point prices for spodumene concentrate (6% Li20 FOB Australia) in the two weeks to end June were pegged at $3,500 a tonne by Benchmark Mineral Intelligence, a decline of 45% so far this year. Benchmark’s assessment for lithium hydroxide spot prices in Asia came in at $47,000 a tonne.

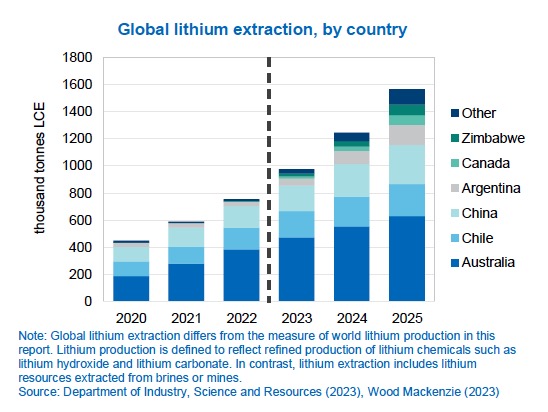

Australia blames growing global output for the predicted decline in prices with production set to come close to 1 million tonnes this year ramping up to 1.5 million tonnes in 2025, double production levels in 2022.

The country’s share will drop from 50% of global output today to 40% by 2025 despite a doubling of production to 596 kilotonnes by that time thanks to expansion of existing mines, including Greenbushes, Wodgina, Pilgangoora, Mt Marion and Mt Cattlin and production from new mines Finniss, Mt Holland and Kathleen Valley.

Number two and three producers Chile and China are also expected to continue to grow while emerging production in Argentina, Canada and Zimbabwe will add to the rapid ramp up worldwide with the latter countries growing market share from 5% to 20% by 2025.

Australia says the outlook could be impacted by recent announcements out of China of intensifying environmental scrutiny of the country’s lepidolite producers and Chile where a new state lithium company will take control of its lithium industry.

In February 2023, Chinese government investigations led to closures of some producers (mainly lepidolite) in Yichun, Jiangxi province, due to unlicensed mining and environmental breaches.

While Chile announced plans to nationalise the lithium industry in April 2023, the government stated its intention to honour current lease arrangements that extend out to 2043 for Albemarle and 2030 for SQM. As a result, this announcement is assumed to not materially impact production by 2025 according to the report.

Recycling is expected to make up only 2–3% of lithium supply from 2022 to 2025.